Arthur Hayes links Fed's Reserve Management Purchases to QE, predicting Bitcoin could reach $80K-$100K and discusses financial implications and potential inflationary risks.

Arthur Hayes, BitMEX co-founder, published on December 19 an analysis claiming the Federal Reserve’s Reserve Management Purchases are a covert form of quantitative easing.

The strategy impacts Bitcoin, potentially raising prices amid liquidity; regulatory implications remain, as the policy mirrors past quantitative easing mechanics without formal acknowledgment.

Arthur Hayes, co-founder of BitMEX, presents an analysis in his Substack essay. He argues the Federal Reserve’s Reserve Management Purchases introduced after the December FOMC meeting function like quantitative easing.

Hayes, once a Wall Street trader, claims the Fed’s strategy involves purchasing short-term Treasury bills, expanding liquidity. This move enables indirect financing and resembles traditional QE, despite being anonymous. John Williams manages these purchases without direct oversight.

Bitcoin Price Prediction and Market Impact

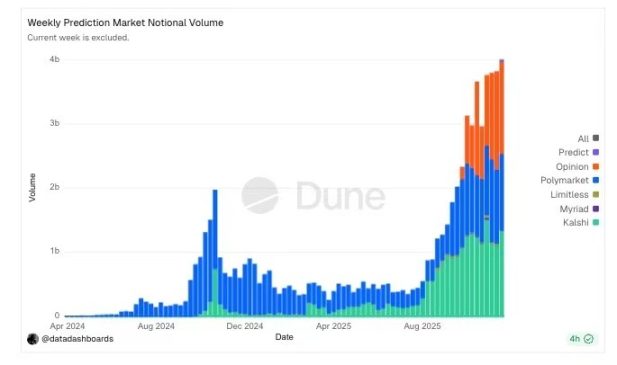

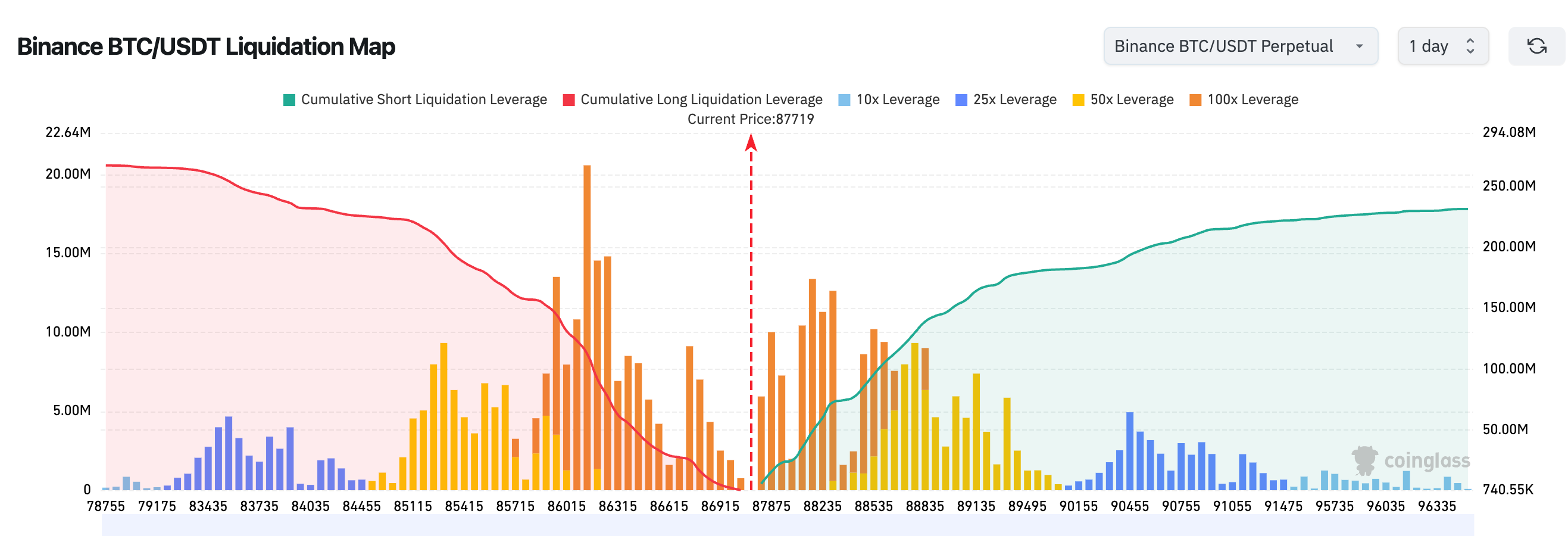

Hayes predicts Bitcoin might reach $80,000 to $100,000 through early 2026, leveraging the increased liquidity. Market forecasts see indirect expansion of available funds through these Treasury activities, affecting cryptocurrencies and DeFi assets.

Financial implications are analogous to past QE rounds, aligning with higher deficits. The Fed’s actions reduce yields similarly, impacting the broader economy by keeping interest rates at bay, though technically smaller in volume. This impacts cryptocurrency valuations noticeably.

Monetary Expansion and Economic Effects

By managing these reserves, monetary expansion could inadvertently finance government deficits. This structure, although not formally classified as QE, mirrors its impact, with Hayes highlighting potential inflationary risks.

Historical precedents for such schemes show asset inflation effects, notably on financial products. Hayes expects high-quality DeFi assets to outperform with increasing fiat liquidity, encouraging further diversification and portfolio shifts.

As Hayes noted, “The RMP is a thinly disguised way for the Fed to cash the government’s checks. This is highly inflationary from both a financial and real goods/services perspective,” illustrating the potential systemic impacts on the economy.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Brevis token launch imminent: Community incentives account for 32.2%, airdrop registration coming soon

2025 Airdrop Review: Didn’t Make Money, But At Least Got Tired