News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Bitcoin's 30% August 2025 price drop triggered debates over institutional exit vs. strategic rebalancing, with data showing diversification into Ethereum and altcoins. - Despite $1.17B ETF outflows, BlackRock's IBIT retained 89% of Q3 inflows, while corporate treasuries accumulated 3.68M BTC, removing 18% of circulating supply. - On-chain metrics revealed 64% of Bitcoin supply held by 1+ year HODLers, with whale accumulation scores and long-term lockups confirming sustained institutional confidence. - Re

- Japan Post Bank plans to launch DCJPY in 2026 to modernize services and attract younger customers. - The token enables instant savings conversion to 1-yen redeemable tokens, accelerating asset settlement from days to near-instant. - DeCurret DCP collaborates with Japanese governments to use DCJPY for subsidies, expanding its utility in public finance. - Japan's $1.29T bank aims to rejuvenate dormant accounts with 3-5% returns on tokenized real estate/bond investments. - SBI Group's Chainlink partnership

- Three 2025 meme coins—Bonk (BONK), Dogwifhat (WIF), and Remittix (RTX)—attract investor attention for triple-digit growth potential amid crypto market shifts. - BONK gains institutional backing via $25M Safety Shot investment, while WIF shows bullish triangle patterns and $2 price targets despite 10.65% weekly declines. - RTX distinguishes itself with real-world PayFi utility, enabling crypto-to-fiat conversions and hitting $20M presale milestones ahead of September 15 beta launch. - The trio reflects 20

- 2025 Bitcoin bull market driven by institutional adoption and spot ETFs, boosting BTC price from $45k to $120k. - Miners outperformed BTC by 3.6x leverage via efficiency gains, institutional capital shifts, and network hashrate growth to 31.5% U.S. dominance. - Institutional demand created 18% circulating supply ownership, reducing exchange-held BTC to 7-year low while regulatory clarity cut volatility to 32%. - Miners diversified into AI/HPC infrastructure (e.g., TeraWulf's $1.4B Google partnership) to

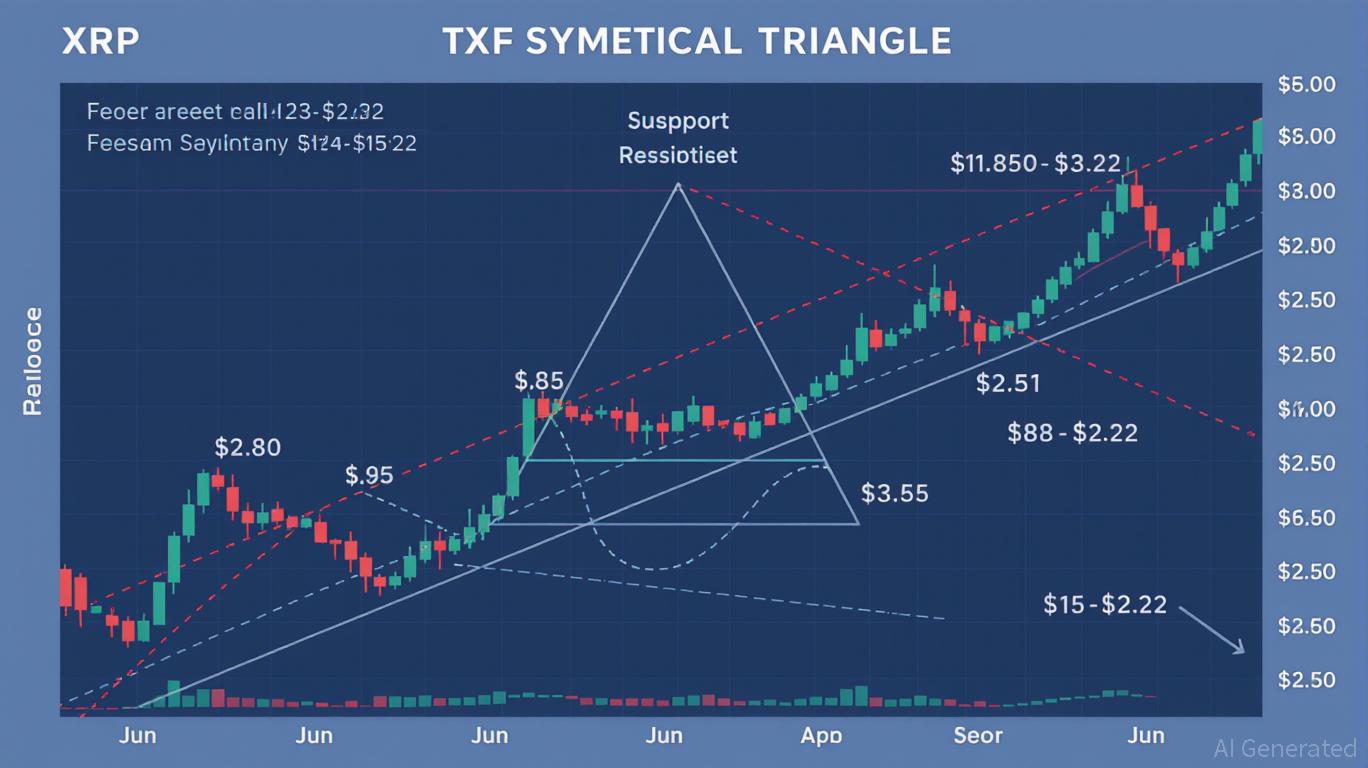

- XRP's 2025 Wave 4 correction (from $3.65 to $2.60–$2.65) creates strategic entry points for long-term investors amid institutional accumulation. - Regulatory clarity post-SEC/CLARITY Act and pending 11 XRP ETF approvals could unlock $5–$8B in institutional capital by Q4 2025. - Technical analysis projects $5.85 short-term and $15–$18.22 Wave 5 targets if $2.80 support holds, validated by $1B+ institutional buying. - Ripple's $1.3T Q2 ODL volume and Grayscale's 40% XRP Trust growth highlight growing insti

- Political disinformation and crypto markets form a volatile feedback loop, with AI amplifying manipulation and distorting regulations. - Russian-linked actors used crypto-funded deepfakes and darknet networks to destabilize markets during the 2024 U.S. election cycle. - Pro-crypto policies and $130M in political spending fueled Bitcoin's 2025 high, while AI-generated misinformation created regulatory uncertainty. - Investors now require real-time sentiment analysis and geopolitical intelligence to naviga

- The 2025 meme coin market shifts toward high-utility projects blending virality with blockchain innovation, outpacing legacy tokens like Shiba Inu (SHIB). - SHIB faces stagnation due to flawed tokenomics, 98% reduced burn rates, and a $0.000012–$0.000013 price range despite $6.84B market cap and ecosystem expansions. - New contenders like LILPEPE (Ethereum Layer 2), APC (769% ROI potential), and RTX (cross-border payments) leverage deflationary mechanics, institutional-grade utility, and structured incen

- SEC's 2020 lawsuit against Ripple triggered panic, causing XRP's price to drop 83% as investors adopted risk-seeking behaviors. - A 2023 court ruling favoring Ripple led to a 75% XRP price surge, reflecting risk-averse behavior amid regulatory clarity. - The 2025 SEC settlement and $50M penalty drove XRP to $2.59, showcasing how regulatory outcomes shape investor sentiment. - Whale accumulation and offloading in 2025 exacerbated price swings, highlighting herd mentality's role in amplifying volatility. -

- Former U.S. President Trump launches "WLFI Token" on Sept 1, aiming to integrate it into his media/business ecosystem for supporter engagement and revenue growth. - Parallel platform "DOT Miners" promises $9,700/day passive income via staking, using proof-of-stake mechanisms but drawing comparisons to high-risk HYIP schemes. - Experts warn of volatility and regulatory risks in crypto markets, as political figures increasingly leverage blockchain for audience engagement and monetization. - Trump's token e

- Kevin O’Leary’s 10% Bitcoin/crypto and 5% gold allocation sparks debate on digital assets’ role in modern portfolios, democratizing access via ETFs like IBIT and IAU. - Traditional diversification falters as equities-bonds correlation collapses, pushing investors to Bitcoin and gold as hedges against inflation and geopolitical risks. - Institutional adoption accelerates with $29.4B Bitcoin ETF inflows and the U.S. Strategic Bitcoin Reserve, while VaR models now standardize crypto risk management in diver