News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

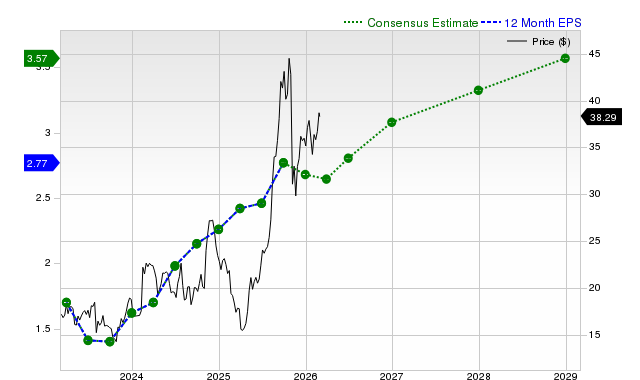

What Is Going On With Micron Stock On Tuesday?

Finviz·2026/03/03 18:42

Lupaka Gold may seize Peru state assets over unpaid $67M arbitration award

Mining.com·2026/03/03 18:39

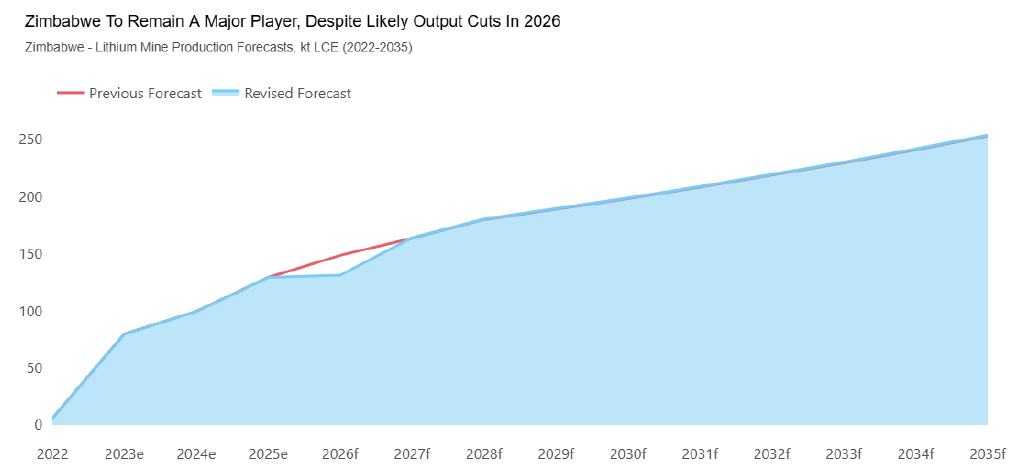

Zimbabwe export ban a temporary dent on lithium supply, says Fitch’s BMI

Mining.com·2026/03/03 18:39

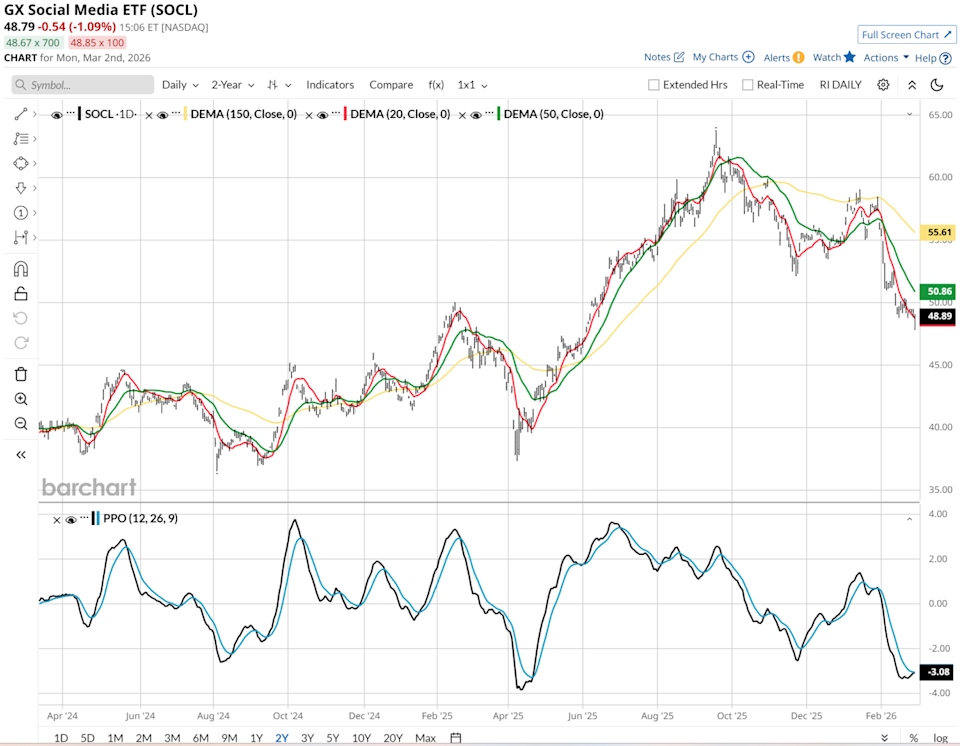

This Once Popular Social Media ETF Is Becoming Increasingly Anti-Social

101 finance·2026/03/03 18:39

Short Squeeze And Earnings: Why Paysafe Stock Spiked Tuesday

Finviz·2026/03/03 18:39

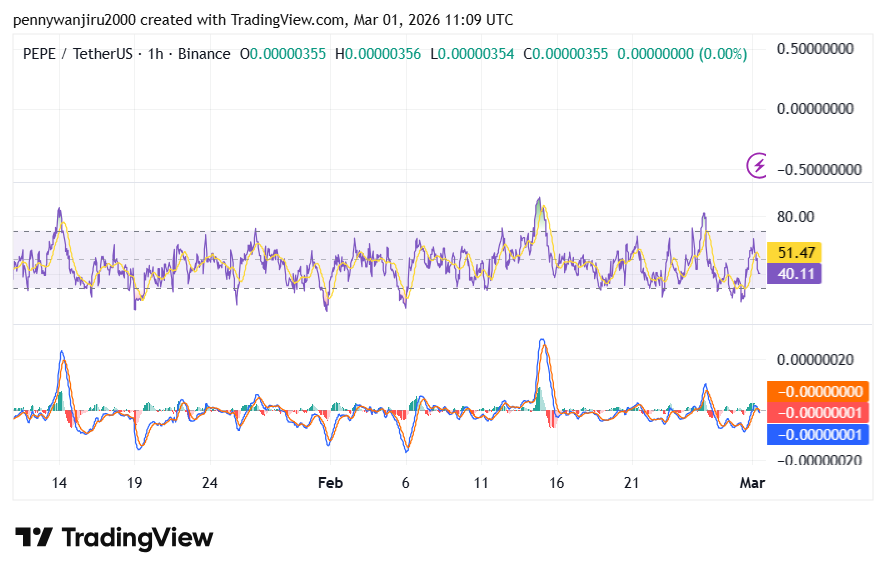

PEPE Trades at $0.053571 With Indicators Reflecting Narrow Intraday Structure

Cryptonewsland·2026/03/03 18:36

Silver Slips Amid Strong Dollar, Middle East Tensions

Finviz·2026/03/03 18:36

Theravance Biopharma Plummets As Phase 3 Study Falls Short

Finviz·2026/03/03 18:21

Dover's DFS Boosts Portfolio With ProGauge LR120 Radar Launch

Finviz·2026/03/03 18:21

Why Resideo Technologies (REZI) Might be Well Poised for a Surge

Finviz·2026/03/03 18:21

Flash

2026/03/05 23:53

Vitalik: Prediction Markets Help Us Understand the World and the Near FutureBlockBeats News, March 6th, Ethereum co-founder Vitalik Buterin stated that prediction markets help us better understand the world and possible near-term futures, and I hope prediction market projects can further optimize this direction, especially with more conditional markets.

BlockBeats has launched a prediction market section, users can go subscribe to exclusive updates.

2026/03/05 23:46

The crypto market experienced overnight volatility and declined, with bitcoin falling below $71,000, and US crypto-related stocks generally dropping.BlockBeats News, March 6, according to market data from a certain exchange, the crypto market maintained a downward trend overnight. Bitcoin is currently quoted at $70,900, down 1.95% in 24 hours; Ethereum is currently quoted at $2,073, down 1.98% in 24 hours. The total cryptocurrency market capitalization fell 1.7% in 24 hours, now reported at $2.487 trillions. The top gainers and losers among altcoins are: SAHARA fell 10.72% in 24 hours, now quoted at $0.26; GIGGLE fell 10.7% in 24 hours, now quoted at $28.56; COOKIE fell 9.8% in 24 hours, now quoted at $0.02; FIO fell 9.3% in 24 hours, now quoted at $0.0087; BARD rose 52.5% in 24 hours, now quoted at $1.66;KITE rose 21.2% in 24 hours, now quoted at $0.273;HUMA rose 18.7% in 24 hours, now quoted at $0.016;ORCA rose 1.4% in 24 hours, now quoted at $1.04. In the US stock market, the three major indexes closed lower. The Dow Jones fell 1.6%, the S&P 500 index fell 0.57%, and the Nasdaq fell 0.2%. Crypto-related stocks generally declined, including: Strategy (MSTR) fell 4.53%; Circle (CRCL) rose 0.4%; MARA Holdings (MARA) fell 5.6%; Riot Platforms (RIOT) fell 5.3%; BitMine Immersion (BMNR) fell 3.5%; SharpLink Gaming (SBET) fell 2.46%.

2026/03/05 23:43

Justin Sun: SEC has dismissed all charges against TRON, looking forward to cooperating with SEC to develop cryptocurrency guidelines孙宇晨说,期待与美国证券交易委员会合作,共同制定加密货币未来的发展指导方针和监管法规。 展开Sun Yuchen said that he looks forward to cooperating with the U.S. Securities and Exchange Commission to jointly formulate guidelines and regulatory policies for the future development of cryptocurrencies. Expand