News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Gold price bulls say broader rally is intact despite investors’ dash for cash

Mining.com·2026/03/03 19:15

US Antimony estimates resource for Ontario tungsten project

Mining.com·2026/03/03 19:15

SKM: $30 | another random LUCKY pick

TradingView·2026/03/03 19:09

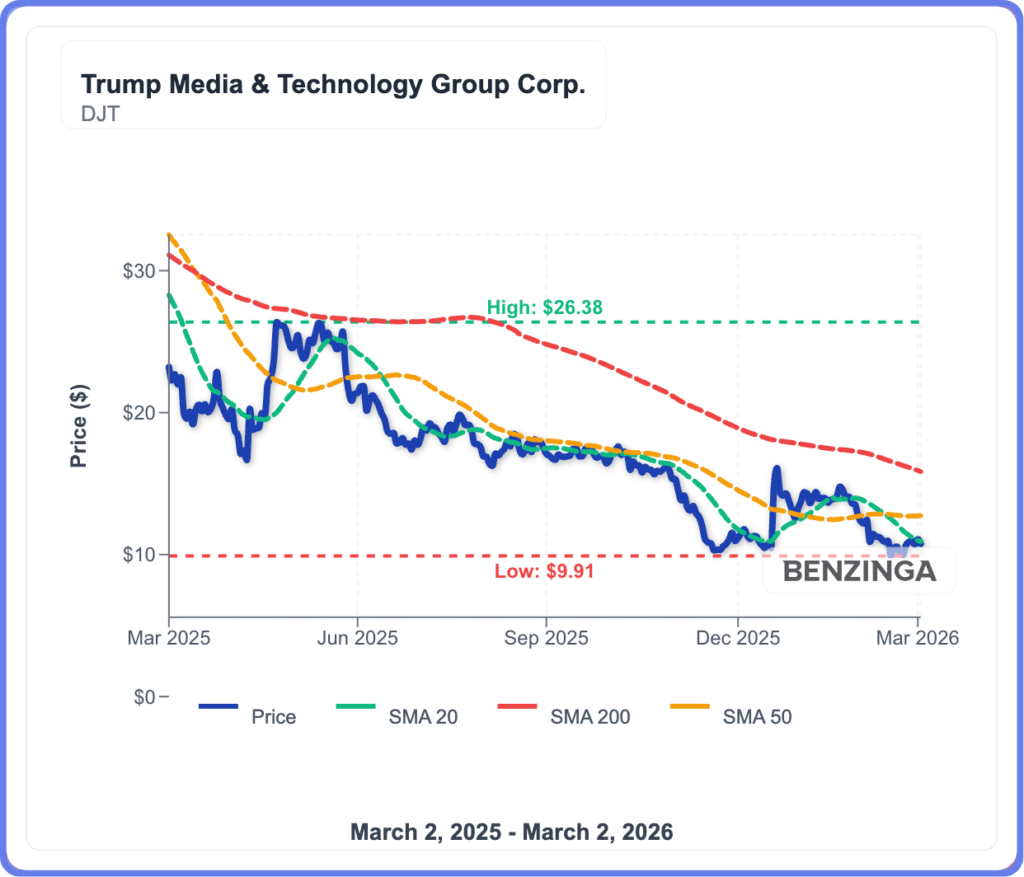

Trump Media (DJT) Stock Is Sliding Tuesday: What's Driving The Action?

Finviz·2026/03/03 19:06

Best Tech Stocks to Buy in March: Soaring GRMN Before a Breakout?

Finviz·2026/03/03 19:06

Acquisitions Aid Corpay Amid Seasonality & Low Liquidity

Finviz·2026/03/03 19:06

Why I believe Target shares continue to be the definitive 'challenge my perspective' narrative

101 finance·2026/03/03 19:03

Machi Reloads ETH Price Play After Going From $44M To Deep Red

DailyCoin·2026/03/03 19:03

Canton Foundation Welcomes Fireblocks as Super Validator to Drive Institutional On-chain Settlement

BlockchainReporter·2026/03/03 19:00

Flash

14:17

Exclusive Article on Futures Monitoring ToolCBOT Evening Agricultural Analysis: U.S. ethanol production has declined for two consecutive weeks, and the industry has entered the maintenance season. Although rising crude oil prices provide a short-term boost, will the seasonal slowdown in demand become the final straw that breaks the corn market?

14:13

Science raises $230 millions to challenge Neuralink as the commercialization race for brain-computer interfaces heats upGolden Ten Data reported on March 5 that neurotechnology company Science Corp has raised $230 millions from investors to commercialize its implant device for the visually impaired and to develop more advanced brain devices. According to informed sources, after this round of financing, Science's valuation (including new funds) has reached $1.25 billions. This makes it the second highest-valued brain-computer interface company in the world, following Musk's startup Neuralink. At the same time, the company is also one of the best-funded, having raised a total of $489 millions to date. A study published last October in The New England Journal of Medicine showed that the system improved the vision of 26 out of 32 patients with late-stage age-related macular degeneration. In recent years, investors have poured more than $2 billions into the six major brain-computer interface companies in the United States. Currently, the U.S. Food and Drug Administration (FDA) has not approved any devices for long-term commercial use, so these devices are only available in clinical trials.

14:09

Classover Holdings Inc has filed documents with the U.S. Securities and Exchange Commission, announcing a company resolution to implement a reverse stock split and simultaneously reduce the number of authorized common shares.This major corporate action is scheduled to take effect on March 9, 2026. A reverse stock split is typically intended to increase the trading price per share and optimize the capital structure. Meanwhile, the reduction in authorized share capital reflects the company’s strategic adjustment to its equity structure. The simultaneous implementation of these two measures indicates that Classover Holdings Inc is actively optimizing its equity framework, laying the foundation for future capital operations and market positioning.