Where Did the Funds Go After the Meme Craze? Deep Dive into the Prediction Market Track and the Top 5 Dark Horses on the BNB Chain

Polymarket is only the prologue of this transformation. In the future, prediction markets will become the immutable infrastructure of a quantifiable world.

Written by: Changan, Amelia, Biteye Content Team

The Meme tide is receding, and prediction markets are taking over. This is not speculation, but an ongoing capital migration.

When Polymarket obtained a full license in the US and received a $2 billion investment from the NYSE parent company, you should realize: the era of speculating on cats and dogs Meme coins is over, and the era of speculating on "truth" has officially begun.

This article will guide you to:

- Understand why prediction markets have suddenly exploded in popularity;

- Review the dark horse projects worth ambushing on the BNB Chain;

- Teach you step-by-step how to position yourself early and capture early-stage dividends.

I. Why Have Prediction Markets Suddenly Become Popular?

The moment when market sentiment truly shifts is often not during a crash, but when numbness sets in.

You’ll notice: meme coins are still being launched, but you’re too lazy to even click; narratives are still flying, but deep down you only think: in the end, they’ll all go to zero anyway.

Meme coins didn’t die suddenly.

They died from a structural contradiction: tokens are permanent, but attention is fleeting.

When Pump.fun lowered the threshold for launching tokens to nearly zero, supply began to expand exponentially; meanwhile, retail investors’ time, emotions, and capital are linear. The result is only one: hot topics get shorter, and slow declines get longer.

At this moment, a new gameplay that seems "less exciting" but is even more brutal began quietly absorbing the funds lost from Meme coins.

It’s called: prediction markets.

1.1 The More Uncertain the World, the More People Need the Truth

In this era of information explosion and fragmentation, the media can often only provide timeliness, but cannot guarantee accuracy.

For example: someone used AI to forge an autobiography of CZ, not only with a complete cover and outline, but also uploaded it to Apple Books and other publishing platforms, even fooling the media. At the time, the Meme coin for this book was hyped to a market cap of $3 million.

Under the Meme mechanism, speculators can be the first to know the news by scanning the chain, but they are also easily caught up in rumors. Because in the logic of "speed is everything," the cost of verifying authenticity is too high—by the time you finish checking, the coin price may have already gone to zero.

This is precisely the significance of prediction markets: they introduce a Skin in the Game mechanism, forcing participants to reveal their true expectations through real-money bets.

The logic is simple: Talk is cheap, show me the money.

Prediction markets are the process of turning "cognition" into "assets." In the initial state where Yes and No each account for 50%, participants use real money to vote on information; the more buyers, the higher the price, and price fluctuations quantify the real probability of an event in real time.

1.2 From "Speculating on Coins" to "Speculating on Events": Speculation Upgraded

The decline of Meme coins is fundamentally because: asset issuance is too fast, and attention runs even faster. When attention is scattered, what remains are permanently existing tokens, and slow declines become the norm.

Prediction markets solve several of these problems:

- Clear settlement date: focuses speculative funds on the window when the event occurs; when the event ends, funds are settled, and there are always winners. This solves the slow decline torture of Meme coins.

- Speculator-friendly: clear win/loss results ensure that users can always obtain settlement returns, fundamentally improving the survival environment for speculators.

- More concentrated funds: no longer troubled by endless splits and duplicate tokens, but focuses attention on a limited number of important events.

This is not just a change in gameplay, but an upgrade in the dimension of speculation. You don’t need to run faster than others, just see more accurately than others.

1.3 Compliance Breakthrough, Institutions Enter

The popularity of prediction markets is not only due to good mechanisms, but also because they have been recognized by regulators.

On September 3 this year, Polymarket CEO Shayne Coplan successfully ended years of tug-of-war with regulators. Polymarket broke Kalshi’s long-term monopoly in the compliant market, proving that prediction markets can break out from the "legal gray area" and transform into transparent, compliant "information derivatives markets."

Just over a month later, on October 7, NYSE parent company ICE invested $2 billion, and prediction markets officially entered Wall Street’s field of vision. This marks prediction markets officially entering the global financial core as a new asset class.

The compliance breakthrough has completely eliminated legal concerns for institutional funds. Prediction markets are rapidly shedding the label of "crypto niche toys" and are officially evolving into financial infrastructure on par with the S&P Index and gold prices, quantifying global risk and public opinion trends.

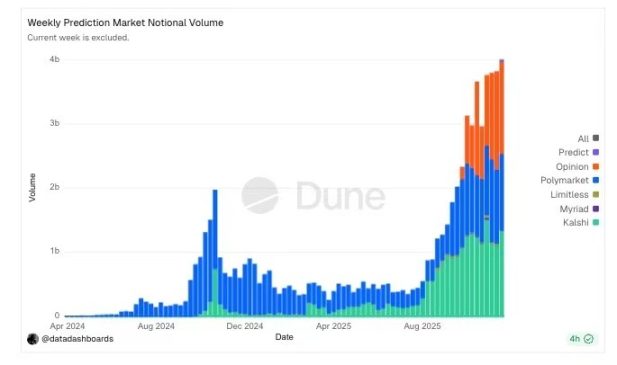

As shown in the chart, the weekly trading volume of prediction markets has recently seen an unprecedented exponential explosion, with peaks exceeding $4 billion.

Data source: Dune

II. The Leaders and Rising Stars of Prediction Markets

2.1 Kalshi: The Lone Warrior Facing Regulators Head-On

Before discussing prediction markets, we must first pay tribute to Kalshi. If Polymarket gained freedom through a backdoor, then Kalshi tore open the compliance gap by confronting regulators head-on.

Before 2024, the US prediction market was basically in a gray area, with the greatest uncertainty coming from regulatory attitudes. Kalshi obtained the CFTC’s Designated Contract Market (DCM) license as early as 2020, becoming the first regulated platform focused on event contracts. Subsequently, in the approval of political contracts, it fought a protracted battle with the CFTC—in 2023-2024, the CFTC once banned related contracts, Kalshi went directly to court and won, ultimately forcing the CFTC to drop its appeal in 2025.

This victory is seen by many as a key turning point for the legalization of prediction markets: this is not gambling, but a protected financial derivatives market.

The cost of compliance seems high, but what it brings is institutional-level trust and a regulatory moat. Kalshi is the earliest and most mature fully regulated CFTC platform, allowing US institutions and retail investors to legally and directly trade event contracts in USD. Although competitors like Polymarket are gradually returning to the US market by the end of 2025, Kalshi’s first-mover advantage and strict compliance model still make many feel the cost is worthwhile.

But the price of compliance is self-isolation. Strict KYC, limited to US users, can only operate in the "intranet" of the US market. This weakens its connection with the much larger global user base.

2.2 Polymarket: The First-Generation King, But Not the Endgame

If Kalshi won in court, then Polymarket undoubtedly won in the market, with the capital market giving the most real answer with real money.

This year, its valuation has jumped three times, from the $1 billion unicorn threshold at the beginning of the year, quickly soaring to $8 billion (with a $2 billion investment from NYSE parent company ICE), and recently it is rumored to be seeking a new round of $15 billion valuation.

During the US election, it carried massive amounts of capital speculation. For the "2024 US Presidential Election" prediction pool alone, cumulative trading volume exceeded $3.2 billion.

Digging deeper, Polymarket’s success comes from a dual victory in product and compliance:

From a product perspective: it strives to downplay the "gambling" attribute and instead emphasizes the information attribute. During the election, even CNN and Bloomberg quoted its odds. It successfully established a sense of authority, making users feel that betting is not gambling, but pricing information.

Compared to early prediction markets like Augur, Polymarket has streamlined the user experience to the extreme. No obscure on-chain interactions, direct settlement with USDC stablecoins. It allows Web2 users to seamlessly enter the prediction market.

From a compliance perspective: Polymarket proactively settled with regulatory agencies (CFTC). This "fine" was actually a "ticket" to enter the mainstream world, clearing compliance obstacles and paving the way for entry into the US market.

But this compliance + focus-on-headline-events approach has a ceiling.

Polymarket’s success is built on a highly controlled, heavily operated model. While this model is safe, it is extremely inefficient. It’s like a finely crafted workshop, heavily dependent on the official team’s taste and institutional capital to keep running. It performs perfectly when facing super events like the US election, but when facing more fragmented, higher-frequency mass demand, this centralized framework is too slow and too heavy.

It successfully validated the 0-to-1 of prediction markets, but the core contradictions preventing the industry from exploding from 1 to 100 remain unsolved in its model.

2.3 The 7 Unresolved Issues of Prediction Markets

If we peel off Polymarket’s label as the prediction market leader and deeply experience the product, we’ll find that Polymarket still has many fatal problems.

1. Centralized market creation and operational dependence: Platforms like Polymarket, due to geographical and cultural differences, have a natural "cognitive barrier" for non-English-speaking users. Currently, market creation is highly dependent on the official team’s selection, leading to extreme concentration of resources in highly commercialized tracks.

This "centralized" creation directly leads to the desolation of niche markets, with many interesting needs in vertical fields ignored due to lack of operation. For example, Chinese-speaking users are unfamiliar with the high-liquidity tracks like politics and culture on Polymarket and don’t want to spend much time on them. Meanwhile, niche tracks that Chinese-speaking users know and are interested in lack liquidity.

2. Liquidity barriers from the order book model: Mainstream platforms currently use the order book model, which means every new market needs sufficient liquidity walls, or even small trades will cause drastic price fluctuations, harming user experience and creating a negative cycle of "insufficient liquidity → user loss → further liquidity decline."

This order book model results in poor trading experience for long-tail, niche topics due to lack of initial liquidity.

3. User experience gaps: Besides liquidity, another major issue is poor user experience.

In short-cycle predictions for high-volatility assets like BTC/ETH, market probabilities fluctuate violently with K-line prices. Due to time lags between frontend display and on-chain transactions, users may place a "Yes" order at a low probability, but the actual transaction occurs at a much higher probability.

The executed probability is not the probability at the time of clicking, and this poor first experience often leads to high user churn.

4. Low settlement efficiency: After finally winning, users find that profits are not credited immediately and must wait for market settlement.

The "result adjudication" process for many markets is very slow. For example, Polymarket relies on the UMA oracle, and a disputed market may take days or longer, with multiple rounds of voting before final settlement, causing funds to be tied up for a long time. Due to the design of the UMA oracle (Optimistic Oracle), cheating to change the final market result is a potential risk.

5. Oracle scalability issues: Current oracles heavily rely on "human" (such as UMA voters) decentralized adjudication mechanisms, which cannot efficiently handle the thousands of permissionless markets that may emerge in the future.

When the number of markets explodes, this "arbitration system" will be overwhelmed.

6. Single LP income: Not only is the retail user experience poor, but being an LP in the market is also not great.

Due to the mechanism of prediction markets, being an LP has a single income model and risk exposure is difficult to manage, limiting the willingness of professional market makers and DeFi funds to participate.

Additionally, it is difficult for prediction market participants to use their positions in other DeFi scenarios (such as staking), limiting application scenarios.

7. Market manipulation: But the above are not the worst; the following issue is a direct challenge to the very foundation of prediction markets.

The original intention of prediction markets is to measure the truth of events, but when the profit motive is strong enough, participants’ motivation shifts from "measuring events" to "influencing events," using the market to endorse a manufactured "fact."

If market results are ultimately determined by media reports, the optimal strategy becomes paying off the media rather than researching the event itself. At this point, the market is no longer a "truth discovery machine," but a financial tool that legitimizes manipulated facts.

This August’s "Green Dildo" incident at a WNBA game is a typical case: In Polymarket’s market on "whether an object will be thrown onto the court," the mainstream position was "No," making the odds for "Yes" extremely high.

Participants found that by spending a few dozen dollars on tickets and props, and taking minimal risk of penalty, they could enter the arena and throw an object, thereby leveraging thousands of dollars in prediction profits.

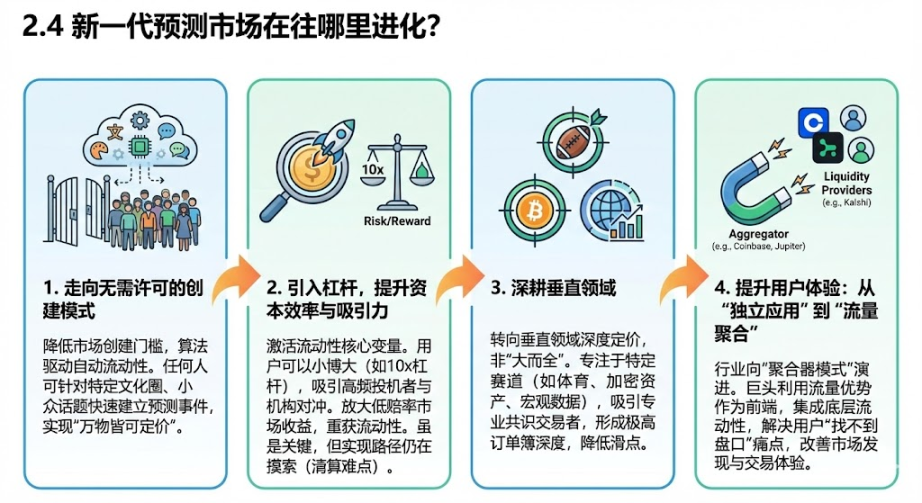

2.4 Where Are the New Generation of Prediction Markets Evolving?

The problems with Polymarket are precisely the best entry points for newcomers. For those without historical baggage, there’s no need to replicate a "cautious giant." The pain points are clear: users are tired of curation and crave freedom; capital is tired of inefficiency and desires leverage.

1. Moving toward permissionless creation: To address the lack of niche markets caused by official curation, the new generation of prediction markets is lowering the threshold for market creation.

Through algorithm-driven automatic liquidity mechanisms, anyone can quickly create prediction events for specific cultural circles (such as Chinese niche markets), niche technical topics, or vertical industry trends, achieving true "everything can be priced."

2. Introducing leverage to improve capital efficiency and attractiveness: To address the long-standing pain point of "high capital occupancy, insufficient return elasticity" in prediction markets, leverage is the core variable to activate liquidity:

Traditional $0-$1 prediction contracts are essentially fully collateralized spot trades. With leverage, users can use minimal margin to pursue outsized returns when major events break out (e.g., 10x leverage on predicting Fed rate hikes). This not only attracts high-frequency speculators but also allows institutional investors to hedge macro risks at lower costs.

For markets with a 90% win rate but very low odds, ordinary users often lack interest. The leverage mechanism amplifies the volatility returns of low-odds markets, allowing markets that are "highly certain but unprofitable" to regain liquidity depth.

Although leverage is key to improving capital efficiency, its implementation in prediction markets is still being explored. The simple "collateralized position for assets" model has inherent flaws in prediction markets. Due to generally poor liquidity and binary settlement mechanisms (prices may jump from 0 to 1 at settlement), the system struggles to smoothly liquidate during volatile moments.

3. Deepening vertical fields: No longer pursuing "big and comprehensive," but shifting to deep pricing in vertical fields. For example: Football fun, which focuses on sports, and Limitless, which focuses on crypto price predictions.

Vertical platforms attract highly specialized traders by focusing on specific tracks (such as sports, crypto asset volatility, or macroeconomic data). This precise participant profile means funds are no longer scattered in ineffective markets but form deep order books in core areas, greatly reducing slippage costs for large trades.

4. Improving user experience: From "standalone applications" to "traffic aggregation" Giants (such as Coinbase, Jupiter) have traffic but the cost of building their own prediction markets is high (involving compliance, oracles, odds calculation, etc.). Therefore, the industry is evolving toward an "aggregator model":

Prediction markets, unlike Meme coins, do not have a unified CA. Giants use their traffic advantage as the frontend, integrating underlying liquidity from Kalshi and others, solving the pain point of users "not finding markets," which will greatly improve market discovery and trading experience.

III. A Panorama of Prediction Market Projects in the BNB Chain Ecosystem

Looking at several major public chains: Solana is seeking transformation to ICM as Meme coins recede, Base is focusing on the creator economy; after the Yzi labs S2 announcement, BNB’s heavy support for prediction markets is a clear signal of its bet.

Moreover, prediction markets on BNB Chain have developed a completely different pattern from other ecosystems: several recently launched prediction markets have chosen to reward the community through airdrops.

Therefore, we need to single out BNB ecosystem prediction market projects for a closer look.

3.1 The BNB Chain Prediction Market Racetrack

@opinionlabsxyz

Led by Yzi Labs, completed a $5 million seed round, with participants including Echo, Animoca Ventures, Manifold Trading, Amber Group, and others.

The platform is growing rapidly, now among the top three prediction markets, and is transitioning from a niche tool to macro financial infrastructure. Users interested in macro trading, DeFi, and event prediction should explore it in depth.

Recently, Dune released an 88-page industry report, rating Opinion as a "leading example of macro prediction markets." Cumulative notional trading volume exceeds $8.2 billion (from $180 million on launch day to now), with multiple days exceeding $200 million in volume.

@predictdotfun

Predict.fun is a native DeFi prediction market on BNB Chain, founded by former Binance Research head and PancakeSwap founder @dingaling. Graduated from EASY S2.

Unlike other prediction market projects, Predict.fun allows prediction positions to be used as DeFi capital, supporting yield, lending, and leverage through on-chain protocols, improving capital efficiency and permissionless liquidity.

Currently, Predict fun has taken snapshots of historically active addresses on BNB Chain meme traders, Aster DEX, Polymarket, Limitless, Myriad, Opinion, and other platforms. Users can check eligibility and unlock points for airdrops by completing tasks (depositing, inviting tweets, completing specified trading volume).

On its first day online, it achieved $10M+ in trading volume.

@0xProbable

A native on-chain prediction protocol jointly incubated by PancakeSwap and Yzi Labs. Offers zero-fee predictions, supports deposits in any token (automatically converted to USDT), and allows anyone to launch new markets.

Secured by UMA’s Oracle, focusing on unique events such as sports and crypto price trends, users can participate in a points program.

Officially went LIVE on the 18th of this month, supporting zero-fee predictions. Currently, multiple real-time event markets are open, such as NBA games (e.g., Grizzlies vs Timberwolves, Bulls vs Cavaliers, etc.).

@42

Graduated from EASY S2, introducing Bonding Curve to turn real-world event outcomes into liquid, tradable token assets. This design continuously produces high-volatility, high-liquidity assets that can be settled fairly and transparently. 42 goes beyond the scope of prediction markets and is more like an "event asset issuance platform."

Founder @Leozayaat repeatedly emphasizes that 42 is not a traditional prediction market variant, but a completely new asset class with a core mechanism different from any prediction market or launchpad. Users can freely buy and sell at any time without worrying about liquidity.

It has created an event asset issuance platform based on real events, theoretically never "rugging" users. This is an elegant mechanism innovation and has the potential to further upgrade the entire ecosystem’s gameplay.

The mainnet mechanism has been fully tested, with a new, more beautiful UI planned for launch at the end of January. Currently, Beta phase is actively promoting event markets.

@Bentodotfun

Graduated from EASY S2 and received support from Base (Batches 001 - Second Prize).

Prediction markets are truth engines, but face challenges such as discovery difficulty, lack of personalization, isolation, and limited profit space.

Bento allows users to reorganize global prediction markets with user-generated markets, creating market designs like challenges and tournaments, providing better discovery mechanisms for markets and traders.

Just as Roblox revolutionized the gaming industry: building personalized games like Lego, inviting friends, and establishing micro-economies; Bento is doing the same for prediction markets.

They believe trading and speculation are new forms of gaming, but also need social-native, user-generated models for rapid growth.

The core team includes co-founders @abhitejxyz and @PratyakshInani. They were previously co-founders of Filament and have been building together for 5 years.

Currently in Early Access testing phase (not yet officially live on mainnet).

3.2 Prediction Market Infrastructure Also Needs Deployment

As mentioned earlier, prediction markets are not just about platform mechanisms; there are still infrastructure changes needed. The BNB Chain ecosystem is clearly aware of this: platform improvements alone are not enough, and infrastructure innovation is also needed. Therefore, prediction market infrastructure is being introduced into the ecosystem.

@APRO_Oracle: An AI-enhanced decentralized oracle platform focused on providing high-fidelity, reliable off-chain data for cutting-edge ecosystems. Vertically serves high-growth areas such as RWA, AI agents, prediction markets, and DeFi.

Graduated from EASY S1, other institutional supporters include Polychain Capital, Franklin Templeton (FTDA_US), ABCDE, etc., and has completed multiple rounds of financing.

The platform has completed 77K+ data validations and 78K+ AI Oracle calls, continuously providing data support for top RWA, AI, and prediction market projects.

The token $AT is already listed on Binance spot, with a current market cap of $28M and FDV of $122M. It’s one of the leading projects from S1.

@soraoracle: An autonomous agent-based decentralized oracle built on BNB Chain, focused on providing an autonomous truth layer for real-world events in prediction markets.

The platform is currently in its early stages, and developers can deploy production-grade prediction markets with its TypeScript SDK + CLI in one click.

IV. KOL Opinions Summary

@Dune (on-chain data platform): Prediction markets are not gambling, but are becoming the world’s most accurate information network. More accurate than polls and expert surveys, faster than econometric models, clearer hedging mechanisms than traditional derivatives, and more transparent signals than media reports.

Matt Huang (Founder of Paradigm) @matthuang: Prediction markets are civilization-scale truth-telling machines, but they are also a way to find interesting and useful financial exposures that society demands, prioritizing breadth.

Ella (Head of Yzi Labs) @ellazhang516: Prediction is innate to humans, from hunting to AI, and prediction markets built on this have huge potential. The real opportunity is not to copy Polymarket, but to solve its pain points—with faster oracles, seamless user experience, and aggregated liquidity, embedding prediction behavior into daily scenarios like TikTok, evolving prediction from a trading product to a social-level truth and consensus infrastructure.

Winry (KOL) @vonzz6: Experience and personal views on the three major prediction market projects on BNB Chain. From a product perspective, she points out that prediction markets on BNB Chain have entered a high-frequency competition stage, marking a shift from "single platform dominance" to "multi-dimensional product competition" maturity.

Sean Ziqi (KOL) @Seanzhao1105: Analysis of the racetrack mechanism of Binance prediction markets. Citing Taleb’s theory, he points out that the fierce internal competition on BNB Chain is essentially "system evolution through individual sacrifice." Although this competition erodes the data of first movers (like Opinion), for the entire Binance ecosystem, this brutal selection mechanism builds an extremely robust, self-iterating prediction market system.

EWL (KOL) @jeg6322: Comparison of emerging prediction markets. He points out that differentiation is the core competitiveness. After comparing five new projects, he notes: Solana’s @factmach is the most innovative in product for "subjective opinion" betting; BNB Chain’s @predictdotfun relies more on CZ’s social endorsement.

TIGER (KOL) @tiger_web3: BNB Chain prediction market racetrack, reviews of three prediction market projects. He believes the current prediction market track shows an "L2-ization" trend, i.e., project competition is increasingly about background, fame, and ecosystem resources, while requirements for pure technological innovation are decreasing.

Jiayi (XDO Founder) @mscryptojiayi: She points out that the new generation of prediction markets is showing a combination of UGC + Bonding Curve. Unlike Pump.fun, which maps sentiment, the new paradigm turns "PVP zero-sum games" into "event outcome-settled" deterministic speculation.

BITWU (KOL/4XLabs) @Bitwux: He points out that prediction markets have shown a clear explosion trend this year, with extremely clear long-term logic: when information is priced, probability becomes an asset. Prediction markets are bull/bear agnostic—there will always be gamblers, and that’s their narrative charm.

V. Step-by-Step Guide: How Can Retail Investors Participate?

Prediction markets on BNB Chain are all in the early stages. We can accumulate potential rewards by using the platforms (usually in the form of points, which may be converted to token airdrops in the future). The specific strategies are divided into two categories:

1) For projects like Opinion and Predict fun that are already online, trading volume is the future airdrop—trade to mine.

2) For projects like Bento and 42 that are not yet in public beta, register for the waitlist in advance.

Let’s review how to participate in these projects:

1. Stable First Choice: Opinion Labs

Opinion is currently a good choice: visit app.opinion.trade, connect your wallet, and accumulate points by placing market orders, limit orders, providing liquidity, or holding positions (distributed weekly based on activity). Points will be related to future tokens.

2. Zero-Fee Trial: Probable

Probable is even earlier stage: visit probable.markets for zero-fee prediction trading (supports any token, auto-converted to USDT). Although there’s no formal points system yet, the website already has a points page. Many users choose to participate with small amounts and stay active on Discord, looking forward to future points or retroactive rewards.

3. Airdrop Hunters: Predict fun

Predict fun is in the airdrop phase, based on your trading snapshots on Polymarket, Opinion Labs, Aster, Limitless, Myriad, etc., but requires a certain trading volume to unlock the airdrop.

4. New Gameplay: 42

Currently in whitelist beta, with an innovative mechanism (Bonding Curve event asset issuance). Feel free to use Biteye invite code BITEYE25 for early beta access.

5. Mystery Box: Bento

Bento is currently in Alpha Testnet, expected to launch mainnet in early January. Register for the waitlist at waitlist.bento.fun for early access and a chance to win a Bento Mystery Box.

VI. Conclusion

From Pump.fun to HyperLiquid, the crypto industry has shifted from mass-producing "fat protocols" to "fat applications."

In the past, we were obsessed with high-performance public chains and complex L2 architectures, but that was just an excess of infrastructure. The real value lies in who can carry real trading demand.

Prediction markets are the ultimate form of such "fat applications"—they do not produce information, but provide the most precise pricing venue for fragmented cognition worldwide.

Polymarket is only the prologue of this transformation. In the future, prediction markets will become the immutable infrastructure of a quantifiable world. Will you continue to gamble on luck in a game of musical chairs, or will you price the future with your cognition in the market of truth?

The answer lies in the moment you place your bet.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PIPPIN Holds Bullish Structure Despite a 20% Drop From Its ATH

Hyperliquid: Can $912 mln in token burns help HYPE target $40?

Base App fully open, how is the user experience?