Bitget Daily News: Mt. Gox hacker may sell 1,300 BTC within 7 days; initial jobless claims in the US last week reached 214,000

Author: Bitget

Today's Preview

1. Metaplanet plans to increase its bitcoin holdings to 210,000 by the end of 2027.

2. Lookonchain monitored yesterday that BlackRock deposited 2,292 bitcoins ($199.8 million) and 9,976 ethereum ($29.23 million) into Coinbase Prime.

3. Arkham analyst Emmett Gallic: Entities related to Mt. Gox hacker Aleksey Bilyuchenko deposited 1,300 BTC (worth about $114 million) to unknown trading platforms in the past 7 days. This series of addresses still holds 4,100 BTC (worth $360 million). A total of 2,300 BTC have been sold.

Macro & Hot Topics

1. The number of initial jobless claims in the US last week was 214,000, with an estimate of 223,500, falling short of market expectations. The number of continuing jobless claims for the week ending December 13 was 1.923 million, with an estimate of 1.9 million.

2. BlackRock strategists Amanda Lynam and Dominique Bly pointed out in a report that the Federal Reserve is expected to implement only limited rate cuts in 2026. With a cumulative rate cut of 175 basis points in this cycle, the Fed is approaching a neutral interest rate level. Unless there is a sharp deterioration in the labor market, there is very limited room for further rate cuts in 2026. According to LSEG data, the market currently expects the Fed to cut rates twice in 2026.

3. Swissquote Bank senior analyst Ipek Ozkardeskaya pointed out that gold prices have hit record highs more than 50 times this year, and the core factors driving gold prices higher have not dissipated. She stated: "The medium- and long-term outlook for gold remains optimistic in theory."

Market Trends

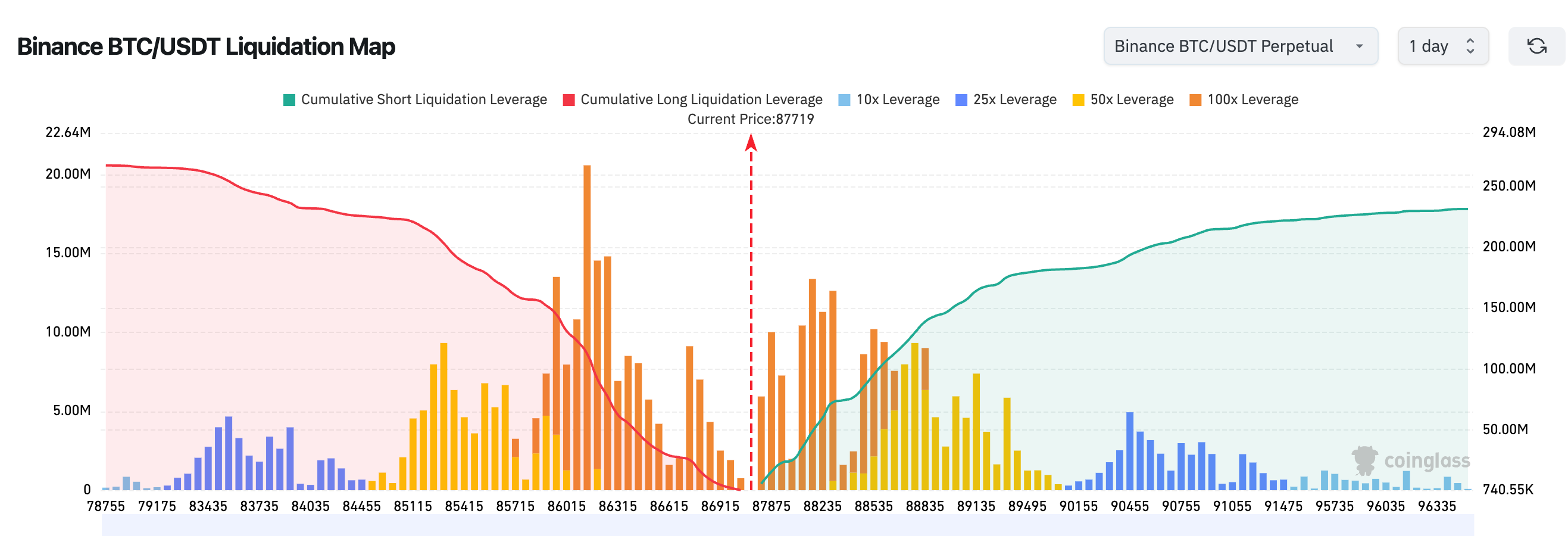

1. In the past 24 hours, the entire cryptocurrency market saw $167 million in liquidations, with long positions accounting for $102 million. BTC liquidations amounted to about $53 million, and ETH liquidations about $38 million.

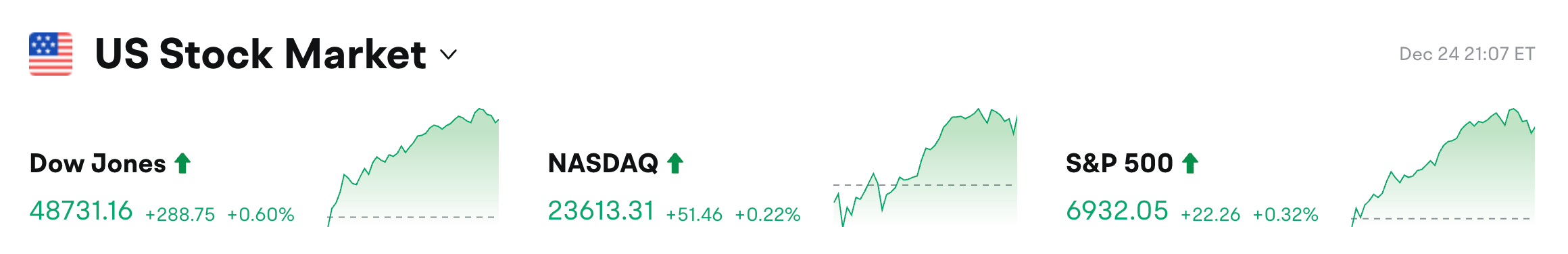

2. Due to the Christmas holiday, the US stock market closed early on Wednesday. The Dow Jones closed up 0.6%, the S&P 500 rose 0.32%, and the Nasdaq rose 0.22%. In addition, spot gold fell below $4,450, down 0.78% on the day.

3. Bitget BTC/USDT liquidation map shows: Leverage is highly concentrated near the current price (about $87,700), making short-term fluctuations likely to trigger a chain of liquidations. There is dense short liquidation in the $88,500–90,000 range above, and higher long risk around $86,000 below. The market is more likely to be "squeezed" toward the side with denser liquidity.

4. In the past 24 hours, BTC spot inflows were about $45 million, outflows about $52 million, with a net outflow of $7 million.

News Updates

1. Nvidia acquired Groq assets for $2 billion, but officially stated it did not acquire the entire company.

2. Former acting chair of the US CFTC Caroline Pham has joined MoonPay as Chief Legal Officer.

3. OpenAI is considering placing ads in ChatGPT.

4. USDC Treasury burned 50 million USDC on the Ethereum network.

5. Circle launched tokenized gold and silver swap services based on USDC.

Project Developments

1. Suspected that Multicoin purchased 60 million WLD OTC from the Worldcoin team.

2. Brevis released the $BREV tokenomics: total supply of 1 billion tokens, with 32.20% allocated for community incentives.

3. The US XRP spot ETF had a net inflow of $11.93 million yesterday.

4. Ethereum L1 daily transaction count hit a new high for 2025, reaching 1.91 million transactions.

5. Scroll clarified misunderstandings about DAO closure, emphasizing that the governance restructuring aims to improve rather than terminate.

6. The market cap of stablecoins on the Aptos chain grew by over 60% this year, peaking at $1.8 billion.

7. The founder of Aave was accused of seeking to enhance governance voting rights by increasing his holdings of $10 million in AAVE tokens.

8. West Main Self Storage increased its bitcoin holdings by 0.114, bringing the total to 2.074 bitcoins.

9. Data: Aave's lending volume has dropped by about 70% since August, and DeFi leverage is receding.

10. A whale went long on 127.4 million TST with 1-2x leverage on Hyperliquid, suspected of manipulating the price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid: Can $912 mln in token burns help HYPE target $40?

Base App fully open, how is the user experience?

The $200,000 Bitcoin dream shattered: Why did all the predictions fail?

Brevis token launch imminent: Community incentives account for 32.2%, airdrop registration coming soon