Cango Secures $10.5M Equity Investment as Bitcoin Mining and AI Strategy Expands

Quick Breakdown

- Cango raises $10.5M through the issuance of 7 million Class B shares to Enduring Wealth Capital.

- The deal increases EWCL’s voting power to nearly 50%, strengthening its influence over the Bitcoin miner.

- Cango plans to scale global mining operations while expanding into energy and AI computing infrastructure.

Cango Inc., a publicly listed Bitcoin mining company, has announced a new equity investment from Enduring Wealth Capital Limited (EWCL), reinforcing its capital base as it scales global mining operations and expands into energy and AI computing infrastructure.

Under an investment agreement signed on December 29, Cango will issue 7 million Class B ordinary shares to EWCL for $10.5 million in cash, valuing each share at $1.50. The Class B shares carry enhanced voting rights of 20 votes per share, significantly strengthening EWCL’s influence over corporate governance.

🚨 Big news! Our major shareholder Enduring Wealth Capital Limited (EWCL) is boosting its investment with a US$10.5M commitment at US$1.50/share.

A strong signal of confidence in our roadmap across Bitcoin mining, AI compute, and energy.

🔗 Learn more: …

— CANGO (@Cango_Group) December 29, 2025

Ownership and voting power shift

Following the transaction, EWCL’s equity ownership is expected to rise from 2.81% to approximately 4.69% of Cango’s outstanding shares. More notably, EWCL’s voting power would increase from 36.68% to about 49.61%, positioning the firm just below majority control. EWCL is currently the sole holder of Cango’s Class B shares.

The deal remains subject to customary closing conditions, including approval from the New York Stock Exchange. Cango expects the transaction to close in January 2026, though completion is not guaranteed.

Strengthening crypto and AI infrastructure

Cango has increasingly positioned itself as a Bitcoin mining and digital infrastructure company, operating mining sites across North America, the Middle East, South America, and East Africa. Since entering the digital asset sector in late 2024, the company has launched pilot initiatives focused on integrated energy solutions and distributed AI computing, signalling a shift toward infrastructure supporting both crypto mining and AI workloads.

The new capital injection is expected to support these initiatives as the company pursues an asset-light mining model and explores collaborations among energy optimization, Bitcoin mining, and AI compute services.

Notably, in May this year, the company finalized the $351.94 million sale of its China-based legacy business to Ursalpha Digital Limited, completing its evolution into a pure-play global Bitcoin mining and digital infrastructure enterprise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Crystal Ball 2026: Will Crypto Lose the Fight for a Market Structure Bill?

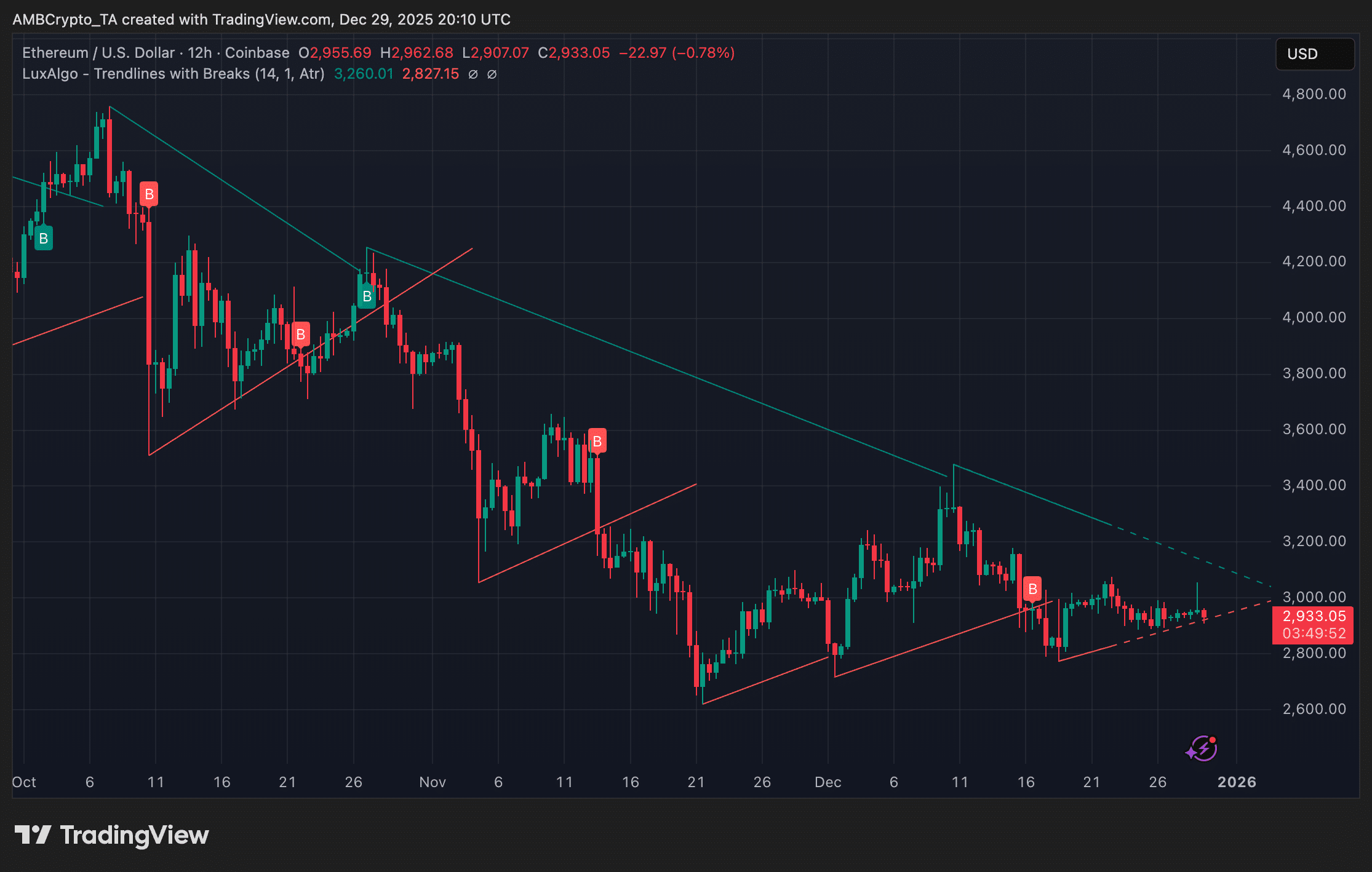

Bitcoin and Ethereum’s post-Christmas bounce fades as sentiment normalises

Social media follower counts have never mattered less, creator economy execs say

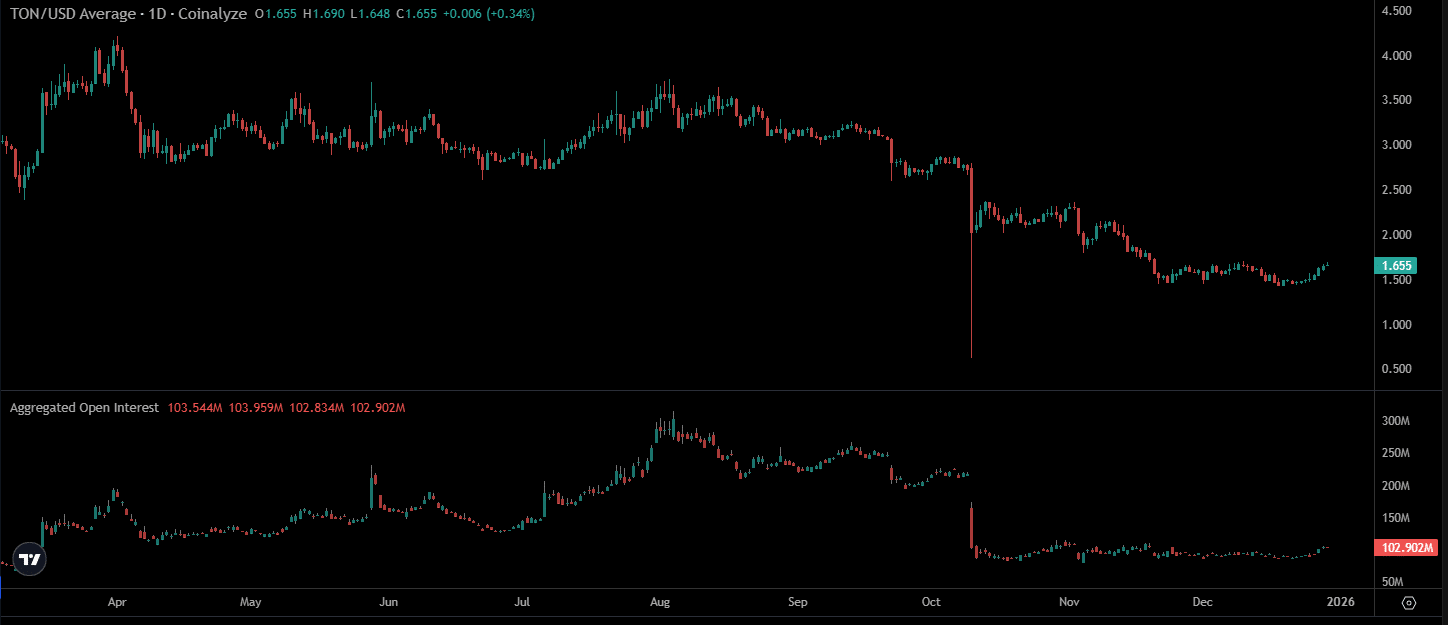

Can Toncoin break above $1.705 and extend its rally? Examining…