News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Argentina's President Milei endorsed a Solana-based memecoin 23 minutes after its launch, triggering a $4.50 price surge before a $251M investor collapse. - Project founder Hayden Davis executed a $87M liquidity withdrawal hours later, admitting to "sniping" tactics typical of memecoin scams. - The scandal sparked impeachment calls, a 5% stock market drop, and highlights political risks in emerging market crypto ecosystems. - Argentina's crypto sector now faces reputational damage, with global investors

- Bitplanet launches South Korea's first $40M Bitcoin treasury, redefining corporate reserve strategies by allocating capital to Bitcoin as a macroeconomic hedge against inflation and geopolitical risks. - The debt-free model aligns with global trends prioritizing liquidity preservation, mirroring traditional treasuries' diversification into gold while leveraging Bitcoin's fixed supply as a "digital gold" asset. - Regulatory advancements like VAUPA and stablecoin oversight by 2025, alongside projected ETF

- XRP's technical patterns (symmetrical triangle, cup-and-handle) and SEC commodity reclassification in August 2025 create a strong case for a $5+ price target by late 2025. - ETF approvals (ProShares Ultra XRP, 11 pending spot ETFs) could inject $5-8B in liquidity, mirroring Bitcoin's 2024 surge while unlocking $7.1B in institutional flows. - Fundamental drivers include Ripple's $1.3T Q2 ODL transactions, 500% XRP Ledger volume growth, and RLUSD stablecoin adoption, though whale activity and macro risks r

- MSTY's 26.15% Q2-Q3 2025 decline reflects structural risks from Bitcoin-linked volatility and MSTR call options, with delta sensitivity creating asymmetric downside exposure. - The ETF's parent company is repositioning in AI media through Dubai AI Week's privacy-first initiatives, emphasizing secure tools for content creation and ethical AI governance. - While crypto-linked risks persist, MSTY's AI media strategy targets growing demand for privacy-conscious solutions, balancing volatility with potential

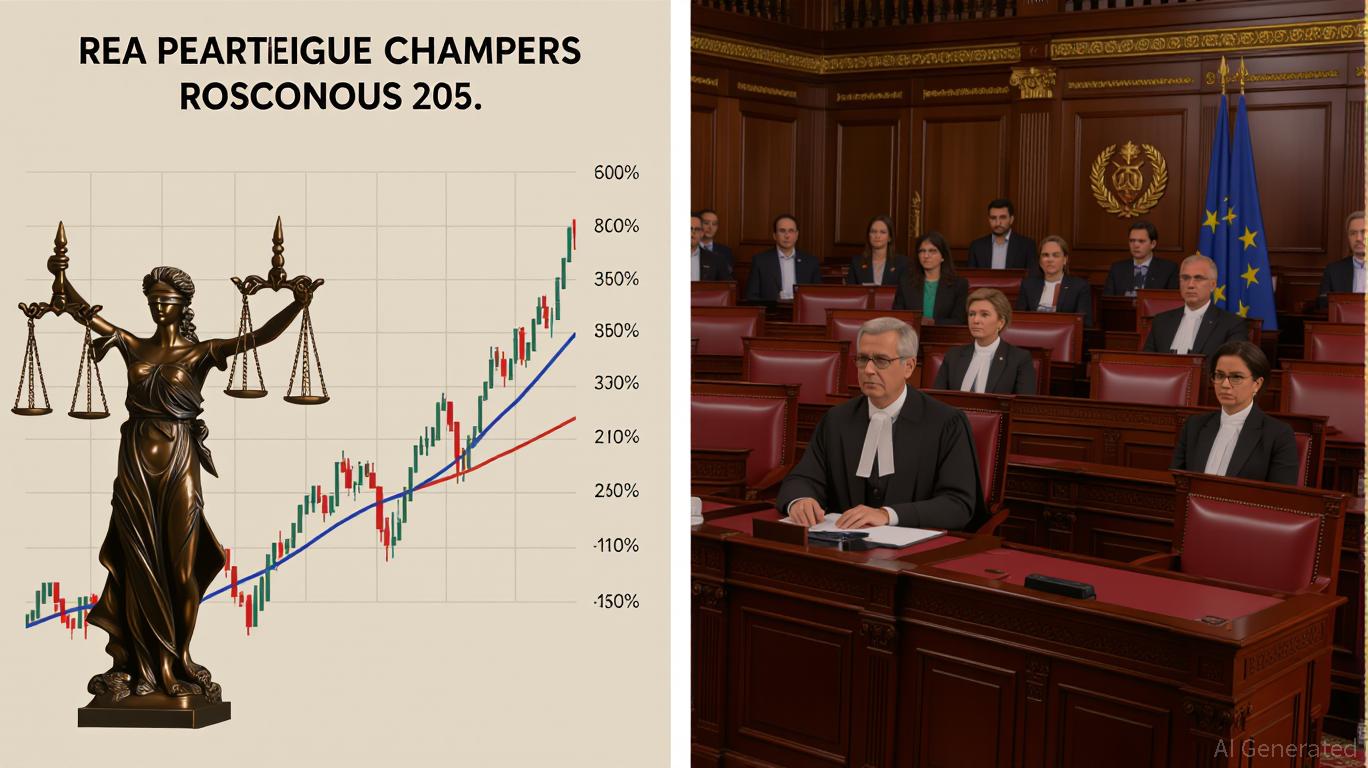

- Ripple and SEC end 5-year legal battle, confirming XRP traded on exchanges is not a security. - XRP price surged 500% post-ruling, with ETF approvals hinted for 2026 as regulatory clarity boosts investor confidence. - Institutional adoption accelerates via tokenized assets (OUSG, DCP) and cross-border payments, with ODL transaction growth exceeding 1,700%. - XRP Ledger's low-cost infrastructure supports stablecoins and CBDC pilots, positioning it as a foundational technology for global financial innovati

- XRP's 2025 valuation is increasingly shaped by legal frameworks, with common law (CL) and civil law (FCL) jurisdictions creating divergent market dynamics. - CL jurisdictions like the U.S. face regulatory fragmentation, while FCL systems in France/Quebec enforce codified transparency, boosting institutional trust and XRP adoption. - France's MiCA regulation and Quebec's ARLPE framework reduced information asymmetry, enabling XRP to process $2.5B in cross-border transactions via Ripple's ODL service. - In

- Legal frameworks in common law vs. civil law jurisdictions shape silver valuation through divergent corporate transparency standards. - Civil law markets (EU, Canada) with enforceable ESG disclosure rules reduce volatility and boost investor trust compared to fragmented common law regimes. - Silver producers in transparent jurisdictions secure 8-12% lower capital costs, while opaque firms face sharper valuation corrections during crises. - Strategic investors prioritize civil law markets with standardize

Trending news

MoreForget about the K-shaped economy, says market expert Ed Yardeni—what’s really happening is that baby boomers are accumulating wealth, while Gen Z faces challenges in growing theirs

Elon Musk claims that putting money aside for retirement is pointless, as artificial intelligence will usher in an era of plenty: ‘It will be irrelevant’