Crazy Gold and Silver: How They Affect the Forex Market

Morning FX

In 2006, a phenomenal comedy directed by Ning Hao, "Crazy Stone," took the world by storm, telling the story of a jade stone coveted and chased by various parties. Now, twenty years later, gold and silver are playing out this script, with the frenzy behind their surges being a celebration for speculators.

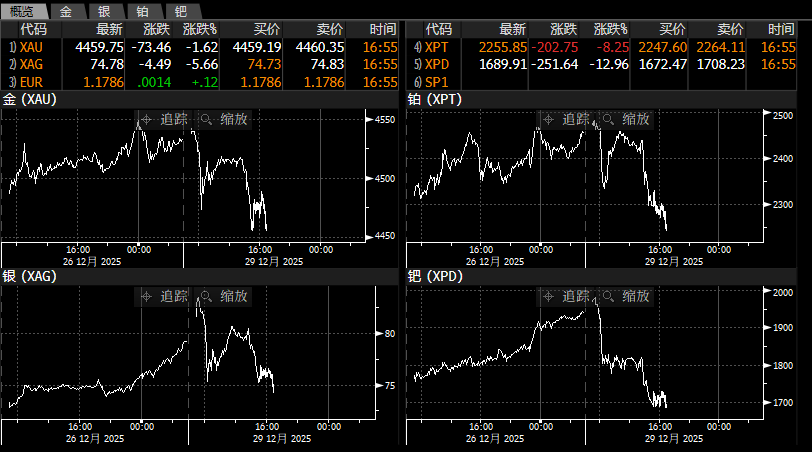

Chart: Intraday volatility of the four major precious metals

Just yesterday, the near-term contract for silver 2602 on the Shanghai Futures Exchange surged by 5% in the morning before quickly collapsing, at one point dropping to -5%, amounting to a 10% swing. Platinum and palladium have been dancing along, with capital rotating in order of the periodic table.

I. How Terrifying Is This Year's Gold and Silver Market

A 10% single-day swing is only a small footnote to silver's epic run throughout 2025.

For the year,gold has risen 70% cumulatively, copper prices are up 45%, and silver has soared as much as 170%. In the first half of the year, silver's rally lagged behind gold, with the gold-silver ratio hitting lows. But in the second half, as supply-demand gaps and catch-up rallies emerged, the relatively small silver market became the main battleground for speculation.

Chart: Silver’s largest annual gain in nearly 50 years

Despite the Shanghai Futures Exchange continuously raising margin requirements, a single contract now fluctuating nearly 50,000 yuan, and silver LOF funds imposing purchase limits (with a bizarre 50% premium emerging), speculation remains unstoppable.In terms of options volatility, silver’s volatility is close to 70%, which is truly frightening—in comparison, the forex market seems tranquil.

II. How Does This Affect Supply and Demand in the Forex Market?

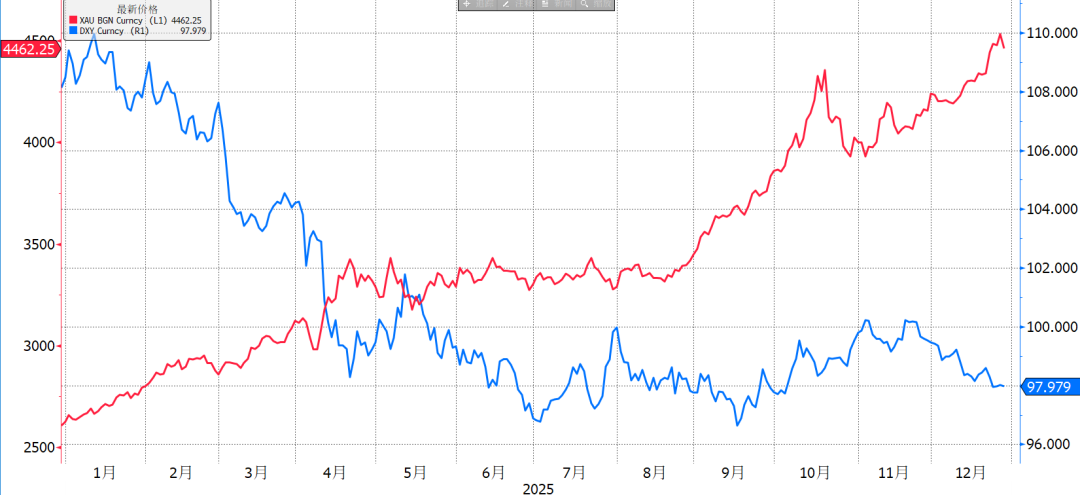

The traditional metals analysis framework can no longer explain such large swings. Although the Federal Reserve continues to cut rates this year, with real interest rates declining, they remain in restrictive territory. Whether from the perspective of the dollar-anchoring mechanism, risk aversion sentiment, interest rates, or inflation expectations, the correlation between gold, silver, and forex is decreasing.

Chart: The declining correlation between gold and the US dollar index

From a capital flow perspective, arbitrage trading between domestic and international gold can have a short-term impact on forex supply and demand. Since international gold (XAU) and Shanghai gold are two separate markets, when overseas gold prices are higher, arbitrageurs tend to sell international gold for US dollars, exchange them domestically for RMB, and buy Shanghai gold, resulting in a force that supports the RMB; conversely, when overseas gold prices are lower, it creates a demand for foreign exchange purchases. This operation helps narrow the price gap between international gold and Shanghai gold, and affects the volatility of USDCNY.

Chart: The onshore-offshore price spread of gold

III. Summary

(1) At year-end, precious metals led by silver are experiencing a historic surge, with their commodity attributes shifting to speculation and hype.

(2) The traditional framework can no longer explain the volatility in gold and silver, and their correlation with forex is declining, but capital flows from arbitrage trading continue to impact supply and demand in the forex market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

USD/JPY nears the 156.70 level as the Dollar gains broadly

CZ Flags Pakistan as Fast-Rising Crypto Power by 2030

Best Crypto to Buy Now for 2026, 2027, and 2028: Prenetics Halts Bitcoin Strategy as DeepSnitch AI Emerges as the Top Pick for 2026

Metaplanet Resumes Bitcoin Buying Spree After 3 Month Pause