The Fed's biggest internal conflict in 37 years! Minutes reveal internal "division," will the 2026 rate cut path change?

FX678, December 31 - After the Federal Reserve's dovish rate cut in December, the market's easing trade continues. With year-end liquidity thinning, investors are focusing on the meeting minutes for clues on the policy path in 2026. The minutes reveal deep internal divisions within the FOMC over the main risks facing the economy—one side is concerned about employment, while the other is alert to inflation.

After the Federal Reserve's dovish rate cut in December, the market's easing trade continues. With year-end liquidity thinning, investors are focusing on the meeting minutes for clues on the policy path in 2026. The minutes reveal deep internal divisions within the FOMC over the main risks facing the economy—one side is concerned about employment, while the other is alert to inflation.

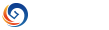

Since the December 10 Federal Reserve meeting (with a more dovish-than-expected outcome: a 25-basis-point rate cut, but with three dissenting votes), precious metals have been the biggest winners due to the weakening US dollar, while crude oil has lagged. The stock market edged up slightly, and bonds showed little volatility.

In the early Asian session on Wednesday (December 31), spot gold traded in a narrow range and is currently trading around $4,335 per ounce, still at a relatively high annual level; US crude oil is fluctuating narrowly, trading near $57.95 per barrel (UTC+8); the US dollar index is oscillating near 98.25, having hit a nearly three-month low of 97.75 on the 24th (UTC+8).

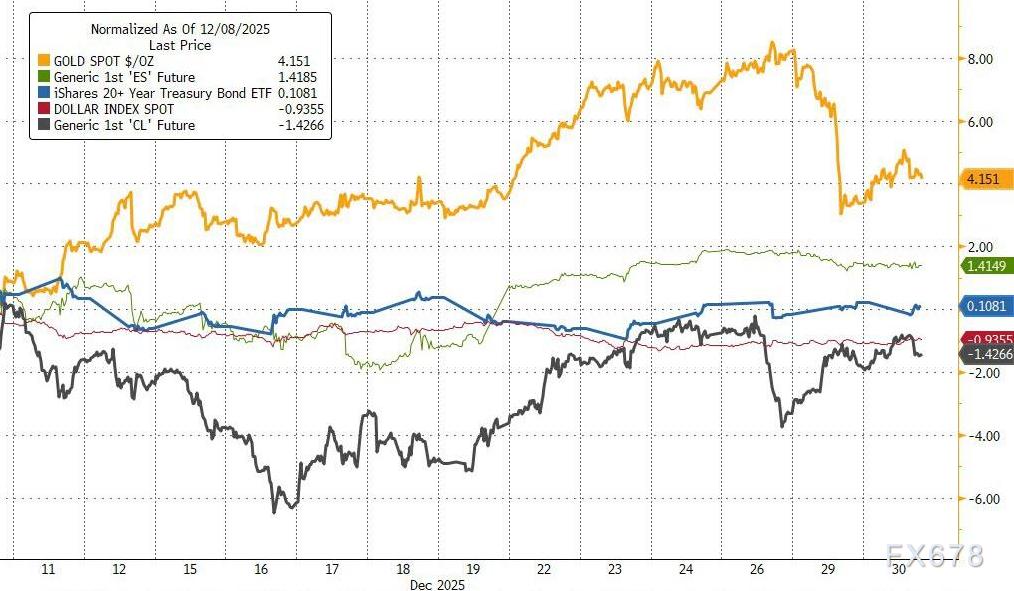

Market expectations for rate cuts have risen significantly, with a particularly notable increase in the probability of a rate cut in March 2026.

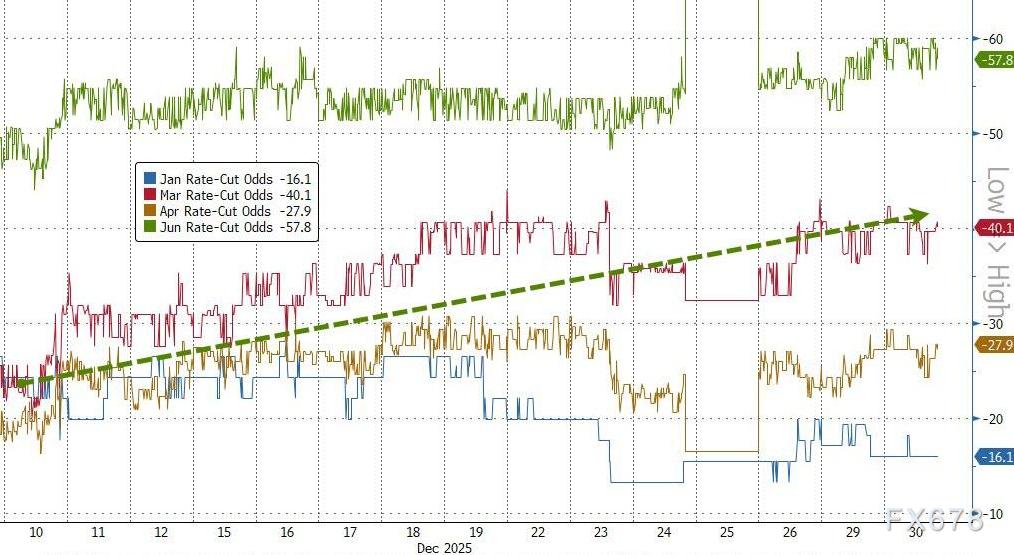

Given the recent lack of major market catalysts and generally light fundamentals and trading volumes, investors are increasingly focused on the Federal Reserve's December meeting minutes. Current market expectations are significantly more dovish than those indicated in the Fed's dot plot.

After the exposure of severe internal divisions within the Fed (the most dissenting votes in 37 years), the policy outlook has become increasingly ambiguous, but the exuberant market seems oblivious.

Amanda Agati, Chief Investment Officer at PNC Asset Management Group, metaphorically said on Tuesday: "The stock market is like a child in a candy store, intoxicated by the sugar rush of chasing more policy easing and a more dovish Fed, without any real sense of whether this is beneficial or harmful."

"The bond market, meanwhile, is like the adults in the room, taking away the child's last lollipop. This may be the first observable instance in market history where the market is reacting to fiscal deficit and debt level issues. I believe long-term yields will undoubtedly continue to face upward pressure."

Previously, Joseph Dahrieh, an analyst at Tickmill Group, pointed out in a report: "We are currently in a period of thin year-end liquidity, which could amplify price volatility. The market is hoping the meeting minutes will provide clearer signals on the Fed's policy path for 2026."

He added that if the minutes clearly lean towards further rate cuts in 2026, it could put pressure on the US dollar and Treasury yields. Conversely, if the minutes present a more balanced or cautious tone on rate cuts, it could provide short-term support.

What Signal Does the Federal Reserve Really Want to Send?

The meeting minutes highlight the profound divisions among the 19 members of the policy-making committee on the biggest threat to the economy:

Most officials believe that if inflation gradually falls as expected, further rate cuts would be appropriate. However, some officials clearly stated that they advocated keeping rates unchanged "for a period of time" after the December meeting.

The minutes show that even some officials who supported the rate cut had reservations: "A few participants who supported lowering the policy rate at this meeting noted that this decision was a difficult trade-off—they might otherwise have supported keeping the target rate range unchanged." This suggests that internal divisions may not be as sharp as outsiders speculate.

However, the minutes also clearly state that policymakers remain significantly divided over whether inflation or unemployment poses a greater risk to the US economy. "Most participants believed that adjusting to a more neutral policy stance would help guard against the possibility of a serious deterioration in labor market conditions."

Meanwhile, the minutes further note: "Some participants emphasized the risk that high inflation may become entrenched, and stated that if rate cuts continue while inflation readings remain elevated, the market may misinterpret this as a weakening of the Fed's commitment to the 2% inflation target."

Finally, the minutes confirm that participants generally judge that reserve balances have "declined to an ample level"—meaning it is appropriate to launch short-term Treasury purchases to maintain ample reserves over the long term.

The market has reacted mildly to the above information: rate cut expectations are unchanged, and while equities are active, no clear direction has emerged.

On the whole, the US dollar is caught in a tug-of-war between "dovish expectations" and the "reality of inflation." The meeting minutes failed to provide a single direction, instead highlighting this contradiction. As the market chases the "candy" of rate cuts, it remains wary of the "ruler" of inflation, leaving the dollar stuck in a range-bound, indecisive trend.

(US Dollar Index daily chart, source: EasyFutures)

As of 9:11 (UTC+8), the US Dollar Index is at 98.23.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

What’s Next for Bitcoin Amid Failed Santa Rally? Analysts Opinions

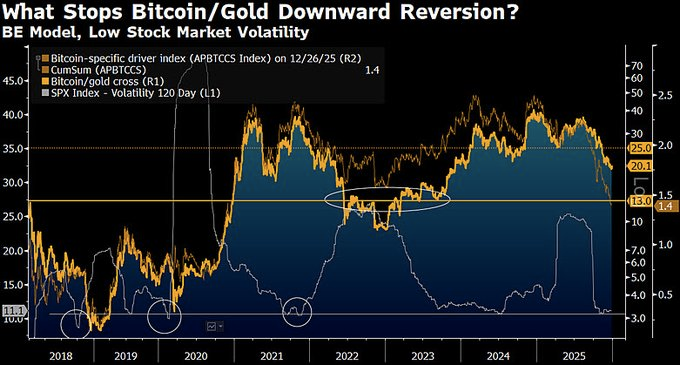

Metals vs Crypto: Volatility Signals Shift Toward Metals in 2026

Shiba Inu Price Prediction: Trend Research Increases ETH Holding to $1.8B, DeepSnitch AI Hits $1M Presale Raise

Top Altcoins to Watch in 2026: Zcash, Solana, Chainlink, and Bittensor Stand Out