News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.26)|SIGN, and JUP are set for large token unlocks this week; crypto market long liquidations reached $612 million; a Spark lending whale sold 11,190 ETH2Bitget UEX Daily | EU Suspends Tariffs on US; Gold Hits Record High Breaking $5000, Silver Breaks $100; Rieder Top Fed Contender (January 26, 2026)3a16z-backed Entropy shuts down, promises investors refunds

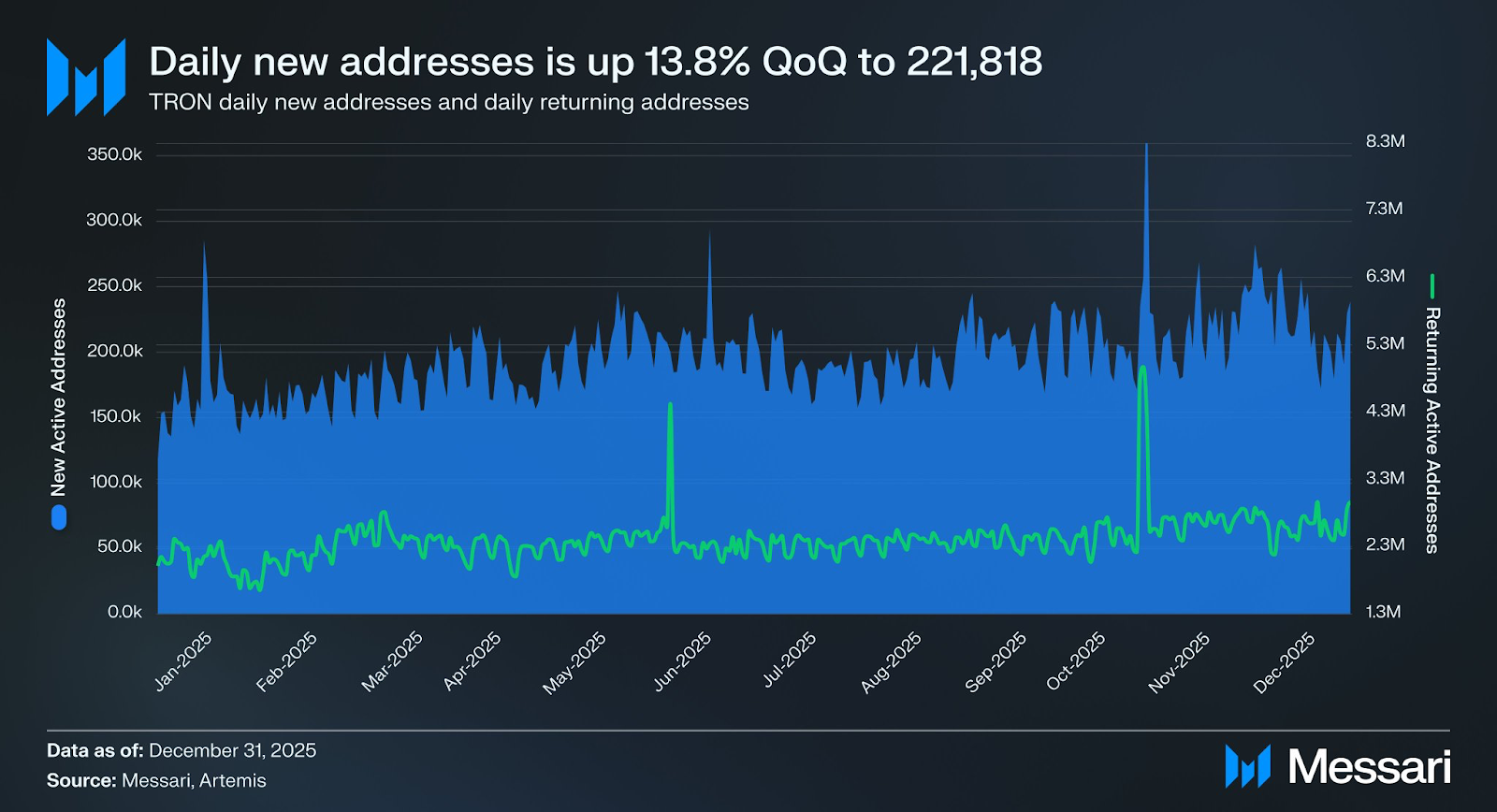

Justin Sun Predicts a Better Year for Tron After an Impressive 2025

CoinEdition·2026/01/21 12:57

Brazil central bank liquidates Banco Master's Will as Mastercard suspends cards

101 finance·2026/01/21 12:48

Gold climbs to a record peak as global markets turn risk-averse

101 finance·2026/01/21 12:42

Intel earnings to highlight recovery strategies as AI-driven data centers increase demand for chips

101 finance·2026/01/21 12:39

Sam Altman Hits Back at Elon Musk Over ChatGPT Safety Claims

Decrypt·2026/01/21 12:38

UK inflation climbs to 3.4% in December, surpassing expectations

101 finance·2026/01/21 12:33

Old National Bancorp: Fourth Quarter Earnings Overview

101 finance·2026/01/21 12:30

Trump Media Announces Crypto Airdrop Scheduled for February 2026

Cointribune·2026/01/21 12:24

NFPrompt Taps BytePlus and ByteDance to Accelerate AI Creativity

BlockchainReporter·2026/01/21 12:21

SNB chairman says Fed independence 'important for the world'

101 finance·2026/01/21 12:18

Flash

07:31

Analyst: The wave of risk aversion without headline catalysts highlights the market's deep-seated demand for safe havensGlonghui, January 26|Swissquote Bank analyst Ipek Ozkardeskay stated that investors flocking to precious metals is a clear signal that, despite some easing of US-European tensions last week, risk appetite has not returned. Silver and gold have reached new highs, while Asian stock markets have retreated. Ozkardeskay pointed out that even the Korean KOSPI index, which previously seemed unaffected by global turmoil and continued to rise, has now declined. Notably, this pursuit of safe-haven assets was not triggered by major geopolitical headlines—there were no new violations of international law, no invasion events, and no direct military threats. Ozkardeskay said that aside from the possibility of the US imposing tariffs on Canada (indicating that trade tensions persist), there is little news, and the rush into precious metals suggests that market pressures are far from over.

07:31

Sol meme coin clawd surges over 110% intraday, market cap surpasses $13 millionAccording to GMGN data reported by Odaily, the Solana chain Meme coin clawd has surged over 110% in the past day, with its market capitalization once surpassing 13 million USD, and is currently around 13.09 million USD. Odaily reminds users that Meme coin prices are highly volatile, and investors should be aware of the risks.

07:18

Tokenized Gold and Tokenized Silver Market Caps Hit All-Time HighsBlockBeats News, January 26th, according to Coingecko data, as the price of gold continues to rise, the total market capitalization of tokenized gold has exceeded 5.27 billion US dollars, currently reaching 5,275,490,349 US dollars, with a 1% increase in the last 24 hours; the market capitalization of tokenized silver has exceeded 400 million US dollars, currently reaching 439,598,206 US dollars, with a 4.5% increase in the last 24 hours, both reaching all-time highs.

News