News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

- Institutional investors increasingly adopt Bitcoin as strategic asset via decentralized governance models, mirroring industrial firms' operational agility. - Decentralized BTC-TCs empower mid-level managers for real-time decisions, using metrics like mNAV and leverage ratios to align with long-term goals. - Regulatory clarity (CLARITY Act, spot ETFs) and innovation (stablecoins, lending) normalize Bitcoin as diversification tool alongside traditional assets. - Investors prioritize transparent governance

- NMR surged 253.64% in 24 hours to $13.36, with 14,666.67% and 15,324.83% gains over the past week and month. - On-chain data shows reduced small-holdings and <10% circulating supply, reinforcing scarcity and upward pressure. - Technical indicators confirm key resistance breaks and strong momentum, with RSI in overbought territory but no bearish divergences. - A backtesting strategy using momentum and volume could capture NMR’s recent rally, aligning with its bullish on-chain and technical signals.

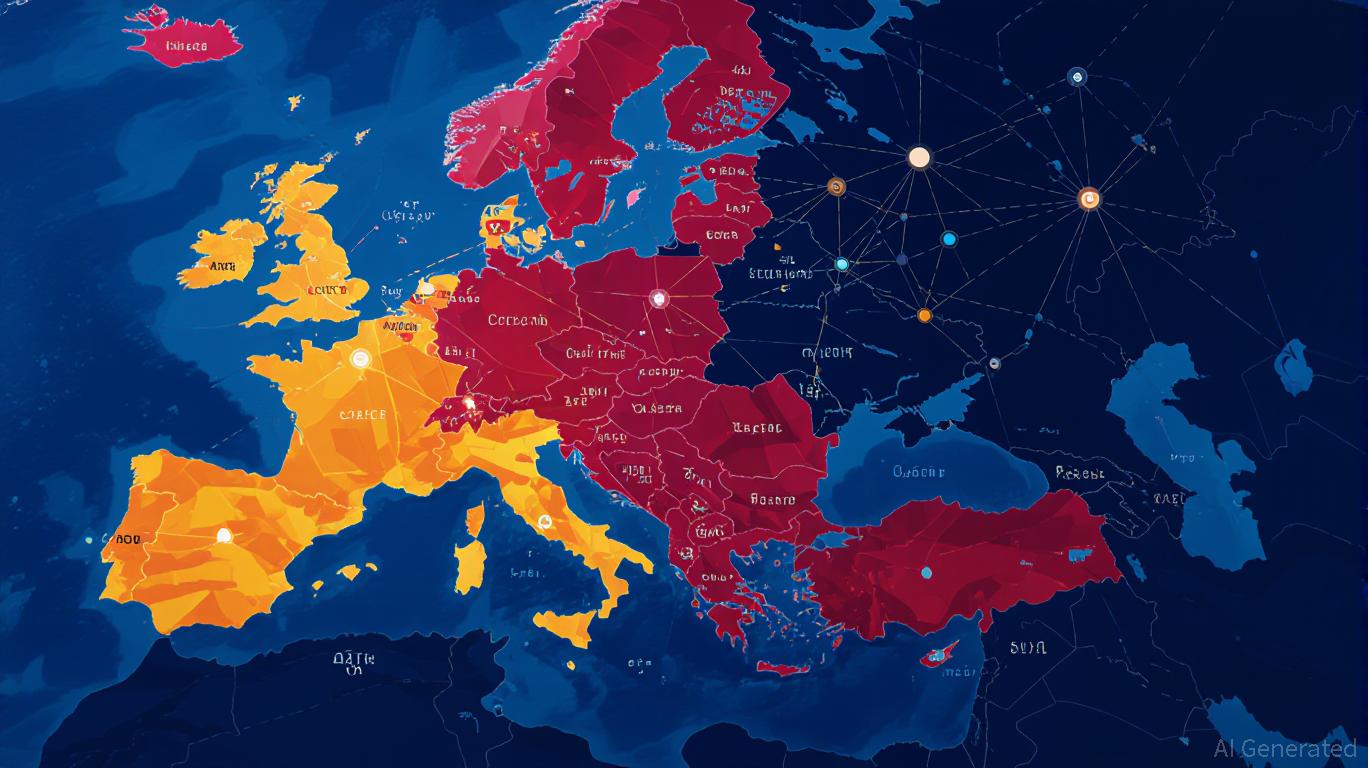

- Eastern European crypto media saw 18.3% Q2 2025 traffic decline, with 17 outlets capturing 80.71% of regional traffic amid regulatory and algorithmic shifts. - Tier-3 platforms (10,000–99,999 visits) retained 17.33% traffic through localized relevance and AI-optimized content in markets like Poland and Czech Republic. - AI-driven discovery tools and regional partnerships (e.g., Kriptoworld.hu) are reshaping distribution, with 20.6% of outlets reporting traffic from platforms like Perplexity. - Investors

- Crypto market signals suggest altcoins may outperform Bitcoin amid waning dominance and bullish technical indicators. - Ethereum's 54% August surge and rising ETH/BTC ratio historically precede altcoin growth cycles. - Dovish Fed policy and $3B Ethereum ETF inflows create favorable conditions for altcoin capital rotation. - Institutional confidence in Bitcoin indirectly supports altcoin momentum through liquidity and risk-on appetite. - Strategic entry points for high-conviction investors include Ethereu

- EU selects Ethereum as foundational layer for digital euro, challenging U.S. stablecoin dominance and validating its scalability and compliance. - Ethereum's smart contracts, energy-efficient post-Merge model, and GDPR-aligned ZK-Rollups address scalability, privacy, and regulatory needs. - Infrastructure providers (Infura, zkSync) and DeFi platforms (Uniswap) stand to benefit from increased demand for CBDC operations and liquidity. - Geopolitical shift reduces reliance on U.S. payment systems, with Ethe

- Metaplanet allocated $887M of its ¥130.3B fundraising to Bitcoin in 2025, reflecting corporate treasury strategies shifting toward digital assets amid macroeconomic instability. - Japan's weak yen and 260% debt-to-GDP ratio drive institutional adoption of Bitcoin as a hedge against currency depreciation, with 948,904 BTC now held across public company treasuries. - Metaplanet's 1% Bitcoin supply target (210,000 BTC) and inclusion in global indices signal growing legitimacy, as regulatory reforms in Japan

- Polygon Labs addresses crypto market chaos via curation-driven governance, filtering speculative memecoins through on-chain metrics like liquidity and security audits. - Its Agglayer infrastructure enables cross-chain utility while avoiding memecoin dominance, supporting projects like Katana without compromising real-world innovation goals. - With $4.12B TVL and 22,000 active developers, Polygon's model boosts investor confidence by prioritizing quality over hype, offering a blueprint for sustainable Web

- In late August 2025, Circle minted $250M USDC on Solana in 24 hours, signaling its role as DeFi infrastructure. - Solana's low-cost, high-speed network accelerates USDC liquidity, driving DeFi growth and institutional adoption. - Partnerships with SBI Holdings and regulatory frameworks validate Solana as a compliant hub for stablecoin activity. - This surge boosts SOL demand through network effects, liquidity velocity, and institutional capital inflows.

- Thomas Lee, Fundstrat's top analyst, forecasts Q4 2025 tech growth via semiconductors/AI while shifting toward value/energy sectors. - His bullish stance on SOX and AVGO contrasts with hedging via small-cap (IWM) and inflation-linked ETFs (USAF) to balance market volatility. - Dovish Fed policy and Bitcoin's $100k milestone drive risk appetite, but Lee warns against overexposure to overvalued tech giants like Nvidia. - Investors urged to rebalance portfolios with GRNY's AI/cybersecurity focus and cyclica