News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

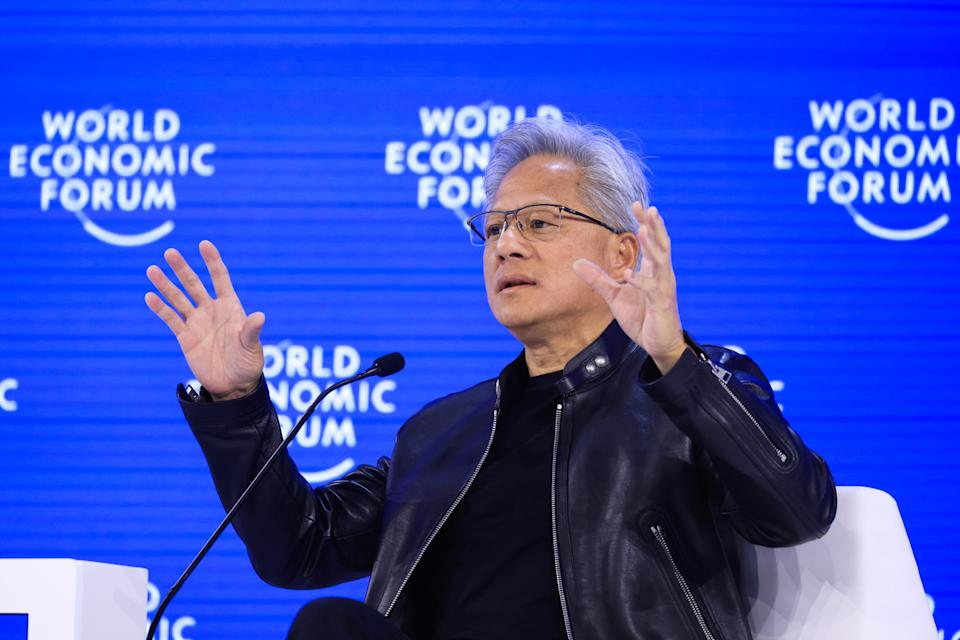

US Considers Mandating Permits for International Sales of Nvidia and AMD AI Chips

101 finance·2026/03/05 18:15

What's Going On With ChargePoint On Thursday?

Finviz·2026/03/05 18:15

Crypto With the Most Potential in 2026: BlockDAG, SUI, AVAX, and Stellar

Coinomedia·2026/03/05 18:15

Venezuelan gov't, Shell sign oil deals, state television says

101 finance·2026/03/05 18:09

Top Stocks From the Staffing Services Industry to Buy Now

Finviz·2026/03/05 18:09

Alexandria Stock Rises 19.2% in 3 Months: Will the Trend Continue?

Finviz·2026/03/05 18:09

All You Need to Know About TransDigm (TDG) Rating Upgrade to Buy

Finviz·2026/03/05 18:03

Amer Sports, Inc. (AS) Upgraded to Buy: Here's Why

Finviz·2026/03/05 18:03

Flash

22:12

All three major U.S. stock indexes closed lower, while U.S. cybersecurity stocks strengthened.格隆汇 March 6|The three major US stock indexes closed down collectively, with the Dow Jones falling 1.61%, the S&P 500 index down 0.57%, and the Nasdaq down 0.26%. Major technology stocks were mixed, with Microsoft rising over 1%, Nvidia, Netflix, Amazon, and Intel posting slight gains; Meta fell over 1%, while Apple, Tesla, and Google saw slight declines. US cybersecurity stocks strengthened, with Okta up 11%, CrowdStrike up over 4%, and Datadog up over 3%.

22:08

Simon Property Group announces completion of amendments, restatements, and extensions to existing credit arrangementsThe latest maturity date for this financing instrument has been set for June 30, 2030. It is worth noting that the agreement includes an optional renewal clause, allowing the company to further extend the term to June 30, 2031.

22:07

According to the latest public documents from the U.S. Securities and Exchange Commission (SEC), biopharmaceutical company Contineum Therapeutics Inc. has launched a new stock offering plan.The company plans to publicly offer its Class A common stock through the underwriter Leerink Partners, with a maximum fundraising scale of up to 100 million USD. This financing plan aims to provide funding support for the company's clinical-stage research and development projects, further advancing the development process of its drugs for the treatment of neurological diseases. Specific issuance terms, including the offering price, number of shares, and final fundraising scale, will be determined based on market conditions.