Webster, NY: A Center for Revitalization and Growth Fueled by Infrastructure

- Webster , NY, leverages public-private partnerships to drive real estate and industrial growth through $4.5M downtown revitalization and $9.8M infrastructure upgrades. - Brownfield Opportunity Area designations and waterfront projects unlock underused land, attracting $650M fairlife® facility and mixed-use developments with state-funded remediation. - Strategic infrastructure investments at Xerox campus and Sandbar Waterfront enhance industrial readiness and property values, creating scalable opportuniti

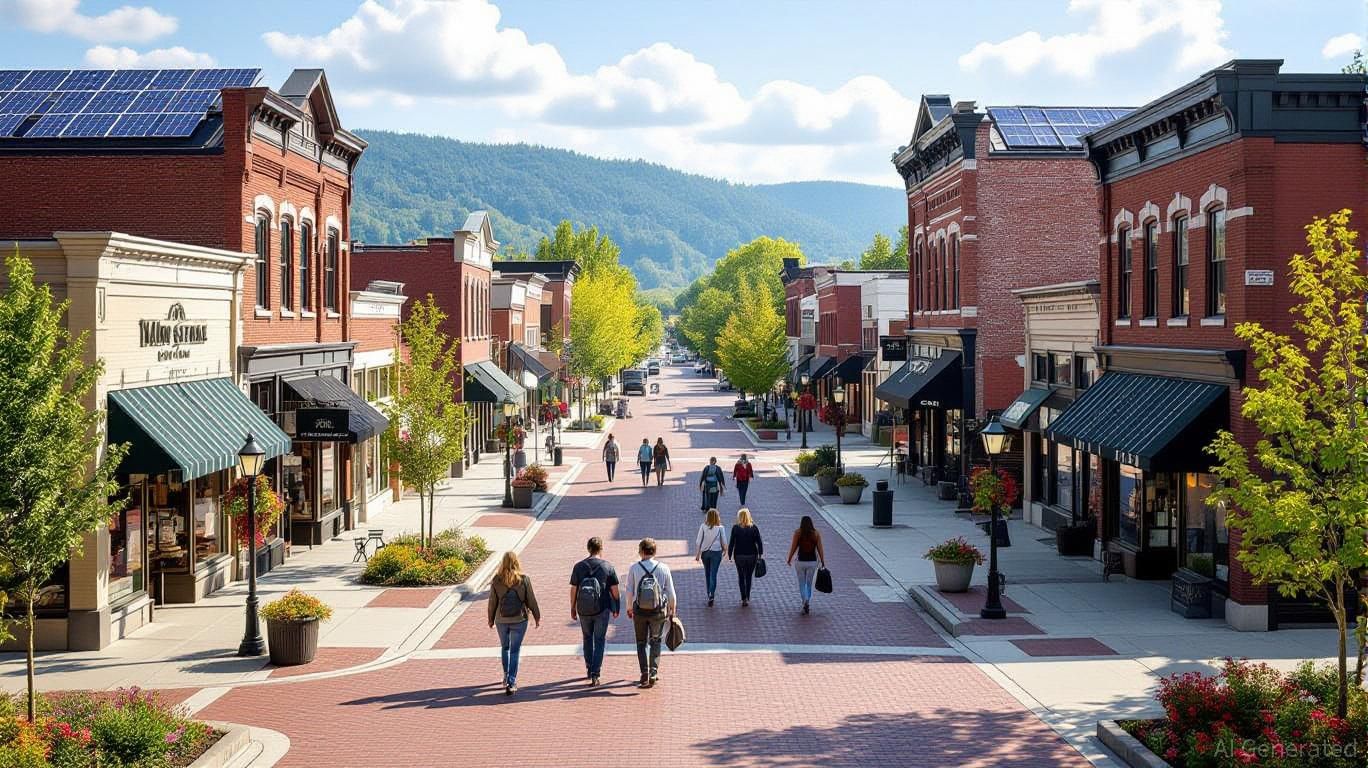

Webster, NY: A Model for Public-Private Transformation

Webster, New York, is quickly establishing itself as a leading example of how municipalities and private enterprises can work together to drive lasting growth in real estate and industry. With numerous redevelopment initiatives and significant infrastructure improvements underway, Webster is setting the stage to become a center for advanced manufacturing, sustainable urban planning, and dynamic mixed-use projects. For those looking to invest, the synergy between government support, private funding, and innovative planning makes Webster an appealing destination in the midst of transformation.

Driving Renewal: Public Investment as a Catalyst

The heart of Webster’s revitalization is the Downtown Business District, which is currently experiencing a $4.5 million transformation through the NY Forward Program. This state-backed initiative is designed to stimulate economic recovery in communities impacted by the pandemic. The project goes beyond visual enhancements, aiming to create a pedestrian-friendly Main Street that merges historic character with modern, eco-friendly features. By upgrading walkways and boosting commercial appeal, the district is set to attract new retailers and residents, fostering a vibrant, self-sustaining local economy.

Supporting this vision is the Reimagine Webster Master Plan, which has identified significant areas within the Village and Town as Brownfield Opportunity Areas. This designation unlocks state resources for cleaning up contaminated land, paving the way for future development. For developers, this means lower initial costs and fewer regulatory barriers, making Webster a prime location for capital seeking high-growth opportunities.

Infrastructure: Fueling Industrial Expansion

Modern infrastructure is at the core of Webster’s strategy to attract high-tech manufacturing and industrial investment. The historic Xerox campus, a longstanding economic pillar, is benefiting from a $9.8 million FAST NY grant. This funding is being used to upgrade roads, modernize sewer systems, and overhaul electrical networks to accommodate advanced manufacturing needs. These improvements are designed not just to maintain existing facilities, but to prepare the region for industries that require state-of-the-art logistics and utilities.

A standout example is the $650 million fairlife® production plant currently being built. This facility is projected to generate 250 well-paying jobs by the end of the year, highlighting how robust infrastructure can attract major private investments. Located on the Xerox campus, which is being upgraded with public funds, the project illustrates the benefits of aligning municipal planning with business needs. Investors in industrial real estate or manufacturing in Webster will find an environment increasingly optimized for growth and efficiency.

Waterfront Renewal and Mixed-Use Growth

The Sandbar Waterfront Revitalization Project is another testament to Webster’s forward-thinking approach. With the first phase completed in 2023 and more on the horizon, this initiative is improving public access to the Genesee River and restoring the local ecosystem. These efforts not only enhance environmental sustainability but also increase the value and appeal of waterfront properties. As these areas become more attractive and accessible, demand for both residential and commercial development is expected to rise, offering early investors the potential for significant returns.

Additionally, the recent demolition of the 600 Ridge Road site in West Webster, finalized in August 2025, has opened up new possibilities for mixed-use development. What was once a blighted property is now available for new housing, retail, or office projects in a community committed to infrastructure investment. A $90,000 transportation planning initiative further demonstrates Webster’s dedication to making these neighborhoods more walkable and interconnected.

Investor Insights: Why Webster Stands Out

For investors, Webster’s transformation is not a short-term effort but a comprehensive, long-term plan to build a diverse and resilient economy. By strategically using public funds to reduce risks for private investors—whether through environmental cleanup, infrastructure modernization, or smart zoning—the town is laying the groundwork for ongoing prosperity.

- Real Estate: Revitalized downtowns and improved waterfront access create strong prospects for residential property appreciation, while commercial and industrial sites benefit from enhanced infrastructure.

- Industrial & Manufacturing: Webster’s proactive infrastructure upgrades, such as those at the Xerox campus and the new fairlife® facility, signal a region ready to support large-scale, capital-intensive operations. The availability of pre-approved sites and attractive incentives further streamline the investment process.

Looking Ahead: A Collaborative Path Forward

Webster’s ongoing progress is rooted in its ability to blend public investment with private sector innovation. While there may be limited historical data on previous collaborations, the current wave of projects—from brownfield redevelopment to waterfront enhancements—demonstrates a proven approach to sustainable growth.

As Webster transitions into late 2025 and beyond, the emphasis will shift from planning to implementation. For those ready to invest early, the town offers a rare chance to be part of a community that is not only rebuilding its infrastructure but also redefining its economic future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Meme Coins Achieve Recognition as Institutional Investors and ETFs Drive Market Changes for 2025

- WLFI's acquisition of Solana-based meme coin SPSC triggered a 139.8% price surge, highlighting institutional interest in meme tokens. - Binance's listing of Dank Penguin and BNBHolder boosted their market caps past $5 million, showcasing exchange-driven momentum in meme coin ecosystems. - Dogecoin's ETF debut via Bitwise's BWOW and Grayscale's GDOG signals growing institutional validation, despite mixed initial performance compared to Solana/XRP ETFs. - 2025 could solidify meme coins and altcoin ETFs as

Bitcoin News Today: Bitcoin Whale Bets $84 Million—Sign of Faith or Disaster Looming?

- A Bitcoin whale opened an $84.19M 3x leveraged long on Hyperliquid after securing $10M in profits, amplifying market volatility and liquidity risks. - Other whales added 20x-25x leveraged positions totaling $75M in BTC/ETH, reflecting heightened confidence in short-term price resilience amid December 2025's 3.64% BTC and 3.79% ETH gains. - Analysts debate the rally's sustainability, citing weak Sharpe ratios (-36% Bull-Bear Index), 30% drawdown from peaks, and structural liquidity challenges favoring ran

Hyperliquid News Today: Avici Soars 1,700%—Is It MoonPay Buzz or Genuine Market Movement?

- Avici (AVICI) surged 1,700% amid speculation of a MoonPay partnership, now valued at $90.7M with $2.5M liquidity. - Analysts highlight its neobank narrative, competing with projects like Cypher while facing $50–$500 price targets implying $1B–$5B valuations. - Security risks persist, exemplified by Upbit's $36M hack and Trezor CEO's warnings on exchange vulnerabilities. - Avici's success hinges on balancing innovation with compliance, regulatory clarity, and execution amid a crowded crypto debit card mar

Bitcoin News Today: Bitcoin Recognized as a Mainstream Asset as Nasdaq Lists IBIT Alongside Leading ETFs

- Nasdaq's ISE proposes tripling Bitcoin options limits for BlackRock's IBIT to 1 million contracts, aligning it with major ETFs like EEM and GLD . - The move reflects IBIT's dominance as the largest Bitcoin options market by open interest, driven by institutional demand for hedging and speculation. - Analysts highlight the normalization of Bitcoin as a tradable asset class, with unlimited FLEX options and JPMorgan's structured notes signaling broader institutional adoption. - Regulatory alignment with gol