News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily Report | Fed Maintains Hawkish Stance on Rates; Trump Threatens Iran Leading to Gold and Silver Pullback; Storage Sector Strong with Seagate Up Over 19% (January 29, 2026)2Bitcoin companies keep buying as AI pulls capital away – Inside ABTC’s move3DePIN startups raise $1B, generate $72M in onchain revenue in 2025

AI Crypto Coins: DeepSnitch AI Attracts Mass of Traders Looking for a High Upside Amid Short-Term Volatility, TAO and ICP Start Correcting

BlockchainReporter·2026/01/22 12:42

Cadence: Q4 Financial Highlights

101 finance·2026/01/22 12:27

After Trump's U-turn on Greenland, gold price holds above $4,800

汇通财经·2026/01/22 12:26

Revolutionary: Brevis Builds Attention-Based Prediction Market on Monad with Zero-Knowledge Verification

Bitcoinworld·2026/01/22 12:18

Snapchat gives parents new insights into teens’ screen time and friends

101 finance·2026/01/22 12:15

India's Cyient posts quarterly profit fall on one-off labour code charges

101 finance·2026/01/22 12:12

Atlantic Union: Fourth Quarter Earnings Overview

101 finance·2026/01/22 11:57

Shiba Inu Price Prediction: Does SHIB Still Have The WOW Factor To Turn $1,000 Into $10,000 Or Are Other Opportunities More Lucrative?

BlockchainReporter·2026/01/22 11:51

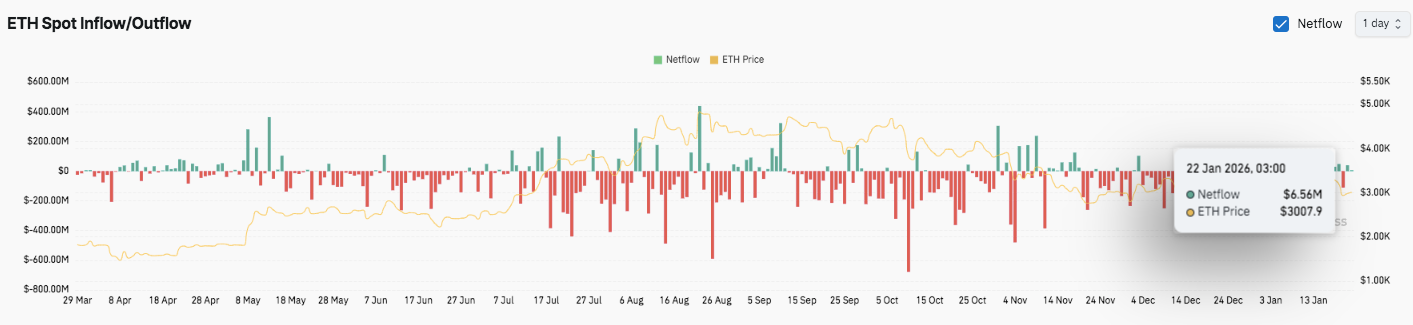

Ethereum Price Prediction: ETH Price Attempts Recovery While Flows Hint at Short-Term Calm

CoinEdition·2026/01/22 11:48

Flash

22:28

US Stocks Move: Apple Rises Over 3% After Hours, Q1 Revenue Exceeds ExpectationsGelonghui, January 30|Apple shares rose more than 3% after hours. Apple's first fiscal quarter revenue was $143.76 billion, up 16% year-on-year, with an estimate of $138.4 billion; first fiscal quarter iPhone revenue was $85.27 billion, up 23% year-on-year, with an estimate of $78.31 billion; first fiscal quarter Mac revenue was $8.39 billion, down 6.7% year-on-year, with an estimate of $9.13 billion; first fiscal quarter iPad revenue was $8.60 billion, up 6.3% year-on-year, with an estimate of $8.18 billion; first fiscal quarter wearables, home and accessories revenue was $11.49 billion, down 2.2% year-on-year, with an estimate of $12.13 billion; first fiscal quarter Greater China revenue was $25.53 billion, up 38% year-on-year, with an estimate of $21.82 billion; first fiscal quarter earnings per share were $2.84, compared to $2.40 in the same period last year, with an estimate of $2.68; first fiscal quarter cash and cash equivalents were $45.32 billion, up 50% year-on-year, with an estimate of $49.73 billion.

22:25

Circle's biggest short seller just conceded defeat, but he warns that this stock is still a roller coaster in the crypto sector.According to a report by Bijie Network: Circle has received its second analyst rating upgrade within a week, as Compass Point analyst Ed Engel upgraded the rating from "Sell" to "Neutral," though he maintained a minimum target price of $60. Engel now believes that Circle's trading is more akin to a cyclical cryptocurrency alternative rather than an independent fintech company. He pointed out the high correlation between USDC and Ethereum, as well as its widespread use in high-risk crypto activities. He mentioned risks such as the decline in USDC supply, competition from new types of stablecoins and traditional bank deposit tokens, and the potential for higher fees. Catalysts for an upside include regulatory clarity that may come with the CLARITY Act and the growth of tokenized assets.

22:14

The probability of the Federal Reserve keeping interest rates unchanged in March reaches 86.6%According to CME "FedWatch" data, the probability that the Federal Reserve will keep interest rates unchanged until March is 86.6%, while the probability of a 25 basis point rate cut is 13.4%. By April, the cumulative probability of a 25 basis point rate cut is 25.5%, the probability of keeping rates unchanged is 72.2%, and the cumulative probability of a 50 basis point rate cut is 2.2%.

News