News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

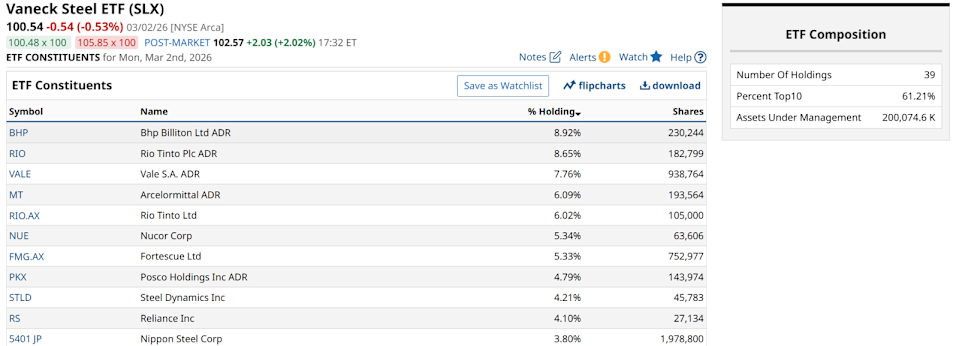

Steel stocks have been soaring lately. The chart suggests another significant surge may be on the horizon.

101 finance·2026/03/03 18:57

The Demise of Traditional Energy Security

101 finance·2026/03/03 18:57

SANAE TOKEN’s Turbulent Debut on Solana Draws Scrutiny and Official Refusal

Cointurk·2026/03/03 18:54

Kyndryl’s Morgan Stanley Event: A Strategic Opportunity for a Dormant Share Price

101 finance·2026/03/03 18:51

HBAR price rejects from value area high as weak demand points to $0.07

Crypto.News·2026/03/03 18:51

Nu (NU) is an Incredible Growth Stock: 3 Reasons Why

Finviz·2026/03/03 18:48

Looking for a Growth Stock? 3 Reasons Why JBT (JBTM) is a Solid Choice

Finviz·2026/03/03 18:48

Stocks, crypto and metals retreat as U.S.–Iran conflict intensifies

CryptoNewsNet·2026/03/03 18:45

Pi Network faces pressure as v22 upgrade shifts token flows

Coinlive·2026/03/03 18:42

Flash

22:12

All three major U.S. stock indexes closed lower, while U.S. cybersecurity stocks strengthened.格隆汇 March 6|The three major US stock indexes closed down collectively, with the Dow Jones falling 1.61%, the S&P 500 index down 0.57%, and the Nasdaq down 0.26%. Major technology stocks were mixed, with Microsoft rising over 1%, Nvidia, Netflix, Amazon, and Intel posting slight gains; Meta fell over 1%, while Apple, Tesla, and Google saw slight declines. US cybersecurity stocks strengthened, with Okta up 11%, CrowdStrike up over 4%, and Datadog up over 3%.

22:08

Simon Property Group announces completion of amendments, restatements, and extensions to existing credit arrangementsThe latest maturity date for this financing instrument has been set for June 30, 2030. It is worth noting that the agreement includes an optional renewal clause, allowing the company to further extend the term to June 30, 2031.

22:07

According to the latest public documents from the U.S. Securities and Exchange Commission (SEC), biopharmaceutical company Contineum Therapeutics Inc. has launched a new stock offering plan.The company plans to publicly offer its Class A common stock through the underwriter Leerink Partners, with a maximum fundraising scale of up to 100 million USD. This financing plan aims to provide funding support for the company's clinical-stage research and development projects, further advancing the development process of its drugs for the treatment of neurological diseases. Specific issuance terms, including the offering price, number of shares, and final fundraising scale, will be determined based on market conditions.