USD/JPY nears the 156.70 level as the Dollar gains broadly

US Dollar Strengthens Against Yen Amid Fed Policy Divergence

On Wednesday, the US Dollar continued its upward momentum against the Japanese Yen for a second straight day, climbing close to its highest level in a week at 156.70 during European trading hours. This movement was fueled by the latest Federal Reserve meeting minutes, which highlighted significant differences among policymakers and lent support to the Dollar in a subdued, pre-holiday market.

During the December 9-10 meeting, Fed officials agreed to reduce interest rates by 25 basis points. However, three members opposed the decision, marking the largest dissent since 2019. The minutes also indicated that the Federal Open Market Committee is inclined to lower borrowing costs further, aiming to bolster a weakening labor market despite persistent worries about elevated inflation.

Ongoing Inflation Worries at the Fed

Looking ahead, most committee members are linking any additional rate cuts to a consistent decline in inflation. While the central bank anticipates another rate reduction in 2026, market participants largely expect at least two cuts within the next year.

Bank of Japan Maintains Cautious Stance

Earlier this week, the Bank of Japan’s Summary of Opinions reiterated the institution's intention to keep interest rates elevated, though it provided little clarity on when the next increase might occur. The Yen briefly strengthened after the report’s release, but has since weakened as investors consider the possibility of further rate cuts in the near future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

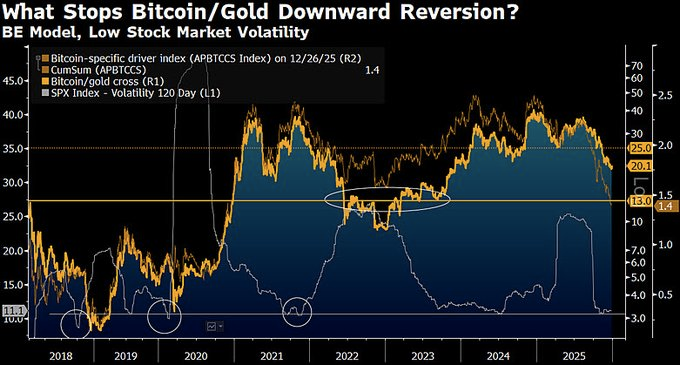

Metals vs Crypto: Volatility Signals Shift Toward Metals in 2026

Shiba Inu Price Prediction: Trend Research Increases ETH Holding to $1.8B, DeepSnitch AI Hits $1M Presale Raise

Top Altcoins to Watch in 2026: Zcash, Solana, Chainlink, and Bittensor Stand Out

The most ridiculous moments in technology this year