Silver Price Crash after Big Rally: Where Does Liquidity Go Next?

After surging aggressively toward the $83 per ounce zone, silver has just seen a sharp and violent pullback, wiping out a significant portion of its recent gains in a very short time. According to market estimates, the move erased hundreds of billions in notional market value, marking one of the most abrupt reversals in years.

The drop did not come out of nowhere. A mix of mechanical market triggers, rising leverage, and growing stress behind the scenes turned a strong rally into a sudden selloff.

What Triggered the Silver Crash?

Over the past few days, silver followed a familiar pattern:

- Fast upside acceleration

- Increasing leverage in futures markets

- Rising volatility as prices pushed toward extreme levels

Then conditions changed quickly.

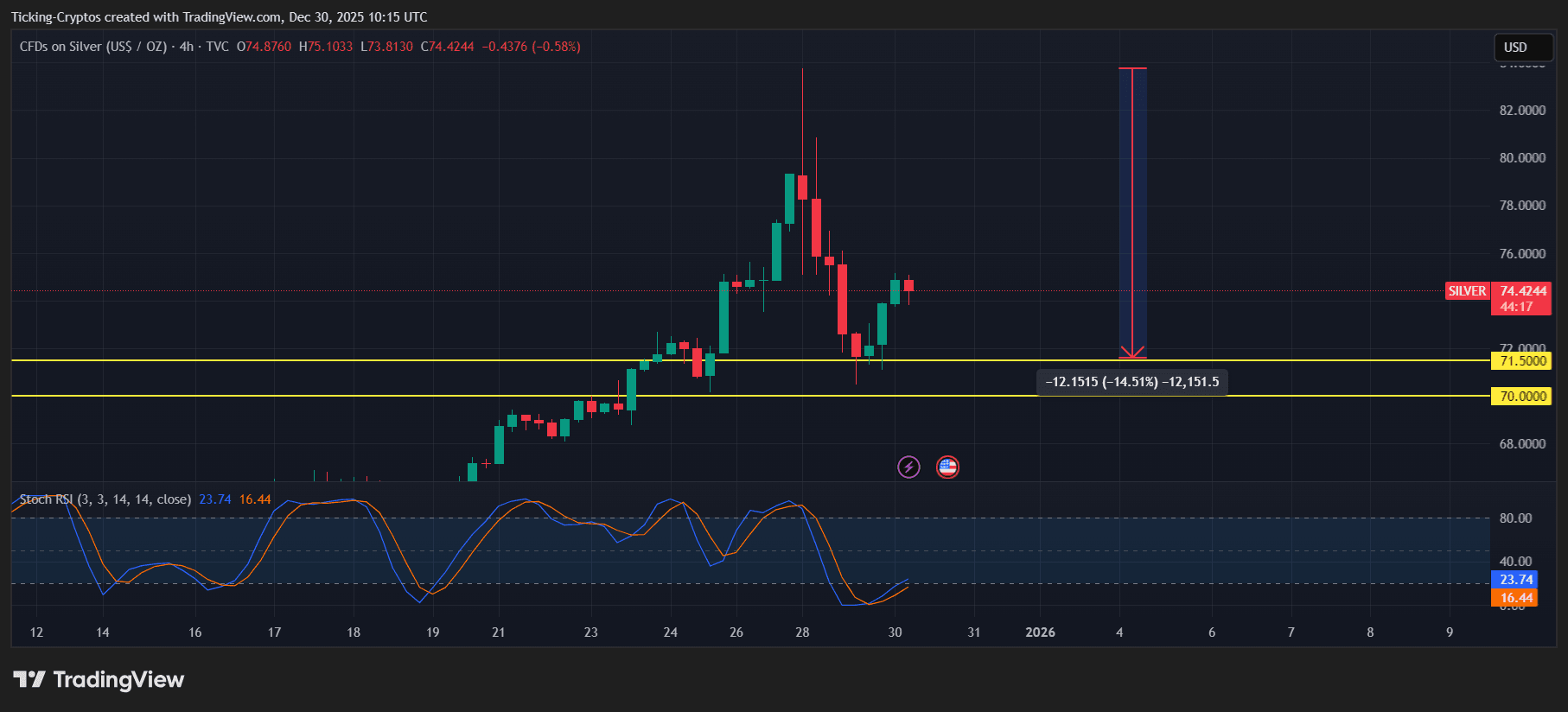

Silver price in USD 4H - TradingView

The CME Group announced a sharp increase in silver futures margin requirements, raising them to $25,000 per contract, effective December 29. This immediately altered the risk profile for traders holding leveraged positions.

When margins rise, traders must either:

- Add more cash to maintain positions, or

- Reduce exposure by selling

In fast-moving markets, many choose the second option.

Forced Selling Took Over the Market

Margin hikes often act as a mechanical brake on overheated markets. As requirements increased, leveraged traders were forced to unwind positions, triggering:

- Rapid liquidations

- Cascading sell orders

- A sharp intraday price collapse

This type of move is not necessarily a reflection of weakening long-term demand, but rather of positioning stress reaching a breaking point.

Rumors Added Fuel to Fragile Sentiment

At the same time, reports began circulating that a systemically important bank may have failed to meet a margin call on its silver futures exposure and was allegedly liquidated in the market.

While these claims remain unconfirmed, they contributed to already fragile sentiment. In highly leveraged environments, confidence matters, and even rumors can accelerate selloffs once liquidation pressure starts.

A Pattern Seen Before in Silver Markets

This setup is not new.

In previous silver cycles — most notably 1980 and 2011 — similar dynamics played out:

- Rapid price spikes

- Multiple margin increases in a short time

- Forced selling that marked major turning points

Margin hikes are commonly used to cool speculation, slow momentum, and reduce systemic risk when price moves become extreme.

What Happens After Silver Cools Off?

Despite the sharp drop, silver demand fundamentals have not suddenly disappeared. However, the market has clearly entered a high-volatility phase, where aggressive moves in both directions become more likely.

Historically, when metals like silver and gold cool off after extreme runs, liquidity often rotates elsewhere. In past cycles, periods following precious-metal slowdowns have coincided with renewed strength in risk assets, including equities and crypto.

That rotation dynamic is now back on traders’ radar.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why XRP price is stuck in a two-year trading range as it eyes $1.58

Before the Breakout: How Capital Repriced Crypto for 2026 — From Winter to Infrastructure

Why XRP Price Faces a 41% Crash Risk Despite Broad Holder Buying?

Standard Chartered Predicts XRP Could Surge to $8 by 2026 Amid Growing Market Interest