News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

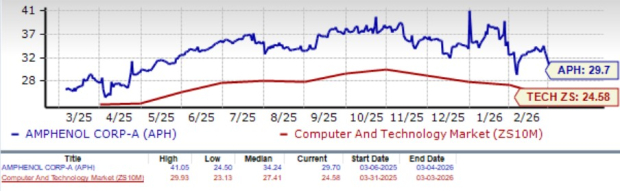

Amphenol Stock Rises 20% in 6 Months: Is There More Room for Growth?

Finviz·2026/03/05 18:33

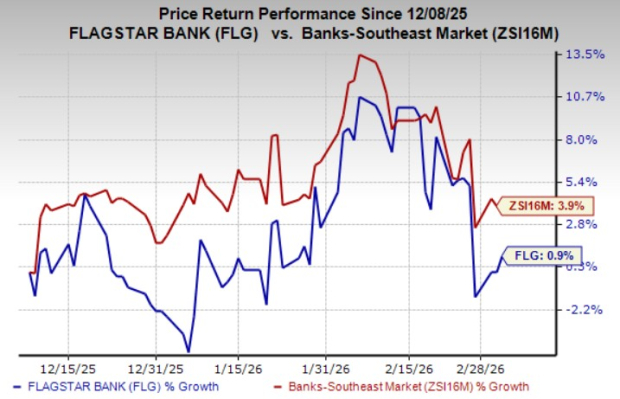

Flagstar Bank's IDR Upgraded to 'BB+' by Fitch, Outlook Remains Stable

Finviz·2026/03/05 18:33

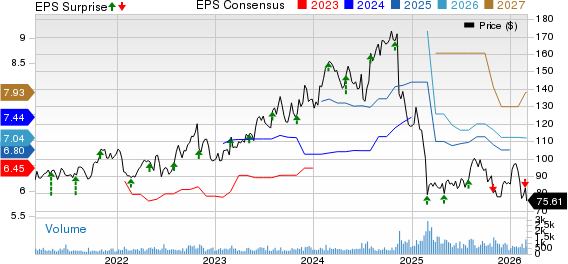

ICF Stock Declines 5.2% Since Q4 Earnings and Revenue Miss

Finviz·2026/03/05 18:33

PEPE Hovers at Critical $0.053414 Support as $432M Volume Surge Tightens Breakout Watch

Cryptonewsland·2026/03/05 18:33

Lluvias en Argentina vuelven a mejorar condiciones para soja y maíz: Bolsa Cereales

101 finance·2026/03/05 18:33

The Biggest Launch In Crypto History – Analysts Project BlockDAG Market Cap to Hit $1.2bn

BlockchainReporter·2026/03/05 18:30

Japanese Fintech Goes Live On XRP Ledger As ETFs Climb

DailyCoin·2026/03/05 18:27

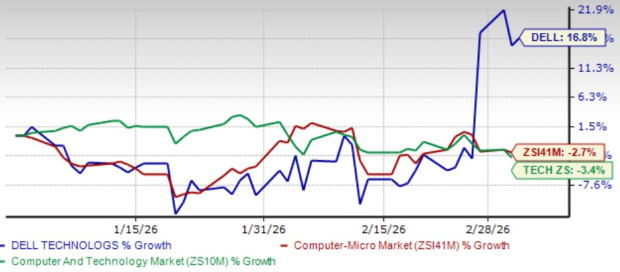

Dell's ISG Revenue Growth Strengthens: Will the Momentum Continue?

Finviz·2026/03/05 18:27

DraftKings Pushes Into Prediction Markets: A New Growth Lane?

Finviz·2026/03/05 18:27

Oracle plans thousands of job cuts as data center costs rise, Bloomberg News reports

101 finance·2026/03/05 18:24

Flash

23:46

The crypto market experienced overnight volatility and declined, with bitcoin falling below $71,000, and US crypto-related stocks generally dropping.BlockBeats News, March 6, according to market data from a certain exchange, the crypto market maintained a downward trend overnight. Bitcoin is currently quoted at $70,900, down 1.95% in 24 hours; Ethereum is currently quoted at $2,073, down 1.98% in 24 hours. The total cryptocurrency market capitalization fell 1.7% in 24 hours, now reported at $2.487 trillions. The top gainers and losers among altcoins are: SAHARA fell 10.72% in 24 hours, now quoted at $0.26; GIGGLE fell 10.7% in 24 hours, now quoted at $28.56; COOKIE fell 9.8% in 24 hours, now quoted at $0.02; FIO fell 9.3% in 24 hours, now quoted at $0.0087; BARD rose 52.5% in 24 hours, now quoted at $1.66;KITE rose 21.2% in 24 hours, now quoted at $0.273;HUMA rose 18.7% in 24 hours, now quoted at $0.016;ORCA rose 1.4% in 24 hours, now quoted at $1.04. In the US stock market, the three major indexes closed lower. The Dow Jones fell 1.6%, the S&P 500 index fell 0.57%, and the Nasdaq fell 0.2%. Crypto-related stocks generally declined, including: Strategy (MSTR) fell 4.53%; Circle (CRCL) rose 0.4%; MARA Holdings (MARA) fell 5.6%; Riot Platforms (RIOT) fell 5.3%; BitMine Immersion (BMNR) fell 3.5%; SharpLink Gaming (SBET) fell 2.46%.

23:43

Justin Sun: SEC has dismissed all charges against TRON, looking forward to cooperating with SEC to develop cryptocurrency guidelines孙宇晨说,期待与美国证券交易委员会合作,共同制定加密货币未来的发展指导方针和监管法规。 展开Sun Yuchen said that he looks forward to cooperating with the U.S. Securities and Exchange Commission to jointly formulate guidelines and regulatory policies for the future development of cryptocurrencies. Expand

23:39

According to the latest filing disclosed by the U.S. Securities and Exchange Commission (SEC), some existing shareholders of electric aircraft manufacturer Archer Aviation Inc. plan to sell up to 5.3 million shares of the company's Class A common stock.This stock sale plan is initiated entirely by existing shareholders, and the company itself will not receive any financing proceeds from this sale. According to the document, the selling shareholders may gradually reduce their holdings through public market transactions or private placements. As a representative enterprise in the emerging urban air mobility sector, Archer Aviation has recently attracted attention due to its strategic partnerships with industry giants such as Boeing and United Airlines. This shareholder reduction plan may provide more liquidity to the market, while also reflecting the early investors' need to realize partial returns. Analysts point out that such secondary market reductions are common among growth technology companies, and investors should pay attention to subsequent changes in shareholder structure and the potential impact on corporate governance.