Astar (ASTR) Price Rally: How Cross-Chain Blockchain Solutions Attract Institutional Interest

- Astar (ASTR) gains institutional traction as blockchain interoperability drives adoption, with $3.16M investment in October 2025. - Technical upgrades like Astar 2.0's 150,000 TPS capacity and partnerships with Sony/Japan Airlines enhance cross-chain utility. - Q3 2025 TVL of $2.38M contrasts with DeFi's $11.96B decline, highlighting Astar's deflationary tokenomics and institutional appeal. - Strategic positioning as a multichain bridge validates ASTR's role in connecting traditional finance with decentr

Institutional Investment Pours Into Astar

Confidence from major institutions in Astar has reached a pivotal stage.

Technical Enhancements Fuel Cross-Chain Growth

Astar’s technical roadmap has played a crucial role in appealing to institutional investors. The debut of Astar 2.0 in September 2023

Strategic Partnerships Expand Real-World Use

In addition to its technical strengths, Astar’s collaborations with Web2 companies have increased its practical significance.

Market Results Outperform DeFi Sector Trends

Conclusion: Astar’s Role in Multichain Investment

The upward movement in Astar’s price is not simply a short-term spike; it reflects the project’s alignment with institutional needs. By merging advanced interoperability, influential partnerships, and significant technical progress, ASTR has established a distinct position in the multichain sector. As the appetite for cross-chain infrastructure among institutions continues to grow, Astar is poised to benefit, serving as a notable example of blockchain’s ongoing adoption.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Onchain Perpetual Futures Surge Past $1 Trillion as Traders Chase Leverage in 2025

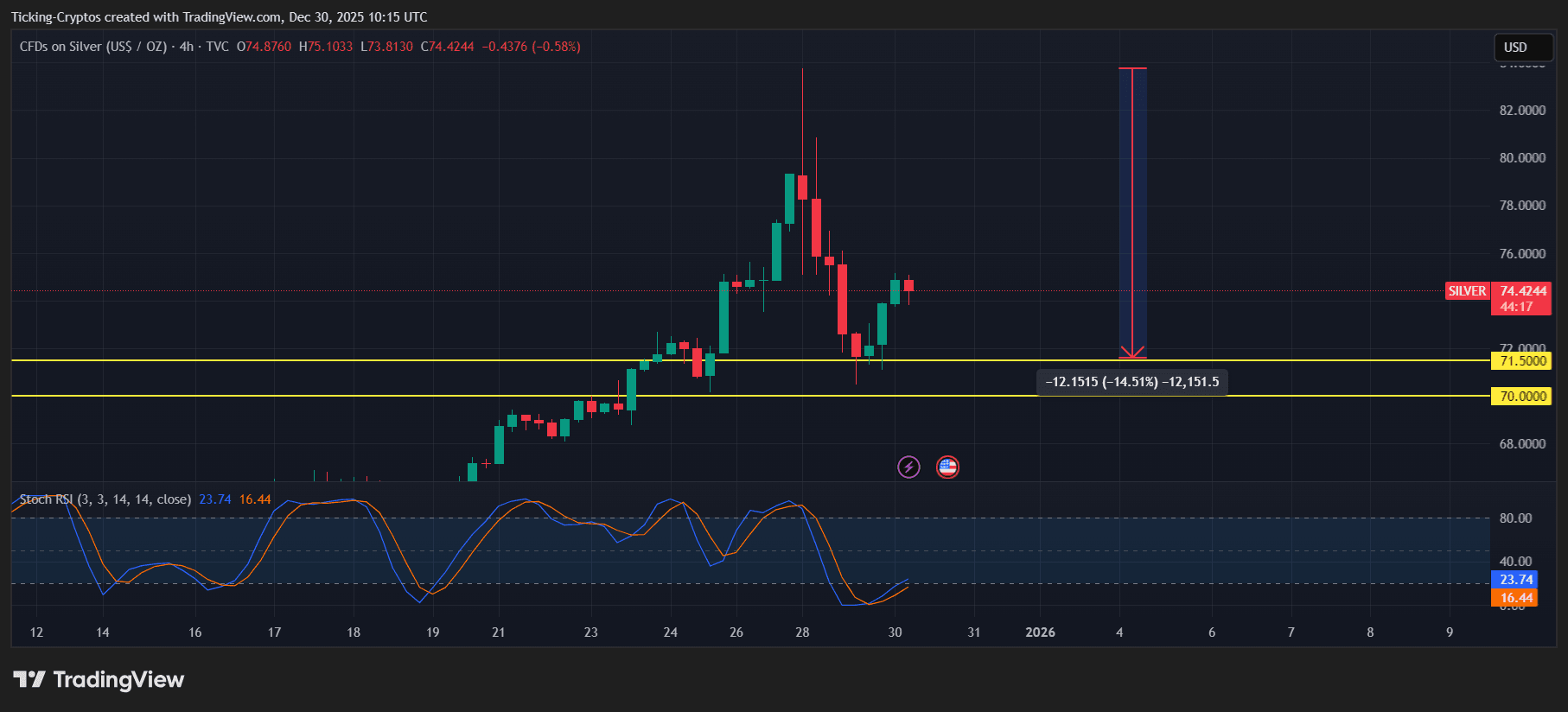

Silver Price Crash after Big Rally: Where Does Liquidity Go Next?

Lummis Announces RFIA of 2026 That Differentiates Securities And Commodities