Renowned English football icon David Beckham is backing the health sciences company Prenetics. Recently, Prenetics announced a halt in their Bitcoin purchases due to prolonged weaknesses in the cryptocurrency market. At the beginning of the year, the company secured $48 million in funding and started a Bitcoin accumulation strategy based on their balance sheet in June. However, by early December, the implementation of this strategy was paused. This decision followed a sharp market downturn in October, aiming to redirect resources toward the company’s core business. Despite this change, the company plans to maintain its current Bitcoin holdings as a reserve asset.

David Beckham’s Supported Company Ceases Bitcoin Purchases

Prenetics’ Shift in Bitcoin Strategy

In June, Prenetics introduced a strategy to accumulate cryptocurrencies on their balance sheet, aiming to purchase one BTC daily. This model aligned closely with the approach led by Michael Saylor, known for advocating long-term cryptocurrency holdings within corporate treasuries. Nevertheless, the rapid market correction in October diminished the company’s appetite for further Bitcoin accumulation.

From December 4th, Prenetics announced the cessation of new BTC acquisitions. The company explained that the persistent fragility in the cryptocurrency market necessitated a mandatory reassessment of their capital allocation strategy. However, they emphasized the retention of 510 BTC in their balance sheet, valued at approximately $45 million at current prices. While Prenetics’ shares surged 189% since the start of the year, shares of Strategy, led by Saylor, fell around 48% in the same period.

The Company’s Focus on IM8

Danny Yeung, CEO and co-founder of Prenetics, announced a funding event on October 27th, which included participation from investors like Kraken, Exodus, GPTX, and American Ventures. Yeung conveyed that the funds would be dedicated to scaling the IM8 brand globally and pursuing a goal of $1 billion in revenue, along with Bitcoin objectives, over the next five years.

Over the past 11 months, IM8’s annual recurring revenue has exceeded $100 million, clarifying the board’s priorities. Yeung stated that IM8 had been scaling much faster than anticipated, emphasizing that the most robust path to creating shareholder value involves directing full attention to this business unit.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What’s Next for Bitcoin Amid Failed Santa Rally? Analysts Opinions

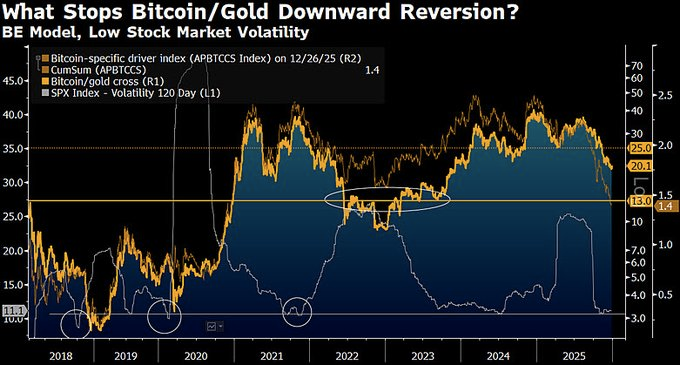

Metals vs Crypto: Volatility Signals Shift Toward Metals in 2026

Shiba Inu Price Prediction: Trend Research Increases ETH Holding to $1.8B, DeepSnitch AI Hits $1M Presale Raise

Top Altcoins to Watch in 2026: Zcash, Solana, Chainlink, and Bittensor Stand Out