Bitget Beginner's Guide — Introduction to Take Profit and Stop Loss (TP/SL) in Futures Trading

[Estimated Reading Time: 3 mins]

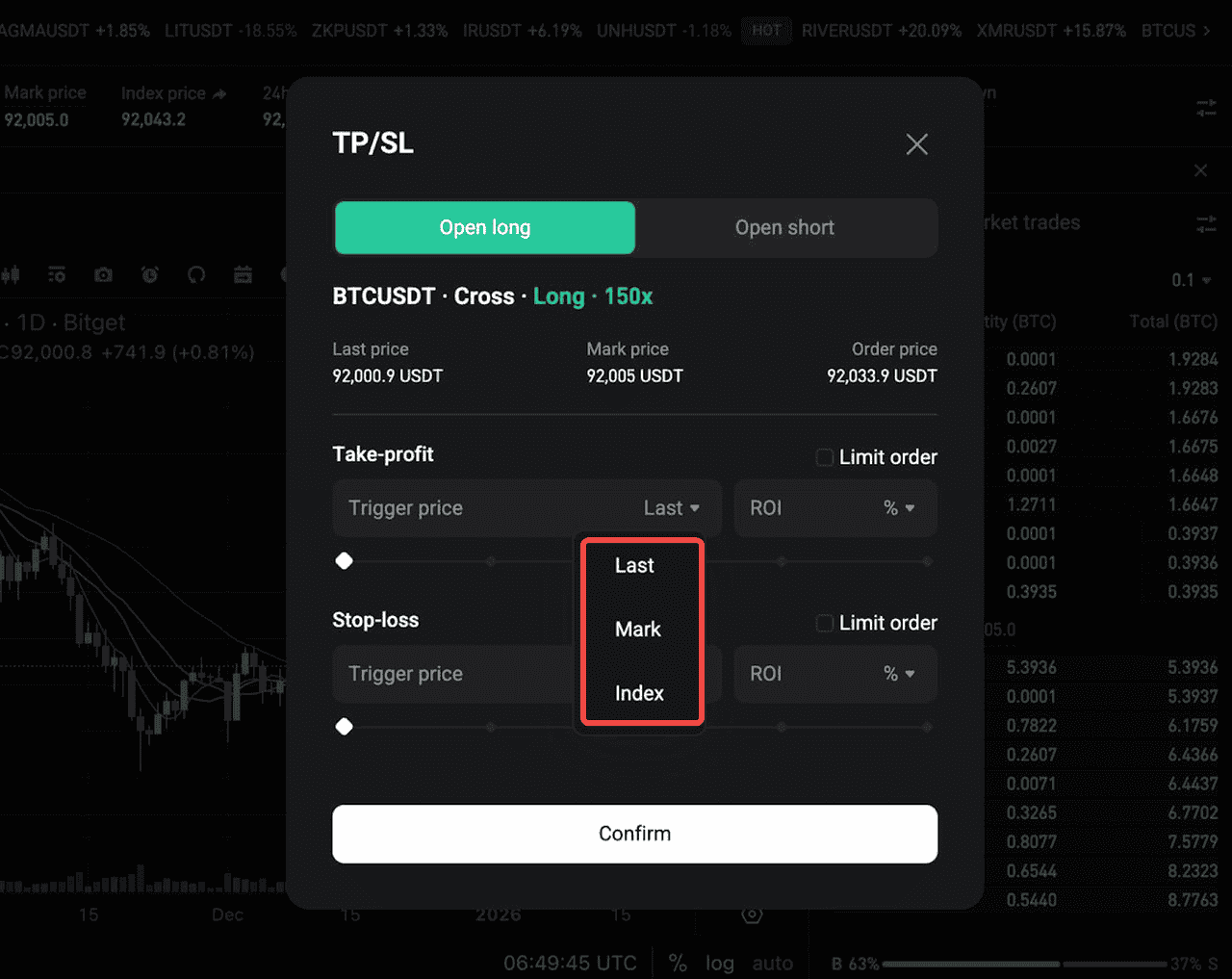

This article provides a detailed introduction to the concepts of take-profit and stop-loss (TP/SL), when to use them, and the pros and cons of using different trigger price options, including last price, mark price, and index price. Whether you are a beginner or an experienced trader, TP/SL can help improve trading efficiency and enhance risk control.

What is TP/SL

Take profit (TP) refers to a common futures trading strategy in which users close their positions when the price rises or falls to a predetermined level, converting unrealized profits into realized profits. Stop loss (SL), on the other hand, is a strategy where users close their positions when the price rises or falls to a specified level to prevent further losses.

In essence, TP/SL is a basic strategy for protecting profits and managing risk. By setting both take-profit and stop-loss prices, traders can lock in profits when the market moves in their favor and limit losses when the market moves against them.

When to use TP/SL

TP/SL orders are commonly used when traders have open positions but cannot monitor market movements continuously. As a general rule, TP/SL can be set at any time while holding a position, depending on trading needs.

Please note that TP/SL orders can only be used to close positions, not to open new ones.

• Achieves target profit: Take-profit settings help secure profits when the market moves as expected and the price reaches the preset profit target.

• Limit losses: When the market moves against expectations, stop-loss settings limit potential losses by closing the position once the price hits a preset threshold.

Trigger Price Options: Last Price, Mark Price, and Index Price

When setting take-profit and stop-loss orders, traders can choose different trigger prices. Bitget supports last price, mark price, and index price as trigger options. Each option has different characteristics and is suitable for different trading strategies and risk preferences.

1. Pros and cons of using the last price:

The last price is the most recent traded price in the futures market and reflects real-time market activity. It provides the fastest response to price changes, making it suitable for short-term traders and strategies that rely on immediate market reactions.

However, the last price is more susceptible to short-term price fluctuations and abnormal trades, which may lead to unintended TP/SL triggers. In low-liquidity markets, slippage may also occur, affecting execution accuracy.

2. Pros and cons of using the mark price:

The mark price is calculated based on the index price and funding rate and is mainly used for risk control and fair settlement. It reduces the impact of short-term price volatility and abnormal market movements, making it more suitable for mid- to long-term traders.

The downside is that the mark price responds more slowly to rapid market changes, which may not be ideal for short-term strategies in highly volatile conditions.

3. Pros and Cons of Using the Index Price:

The index price is a weighted average of spot prices across major exchanges. It reflects the fair market value of cryptocurrency. Using the index price as a trigger helps reduce price manipulation from any single market.

This trigger option is suitable for traders who want TP/SL execution to be based on overall market trends rather than short-term futures price fluctuations. However, since index prices do not directly reflect futures market transactions, TP/SL execution may lag behind fast-moving futures prices.

Key differences and features:

In Bitget futures, the type of order you select determines the type of order to place by the system once the take-profit or stop-loss price is reached.

|

Price type

|

Definition

|

Role

|

Feature

|

|

Index price

|

Weighted average price derived from multiple major spot markets

|

Used as a fair reference price for liquidation calculations

|

Stable and resistant to price manipulation from any single market

|

|

Mark price

|

Calculated based on the index price and funding rate

|

Determines unrealized PnL and liquidation risk

|

Smooths short-term volatility and adjusts under extreme market conditions

|

|

Last price

|

Price of the most recent trade executed in the futures market

|

Reflects real-time market trading activity

|

More volatile and responsive, suitable for short-term trading strategies

|

Market orders: Prioritizes execution as the top goal

A market order is an instruction to execute a trade immediately at the best available market price once triggered. Its core feature is immediate execution.

• Key advantage: High execution efficiency, ensuring the order is filled quickly in most cases.

• Potential risk: In highly volatile or low-liquidity markets, rapid price swings may cause slippage and the final execution price can deviate from the expected market price at the time of trigger.

• Recommended use cases:

a. Risk control in extreme market conditions: During sharp one-sided price movements, the priority is to close positions quickly to limit losses or protect realized profits.

b. Trading assets with poor liquidity: For futures with shallow order books or during inactive trading hours, market orders can enhance execution certainty.

c. Trend breakout entries: When the price breaks a key technical level, you can use a market order can to confirm the trend and enter in time.

Limit orders: Prioritizes execution at a specified price as the top goal

A limit order is an instruction to execute a trade only when the market price reaches or is better than the specified limit price. Its core feature is price certainty.

• Key advantage: Locks in the execution price at a specified level or better, effectively avoiding slippage and precisely controlling transaction costs.

• Potential risk: If the market price fails to reach or stabilize at the limit price, the order may not be filled or only be partially filled, potentially causing users to miss optimal trading opportunities.

• Recommended use cases:

a. Markets with relatively stable volatility: In range-bound markets, limit orders can be placed near support or resistance levels to execute buy-low and sell-high strategies more precisely.

b. Strategies with strict price requirements: For precision-based strategies like arbitrage or grid trading, limit orders are essential to ensure the strategy model runs as intended.

c. Position management for large capital: To reduce market impact and control slippage, limit orders are often preferred for gradual entry and exit of large positions.

Additional considerations

• The futures amount of unfulfilled TP/SL orders can be affected by position closures, whether through agreement, automated closure, liquidation, or manual closure. If a position is closed, the corresponding TP/SL order will be canceled.

• Manual changes to margin can impact the expected liquidation price, potentially causing TP/SL orders to fail.

• A maximum of 20 take-profit/stop-loss orders can be set at a time.

• Elite traders cannot set TP/SL for the total position but can manage orders through the "My trades" section.

• In rare cases, TP/SL orders may fail during extreme market volatility.

• The actual filled price may differ from the price at which a TP/SL order is triggered during periods of extreme volatility and price fluctuations.

• There is also the possibility that TP/SL orders will be unfilled or only partially filled.

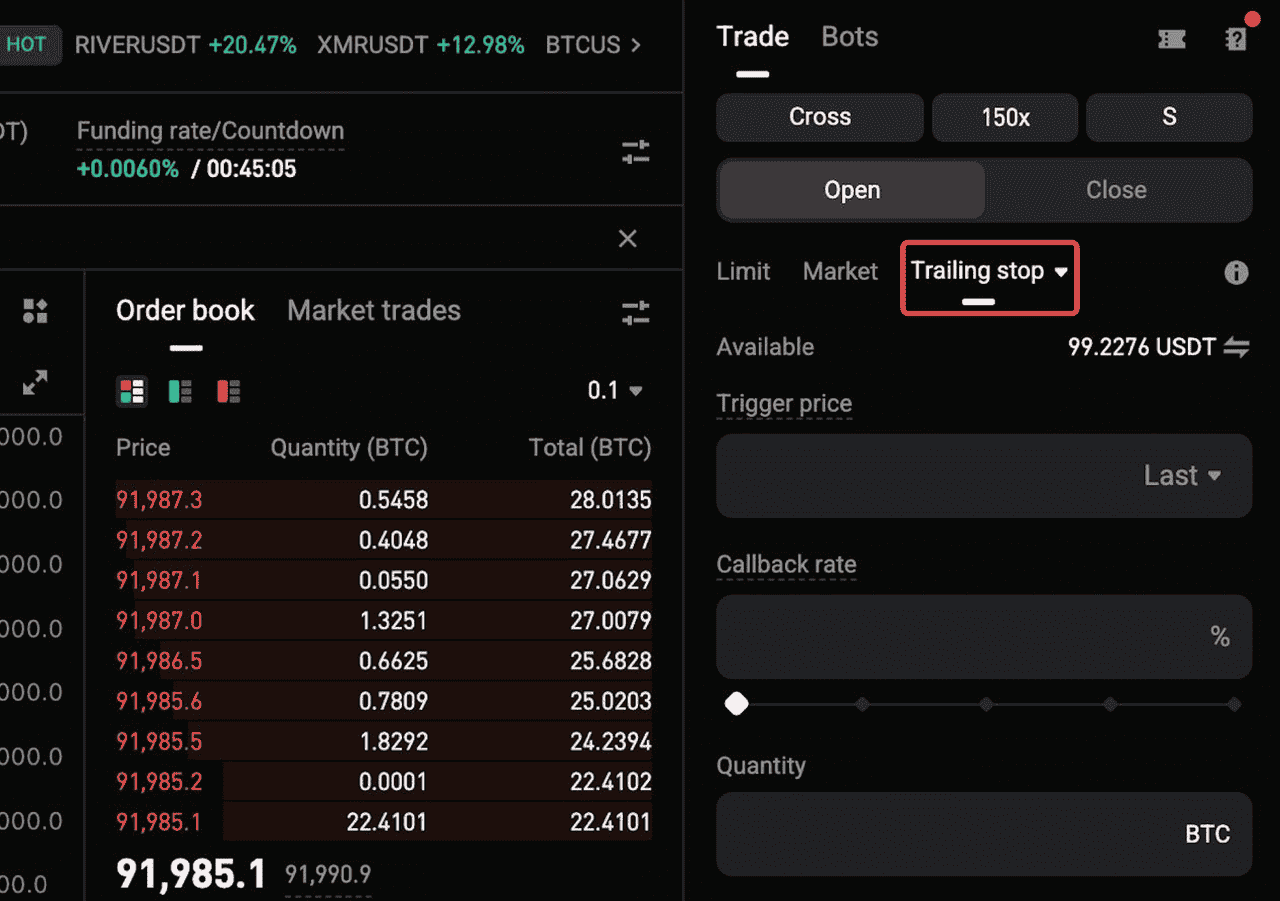

Trailing stop (trailing stop-loss)

A trailing stop, also known as a trailing stop-loss, is a dynamic type of stop-loss order designed to help limit losses and protect profits during market fluctuations. It allows users to set a predefined callback distance (by percentage or amount) from the market price. Once the trailing stop is activated, the system adjusts the stop-loss price automatically as the market moves in a favorable direction.

As the market price continues to move favorably, the trailing stop maintains a fixed distance from the highest (or lowest) price reached after activation. This allows users to retain their positions and continue capturing profits. If the market price reverses and moves against the position by the preset percentage or amount, the trailing stop will close the futures position at the best available market price, helping to lock in profits or limit losses.

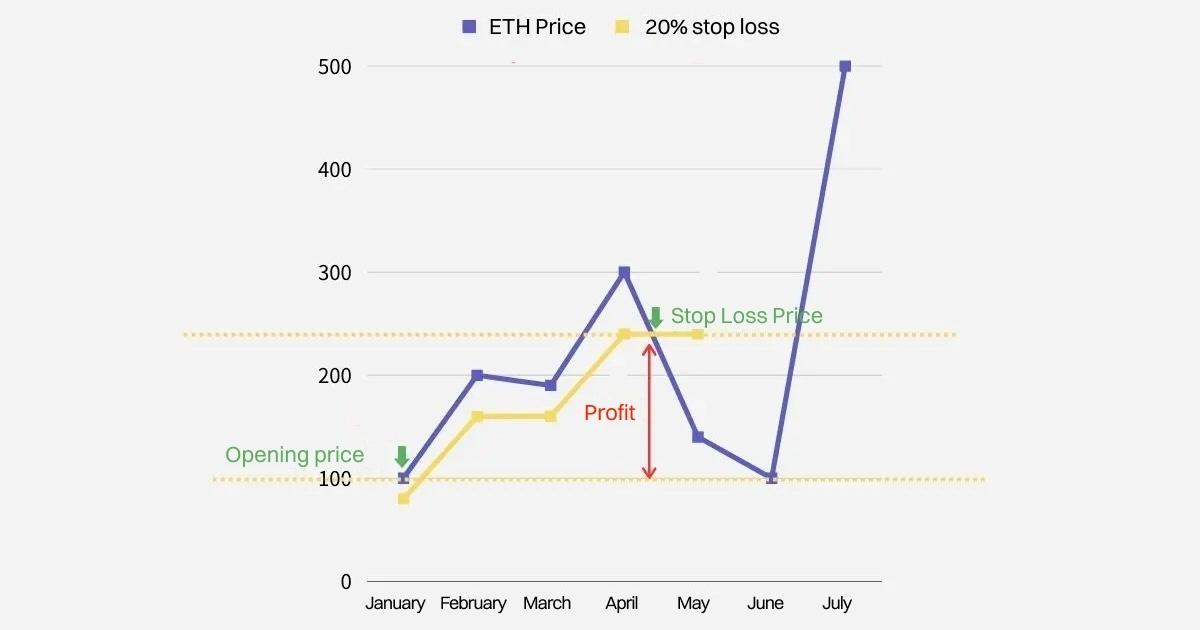

Example

If you open an ETH futures position at 100 USDT and set a trailing stop-loss with a 20% callback rate, as shown in the image below, the following will occur:

• The trailing stop-loss order will be triggered when the ETH's price rises to 200 USDT. The stop-loss price after triggering will be calculated as: the highest price of ETH after triggering × (1 − 20%). When ETH's price drops by 20% from its highest point, the system will automatically sell ETH at the best available market price.

If the trend of ETH moves as shown in the image above, the following events will occur:

• February: The price of ETH rises to 200 USDT, triggering the trailing stop-loss order. The stop-loss price is calculated as: 200 × (1 − 20%) = 160 USDT.

• March: Although ETH's price declines, it doesn't fall by the full 20% as set in the trailing stop, so the user continues to hold ETH.

• April: ETH's price rises to 300 USDT, with a stop-loss price of: 300 × (1 − 20%) = 240 USDT.

• May: The price falls sharply, reaching 240 USDT, triggering an order to sell ETH at the best market price. At this point, the market price is 240 USDT, resulting in a final realized profit of: 240 – 100 = 140 USDT.

By closing the position in May, potential losses from a further price decline below 100 USDT are avoided. However, additional upside is missed if ETH continues rising afterward. All calculations in this example are for illustrative purposes only and are intended to demonstrate how the trailing stop-loss mechanism works under different market movements.

Conclusion

TP/SL and trailing stop-loss orders are essential tools for managing risk and protecting profits in futures trading. TP/SL helps traders secure gains and control downside risk through predefined exit conditions, making it suitable for a wide range of trading strategies.

Trailing stop-loss orders provide additional flexibility by automatically adjusting exit levels as the market moves favorably. This allows traders to capture more upside while protecting existing profits, without the need for constant market monitoring.

FAQs

1. What are take-profit (TP) and stop-loss (SL) orders?

Take-profit and stop-loss are strategies used in futures trading to manage risk. Take-profit automatically closes a position to secure gains when a target price is reached, while stop-loss closes a position to prevent further losses when the market moves unfavorably.

2. When should I choose a market TP/SL order?

Market TP/SL orders are ideal for closing positions quickly in volatile markets, low-liquidity situations, or to capture trend breakouts, ensuring immediate execution.

3. When should I choose a limit TP/SL order?

Limit TP/SL orders are better for stable markets, precision-based strategies like arbitrage or grid trading, or for managing large positions gradually to avoid slippage and control costs.

4. How does a trailing stop-loss order function?

A trailing stop-loss automatically adjusts the stop level as the market moves favorably, keeping a fixed distance from the highest or lowest price reached. If the price reverses by the preset amount, the position closes at the best market price, protecting profits and limiting losses.

5. How do market and limit TP/SL orders differ?

• Market TP/SL: Executes immediately at the best available price, prioritizing speed but may experience slippage.

• Limit TP/SL: Executes only at the set price, prioritizing price certainty but may not fill if the market does not reach the target.

Disclaimer and Risk Warning

All trading tutorials provided by Bitget are for educational purposes only and should not be considered financial advice. The strategies and examples shared are for illustrative purposes and may not reflect actual market conditions. Cryptocurrency trading involves significant risks, including the potential loss of your funds. Past performance does not guarantee future results. Always conduct thorough research, understand the risks involved. Bitget is not responsible for any trading decisions made by users.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Share