Metaplanet is resuming its aggressive buying of Bitcoin after a period of pause, and the scale of its purchases has surprised the markets.

On the 30th of December, Metaplanet announced the purchase of 4,279 BTC, valued at ¥69.855 billion. The acquisition increased the firm’s total Bitcoin holdings to 35,102 BTC, ranking it among the largest public holders globally.

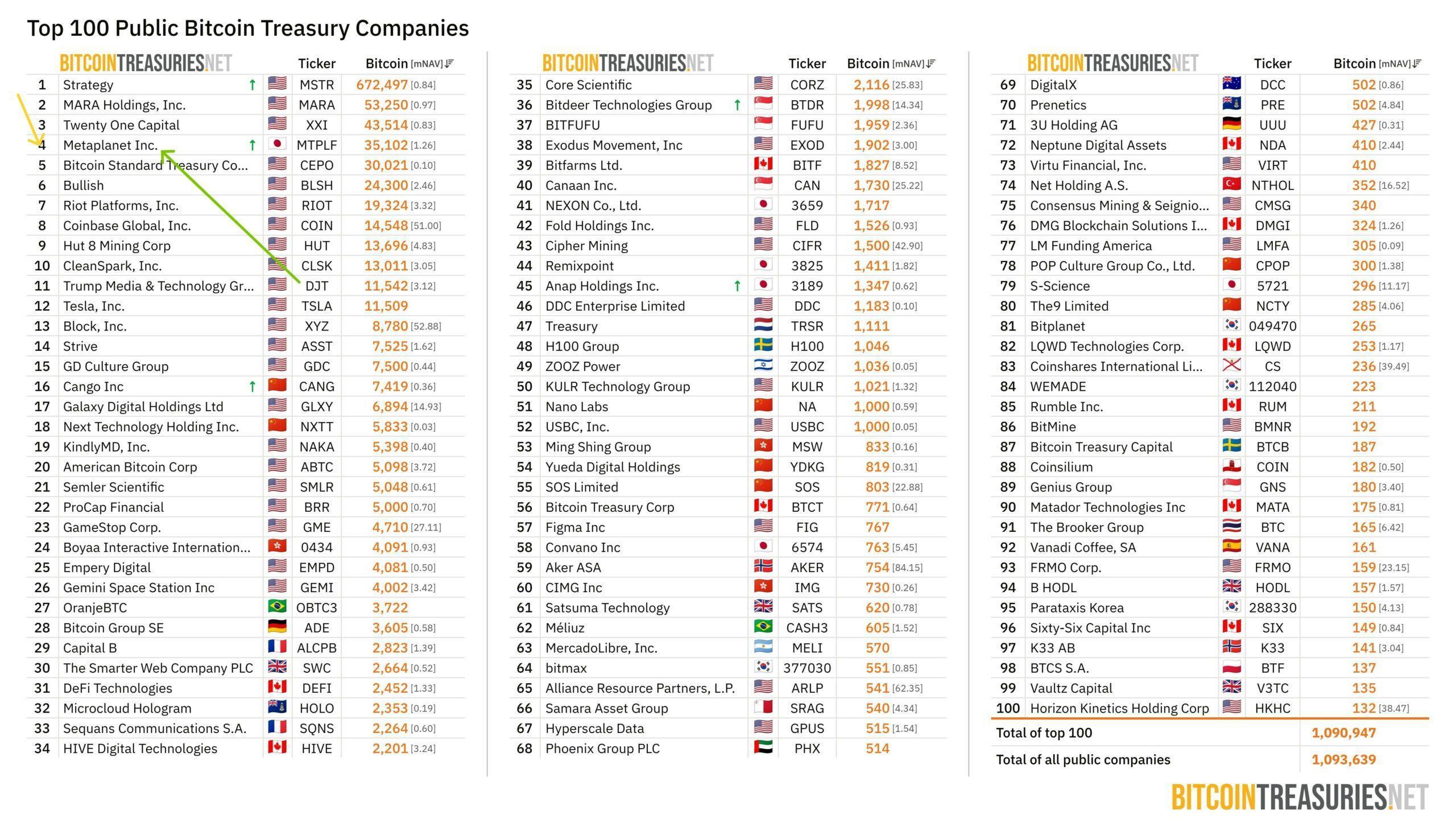

Despite the earlier pause, Metaplanet still ranked fourth among public Bitcoin treasury companies worldwide.

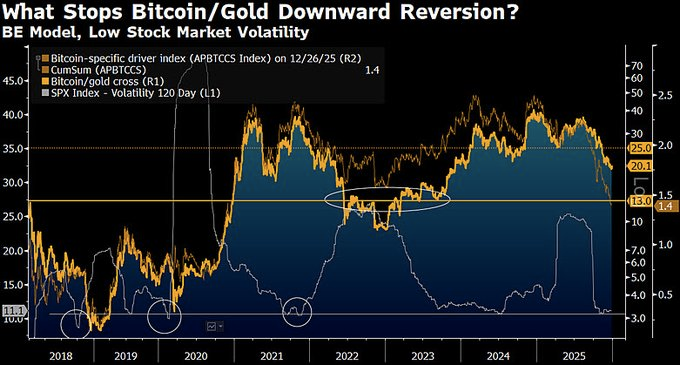

The renewed buying occurred even as Bitcoin traded below the company’s average acquisition cost.

Bitcoin accumulation through equity and debt

Metaplanet funded its Bitcoin purchases through equity issuance and Bitcoin-backed credit facilities.

During the fourth quarter of 2025, the company entered Bitcoin-collateralized loans totaling $280 million. These facilities were drawn in full and remained outstanding as of the 29th of December.

Additionally, Metaplanet raised ¥21.249 billion through the issuance of 23.61 million Class B preferred shares. These shares were fully reflected in diluted share counts, increasing shareholder dilution alongside Bitcoin [BTC] exposure.

Balance sheet sensitivity to Bitcoin price moves

Bitcoin now sat at the center of Metaplanet’s balance sheet risk profile.

As of the 30th of December, Metaplanet’s average Bitcoin purchase price stood at ¥15,945,691 per BTC. With BTC trading below that level, the company faced over $500 million in unrealized losses.

Management highlighted BTC Yield and BTC Gain as performance indicators for accumulation efficiency. However, these metrics explicitly excluded debt obligations and unrealized fair-value losses.

Is Metaplanet asking shareholders to absorb growing downside risk?

Metaplanet framed its strategy as accretive, but dilution and leverage continued to rise.

Fully diluted shares outstanding climbed to 1.459 billion following equity issuance and conversions. This meant Bitcoin exposure per share increased, but so did sensitivity to prolonged price drawdowns.

While BTC Yield remained positive, management acknowledged limitations in capturing balance sheet risks. Debt servicing, refinancing risk, and market volatility could materially affect shareholder outcomes.

Final Thoughts

- Metaplanet’s renewed Bitcoin accumulation reflected long-term conviction but increased exposure to price volatility, leverage, and dilution risks.

- Shareholder outcomes now depended heavily on Bitcoin’s ability to recover above the company’s average acquisition cost.