Onchain Perpetual Futures Surge Past $1 Trillion as Traders Chase Leverage in 2025

Quick Breakdown

- Onchain perpetual futures volumes surpassed $1 trillion monthly in 2025 as traders shifted toward leveraged strategies.

- Decentralized platforms like Lighter, Aster, and Hyperliquid now dominate crypto derivatives trading.

- Equity perpetual futures could become the next major growth area for onchain markets.

Crypto derivatives activity accelerated sharply in 2025, with traders increasingly turning to onchain perpetual futures as spot market opportunities remained muted, according to Coinbase researcher David Duong.

By the final months of the year, decentralized exchanges were processing more than $1 trillion in monthly perpetual futures volume, highlighting the rapid rise of onchain derivatives as a core segment of the crypto market.

Leverage replaces Altcoin season

In an X post, Duong said the lack of a traditional altcoin season led traders to adopt leveraged strategies rather than spot trading. Perpetual futures derivatives that allow traders to speculate on price movements without an expiry date offered what he described as an “unprecedented degree of leverage,” enabling larger positions with relatively small capital outlays.

— David Duong🛡️ (@DavidDuong) December 29, 2025

This shift has significantly boosted activity on decentralized trading venues, where traders can access leverage without relying on centralized exchanges.

DEXs drive record trading volumes

Duong noted that most of the growth has come from decentralized platforms, with onchain exchanges such as Hyperliquid, Aster, and Lighter accounting for a substantial share of trading volume.

Hyperliquid, which

Competition intensified further in September, when Aster briefly

Meanwhile, Lighter, an onchain derivatives exchange founded in 2022 by entrepreneur Vladimir Novakovski, raised $68 million in November shortly after launching its public mainnet.

Equity perps could be the next growth frontier

Looking ahead, Duong suggested that equity perpetual futures could emerge as the next major expansion area for onchain derivatives. Tokenized stock perps could blend crypto’s 24/7 access and leverage with global demand for exposure to major US equities outside traditional market hours.

“Perpetual futures are no longer just high-leverage trading tools,”

Duong said, adding that they are increasingly becoming core, composable building blocks within DeFi markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Most supply chains won’t be ready for transparency | Opinion

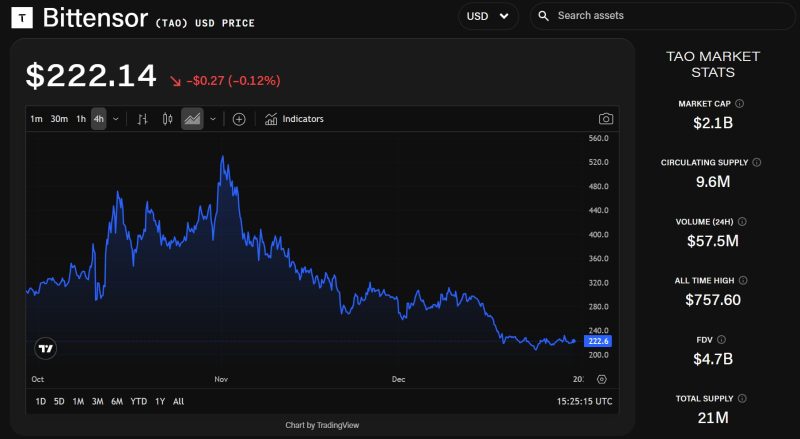

Grayscale files for spot Bittensor ETF following network's first halving event

Blockchain Losses Soar to $2.93B Despite Fewer Incidents in 2025