News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

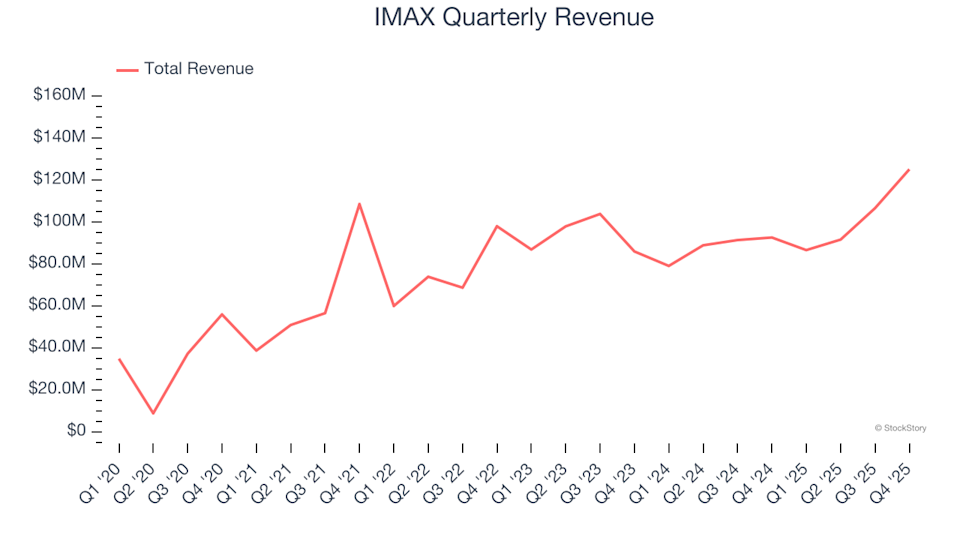

IMAX (IMAX): Should You Buy, Sell, or Hold After Q4 Results?

101 finance·2026/03/06 00:36

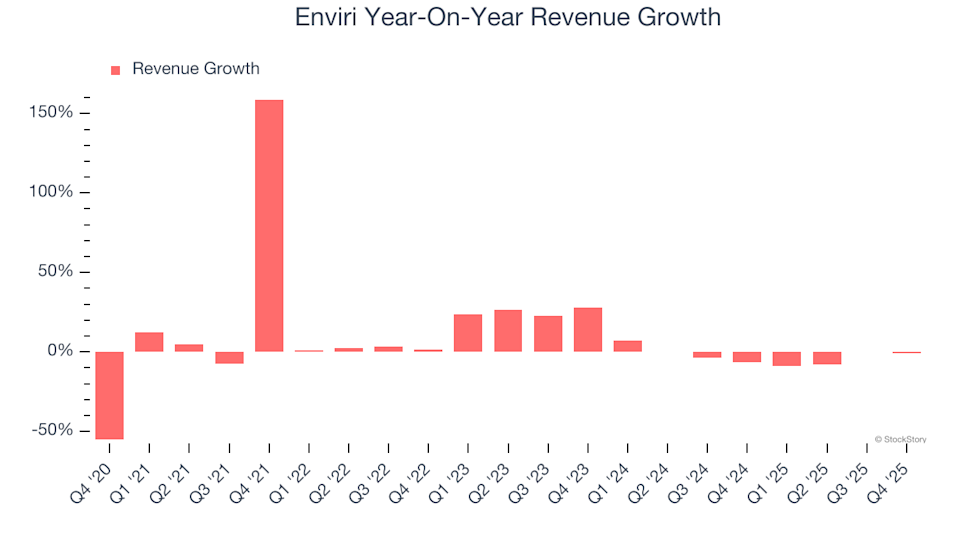

Enviri (NVRI): Should You Buy, Sell, or Hold After Q4 Results?

101 finance·2026/03/06 00:36

Compared to Estimates, Omada Health, Inc. (OMDA) Q4 Earnings: A Look at Key Metrics

Finviz·2026/03/06 00:33

Klaviyo (KVYO) Climbs 8.45% as Firm Launches $500-Million Buyback

Finviz·2026/03/06 00:33

XPO Shares Tumble 3.85% as Trading Volume Slides to 442nd Rank Amid Mixed Earnings Outlook

101 finance·2026/03/06 00:33

Estée Lauder's Stock Plummets 3.37% on $320M Volume Ranking 431st Amid Strategic India Acquisition

101 finance·2026/03/06 00:30

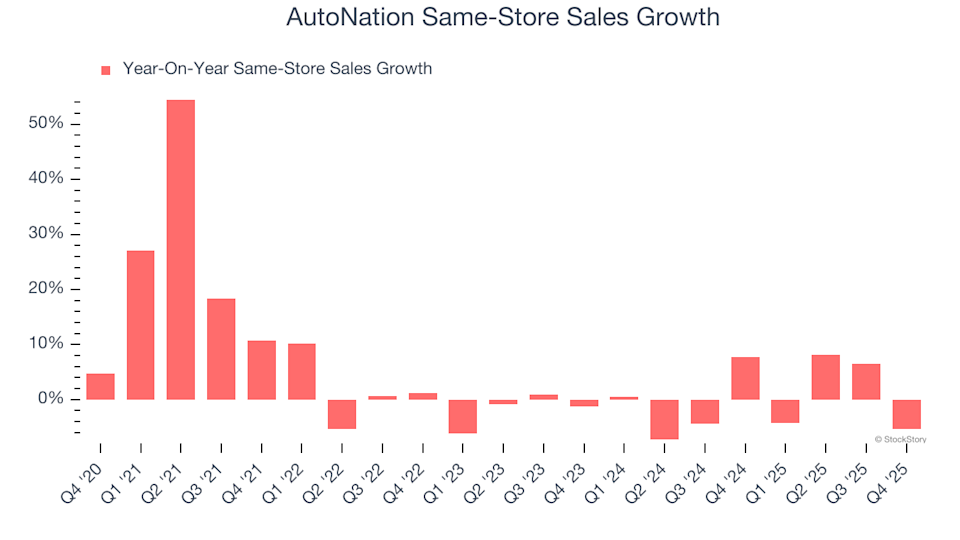

3 Reasons Why AN Is a Risky Choice and One Alternative Stock Worth Buying

101 finance·2026/03/06 00:27

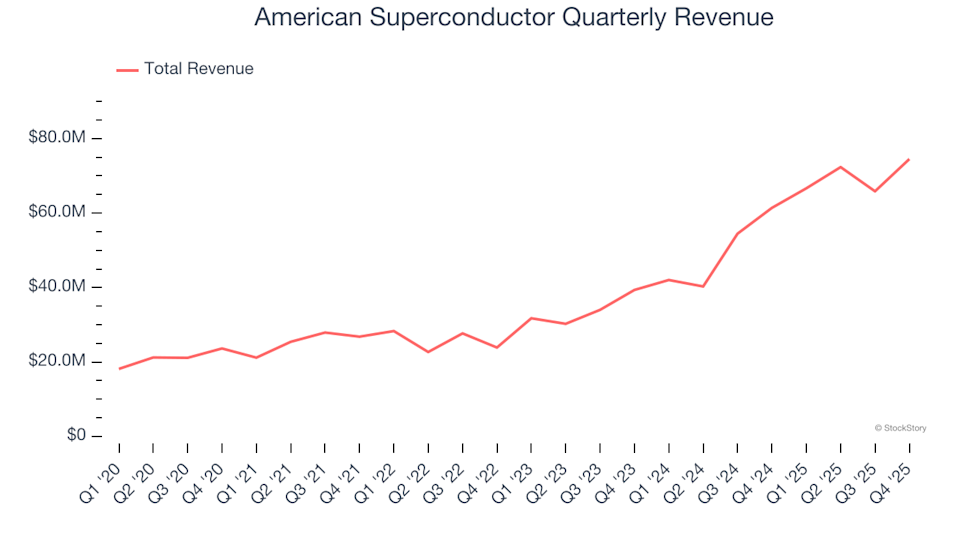

3 Things That Make Us Fans of American Superconductor (AMSC)

101 finance·2026/03/06 00:27

South Bow Corporation (SOBO) Tops Q4 Earnings Estimates

Finviz·2026/03/06 00:27

Flash

06:32

Charles Li: Tokenization Cannot Reduce Real World Asset RisksFormer HKEX CEO and co-founder and chairman of Diguantong, Charles Li, stated that Diguantong currently has no demand for real world asset (RWA) tokenization and sees no need to issue RWA tokens. He pointed out that tokenization cannot reduce the risks of underlying real world assets, and that the scale of on-chain funds is limited, so there is no need to pursue RWA tokenization in the short term to attract on-chain capital. In addition, Charles Li categorized virtual asset investors into five groups, including the earliest entrants, mid-term entrants, traditional financial institutions, traditional finance professionals with a decentralized mindset, and "retail investors."

06:30

Bitwise CIO: The era of broad altcoin rallies is over, and a "non-traditional" market cycle is comingJinse Finance reported that Bitwise Chief Investment Officer Matt Hougan stated that the frenzy of almost all cryptocurrencies surging together in a broad-based altcoin rally is unlikely to return. "I think that game is over. We will see non-traditional altcoin rallies," Hougan said in an interview on Wednesday. "The new altcoin rallies will only reward assets that have real-world use cases and practical applications." "I don't think we will see a situation where 'a rising tide lifts all boats, and everything wins'—that is, the pattern where funds rotate from bitcoin to ethereum, then to DeFi, and finally to NFT projects like stone pictures." Hougan said that future altcoin rallies are more likely to involve the market revaluing certain tokens, especially those tied to what he calls **"large-scale real-world economic businesses."**

06:17

Next Week Outlook: Middle East Conflict Influences US Stocks, Major US CPI Data to Be Released Next Week1. In the coming week, investors will closely monitor the extent of the Middle East conflict's escalation and its impact on energy supplies, while also digesting the latest US inflation data. The US and Israel's military actions against Iran have entered the sixth day, oil prices have surged, and various asset prices have experienced sharp fluctuations. The S&P 500 index fell 0.7% for the week, and the Cboe Volatility Index climbed to its highest level since November.2. One of the market focuses is the surge in energy prices triggered by the conflict. Brent crude has surpassed $85 per barrel, a significant increase from the pre-war level of $70. Analysts point out that a break above $100 would be a psychological threshold, "potentially triggering greater market panic." Rising oil prices could weaken consumer spending by pushing up gasoline prices, thereby dampening the outlook for the stock market.3. The US February CPI data, to be released on Wednesday, is highly anticipated. Surveys expect the February CPI to rise by 0.2% month-on-month. Investors say that if the data is mild (since the statistical period is almost entirely before the conflict), the market may downplay its impact; but a surprise spike in inflation would pose problems. The January CPI data was already below expectations.4. Concerns about energy-driven inflation have prompted investors to delay expectations for rate cuts. The market now sees only a 32% probability that the Federal Reserve will cut rates by at least 25 basis points in June, down significantly from 47% a week ago and 75% a month ago. If energy prices continue to rise and stoke inflation concerns, the Fed's expected two rate cuts this year will face greater resistance.5. Analysts point out that the situation in the Middle East is highly uncertain, and investors are caught in a "stalemate of neither selling nor buying." Although the stock market is only 2% below its historical high and optimism still supports expectations for economic fundamentals and earnings growth, the conflict and inflation data will be key variables in the coming week.