News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Beyond mining: Oklahoma bets on refining to anchor US critical minerals supply chain

Mining.com·2026/03/06 22:18

The Largest Crypto Launch in History? BlockDAG Targets 100x Growth as Staking Surpasses Solana & Kaspa

Coinomedia·2026/03/06 22:06

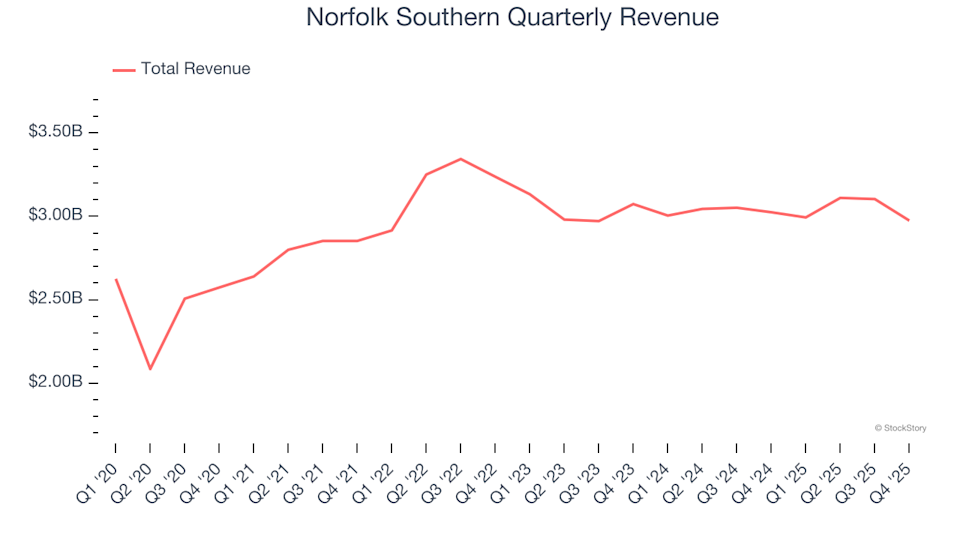

3 Compelling Arguments to Let Go of NSC and One Alternative Stock Worth Buying

101 finance·2026/03/06 22:03

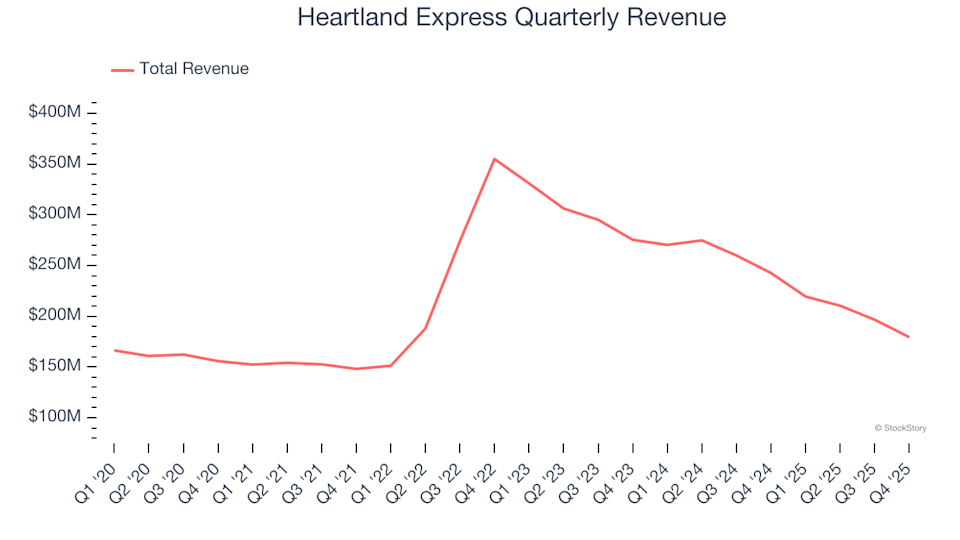

3 Reasons Why HTLD Carries Risk and One Alternative Stock Worth Considering

101 finance·2026/03/06 22:03

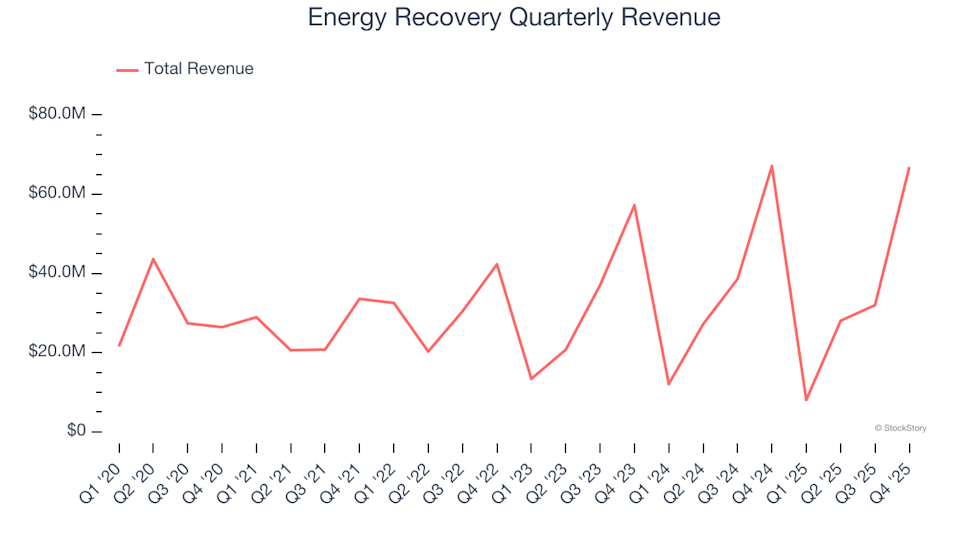

3 Reasons to Steer Clear

101 finance·2026/03/06 21:54

Peru taps fuel reserves to combat worst energy crunch in two decades

Mining.com·2026/03/06 21:54

3 Altcoins To Watch This Weekend | March 7 – 8

CryptoNewsNet·2026/03/06 21:48

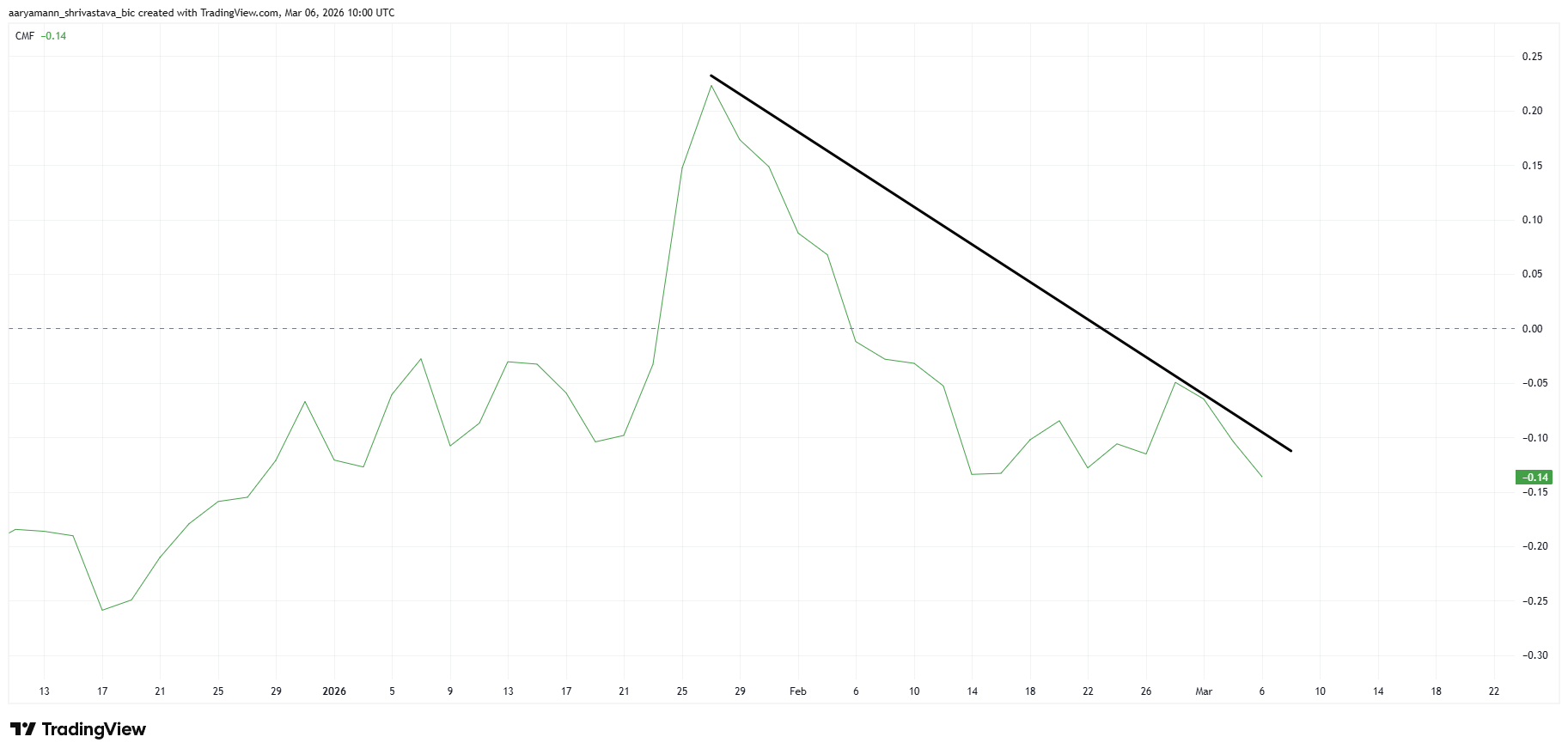

HYPE Price Upside May Struggle Despite $2.8 Million Short Squeeze Ahead

CryptoNewsNet·2026/03/06 21:48

Jupiter Moves Forward with Two-Pronged Approach in Parkinson’s Studies and Consumer Goods

101 finance·2026/03/06 21:48

Flash

17:04

Wall Street investors predict capital shift towards AI and bitcoin's new roleRick Rieder from BlackRock, Ulrike Hoffmann-Burchardi from UBS, and Daniel Loeb from Third Point expect the US economy to maintain steady growth, but the market environment will become more challenging. Some Wall Street investors believe that as capital shifts from large technology stocks to sectors such as industrials, electrification, and healthcare, bitcoin may need to prove its value as a simple and highly liquid investment option in a more mature and diversified market. It is expected to play a greater role in portfolio diversification and institutional assets, rather than relying on macroeconomic fears.

16:22

Data: 9 million TRX transferred from Justin Sun, worth approximately $2.56 millionAccording to ChainCatcher, Arkham data shows that at 00:13 (UTC+8), 9 million TRX (worth approximately $2.56 million) were transferred from Justin Sun to an anonymous address (starting with TAeHU9V9...).

16:16

"Pension whale (pension-usdt.eth)" opened a long position of 22 BTC, worth $1.53 millionAccording to AiCoin's real-time on-chain monitoring, from 03-07 23:56 to 03-08 00:11 (UTC+8), the "pension whale (pension-usdt.eth)" opened a BTC long position, with an opening amount of 22 BTC, valued at $1.53 million. As of press time, the value of its BTC long position is $1.53 million, with an unrealized profit of $0.00 million. In addition, this whale still has pending orders worth approximately $1.5 million that have not yet been filled. Whale address: 0x0ddf9bae2af4b874b96d287a5ad42eb47138a902