Bitget: Ranked top 4 in global daily trading volume!

BTC dominance58.45%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$67520.48 (-1.24%)Fear and Greed Index10(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow -$19.5M (1D); +$1.23B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance58.45%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$67520.48 (-1.24%)Fear and Greed Index10(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow -$19.5M (1D); +$1.23B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance58.45%

Current ETH GAS: 0.1-1 gwei

Hot BTC ETF: IBIT

Bitcoin Rainbow Chart : Accumulate

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$67520.48 (-1.24%)Fear and Greed Index10(Extreme fear)

Altcoin season index:0(Bitcoin season)

Total spot Bitcoin ETF netflow -$19.5M (1D); +$1.23B (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Global X Blockchain & Bitcoin Strategy ETF

BITS

Learn more about Global X Blockchain & Bitcoin Strategy ETF's (BITS) price performance, volume, premium rate, inflows and outflows, and other key data indicators.

BITS price today and history

$53.92 -2.06 (-3.68%)

1D

7D

1Y

Open price$53.74

Day's high$54.76

Close price$54.76

Day's low$53.39

YTD % change-16.11%

52-week high$118.78

1-year % change-12.49%

52-week low$45.63

The latest price of BITS is $53.92 , with a change of -3.68% in the last 24 hours. The 52-week high for BITS is $118.78 , and the 52-week low is $45.63 .

Today's BITS premium/discount to NAV

Shares outstanding517.12K BITS

BTC holdings509.48 BTC

NAV per share$106.53

BTC change (1D)

0.00 BTC(0.00%)

Premium/Discount+0.02%

BTC change (7D)

0.00 BTC(0.00%)

BITS volume

Volume (BITS)1.9K (BITS)

10-day average volume (BITS)48.22 (BITS)

Volume (USD)$102.43K

10-day average volume (USD)$2.6K

What is Global X Blockchain & Bitcoin Strategy ETF (BITS)

Trading platform

XNAS

Asset class

Futures

Assets under management

$55.09M

Expense ratio

0.00%

Issuer

--

Fund family

--

Inception date

--

ETF homepage

--

FAQ

Can I hold the Global X Blockchain & Bitcoin Strategy ETF in a retirement account?

Yes, you can hold ETFs, including the Global X Blockchain & Bitcoin Strategy ETF, in many types of retirement accounts, such as IRAs, as long as the brokerage platform allows for ETF trading.

How is the performance of the Global X Blockchain & Bitcoin Strategy ETF monitored?

The performance of the ETF is monitored through its price movement and net asset value (NAV) per share. Investors can track its performance on financial news websites or through the fund's official website.

What are the fees associated with the Global X Blockchain & Bitcoin Strategy ETF?

Like other ETFs, the Global X Blockchain & Bitcoin Strategy ETF may have management fees and expense ratios. It's important to review the fund's prospectus for specific fee information.

How does the Global X Blockchain & Bitcoin Strategy ETF compare to directly investing in Bitcoin?

The ETF provides diversification by investing in a range of companies and holding Bitcoin, while direct investment in Bitcoin involves buying and holding the cryptocurrency itself, which can be more volatile and less regulated.

What are the risks associated with investing in the Global X Blockchain & Bitcoin Strategy ETF?

Investing in the ETF carries risks associated with cryptocurrency volatility, regulatory changes, and market competition. Investors should be aware of these risks and perform their own due diligence.

Where can I purchase the Global X Blockchain & Bitcoin Strategy ETF?

You can purchase the Global X Blockchain & Bitcoin Strategy ETF through online brokerage accounts and platforms that offer ETF trading, including Bitget Exchange.

Is the Global X Blockchain & Bitcoin Strategy ETF suitable for all investors?

While the ETF offers a unique investment opportunity, it may not be suitable for all investors due to the volatility associated with cryptocurrencies and blockchain technology. Investors should assess their risk tolerance before investing.

What assets does the Global X Blockchain & Bitcoin Strategy ETF hold?

The ETF typically holds a mix of stocks from companies involved in blockchain-related sectors and a portion of its assets in Bitcoin to track the performance of the digital asset directly.

How does the Global X Blockchain & Bitcoin Strategy ETF work?

The ETF invests in a diversified portfolio of companies that are engaged in blockchain technology, while also holding Bitcoin, which allows investors to gain exposure to the crypto market without directly purchasing cryptocurrency.

What is the Global X Blockchain & Bitcoin Strategy ETF?

The Global X Blockchain & Bitcoin Strategy ETF is an exchange-traded fund that aims to provide exposure to companies involved in the blockchain technology and Bitcoin industries, as well as direct investment in Bitcoin.

Global X Blockchain & Bitcoin Strategy ETF news

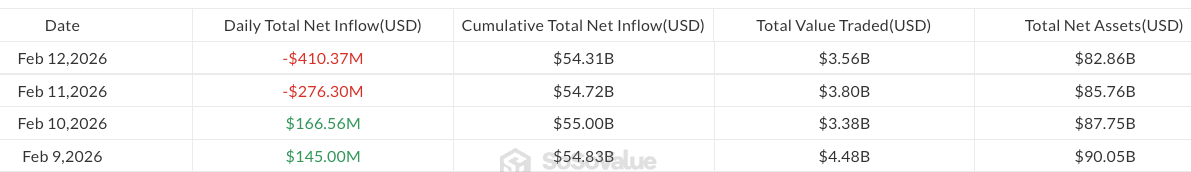

Bitcoin ETFs bleed $410M as Standard Chartered slashes BTC target

Cointelegraph2026-02-13

Spot Bitcoin ETF Outflows Surge: $410.6 Million Exodus Signals Market Caution

Bitcoinworld2026-02-13

'We recognize that customer habits are shifting': McDonald's gets ready for broader GLP-1 use as weight-loss medications become available

101 finance2026-02-12

Crypto Funds Face Pressure as Bitcoin ETF Outflows Rise

Coinomedia2026-02-12

Opinion: Recent Bitcoin volatility is due to liquidity reset rather than a structural turning point, and it still exhibits high-risk asset characteristics in the short term.

Odaily星球日报2026-02-12

The total net outflow from spot Bitcoin ETFs yesterday was $276 million, with Fidelity FBTC leading at a net outflow of $92.5958 million.

ForesightNews2026-02-12

Alternative ETFs

| Symbol/ETF name | Asset class | Volume (USD | Share) | Assets under management | Expense ratio |

|---|---|---|---|---|

IBIT iShares Bitcoin Trust | Spot Active | $2.71B 70.64M IBIT | $53.37B | 0.25% |

BITO ProShares Bitcoin ETF | Futures Active | $1.01B 107.62M BITO | $1.77B | -- |

FBTC Fidelity Wise Origin Bitcoin Fund | Spot Active | $301.99M 5.12M FBTC | $16.08B | 0.25% |

BITB Bitwise Bitcoin ETF | Spot Active | $252.41M 6.85M BITB | $2.71B | 0.2% |

ARKB ARK 21Shares Bitcoin ETF | Spot Active | $237.57M 10.54M ARKB | $2.47B | 0.21% |

GBTC Grayscale Bitcoin Trust ETF | Spot Active | $217.48M 4.12M GBTC | $10.7B | 1.5% |

BTC Grayscale Bitcoin Mini Trust ETF | Spot Active | $196.1M 6.52M BTC | $3.33B | 0.15% |

Prefer buying cryptocurrencies directly? You can trade all major cryptocurrencies on Bitget

Bitget—The world's leading crypto exchange

Looking to buy or sell cryptocurrencies like Bitcoin? Choose Bitget, the cryptocurrency exchange offering top-tier liquidity, an exceptional user experience, and unmatched security!

Bitget app

Trade anytime, anywhere with the Bitget app. Join over 30 million users trading and connecting on our platform.

Cryptocurrency investments, including buying Bitcoin online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Bitcoin, and we strive to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Bitcoin purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and cannot be considered as an offer from Bitget.