Bitcoin’s brief recovery above $90,000 following the Christmas weekend has failed to gain traction, with price slipping back below $87,000 as market sentiment cooled from extreme pessimism to cautious neutrality.

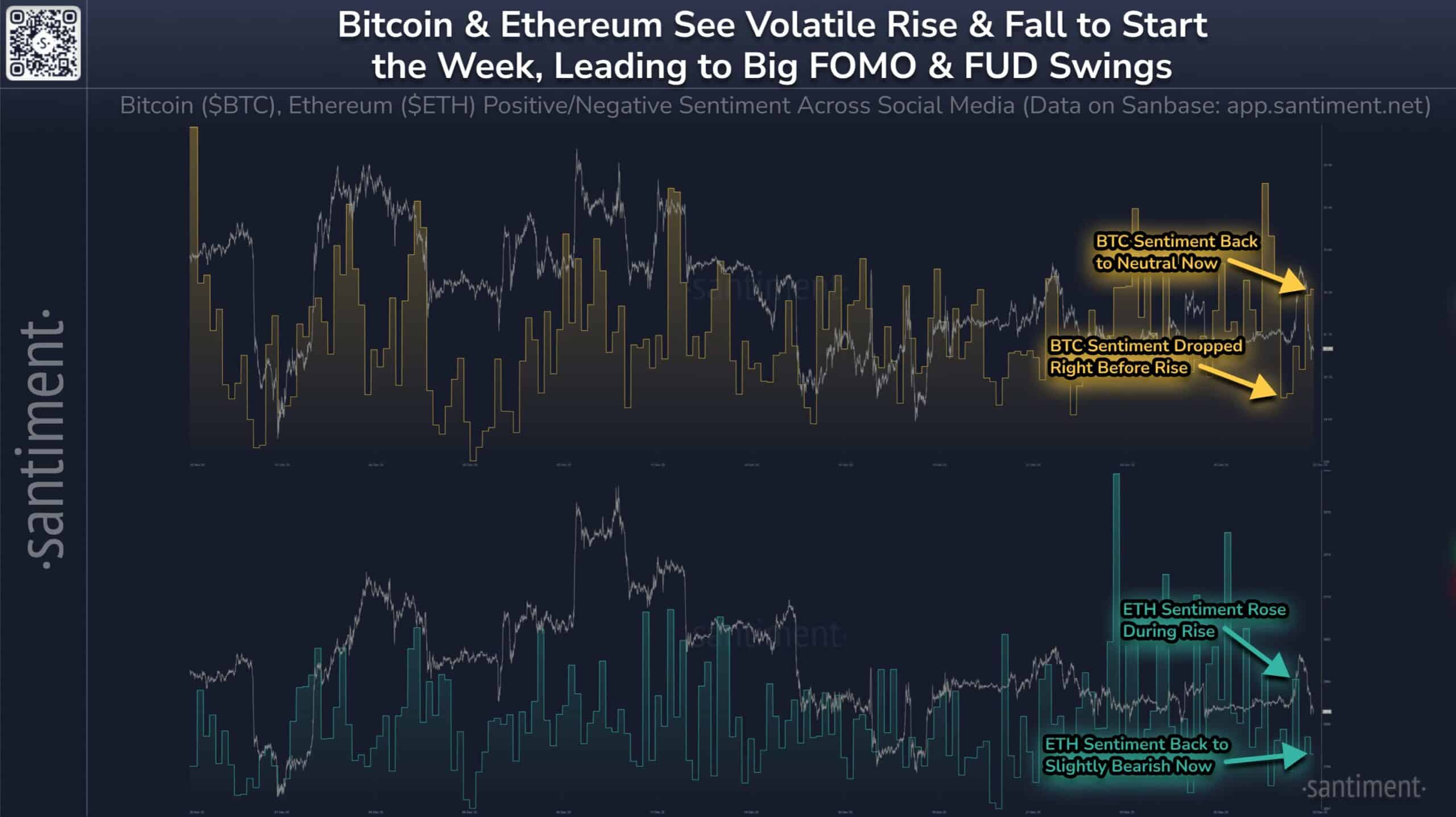

Data from Santiment shows that Bitcoin’s late-December bounce coincided with a sharp spike in negative social sentiment, a pattern often associated with short-term contrarian moves.

However, unlike previous instances where fear gave way to sustained upside, this rally stalled almost as soon as sentiment began to normalise.

Rather than triggering renewed buying interest, the shift away from fear has been followed by consolidation and indecision.

Bitcoin and Ethereum sentiment moved first, price failed to follow through

The Santiment chart highlights a familiar dynamic.

Bitcoin rallied while fear, uncertainty, and doubt dominated social channels, then lost momentum as sentiment returned to neutral levels. This suggests the move was driven less by conviction buying and more by short covering and tactical positioning.

Crucially, sentiment did not flip bullish. Instead, it stabilised, indicating that traders stepped back rather than leaned into the recovery. That lack of follow-through has left Bitcoin without a clear directional catalyst.

Ethereum showed a similar but slightly delayed pattern. ETH sentiment improved during the price bounce, briefly outperforming Bitcoin on a relative basis.

That optimism has since faded, with sentiment now hovering slightly bearish as price failed to reclaim key resistance levels.

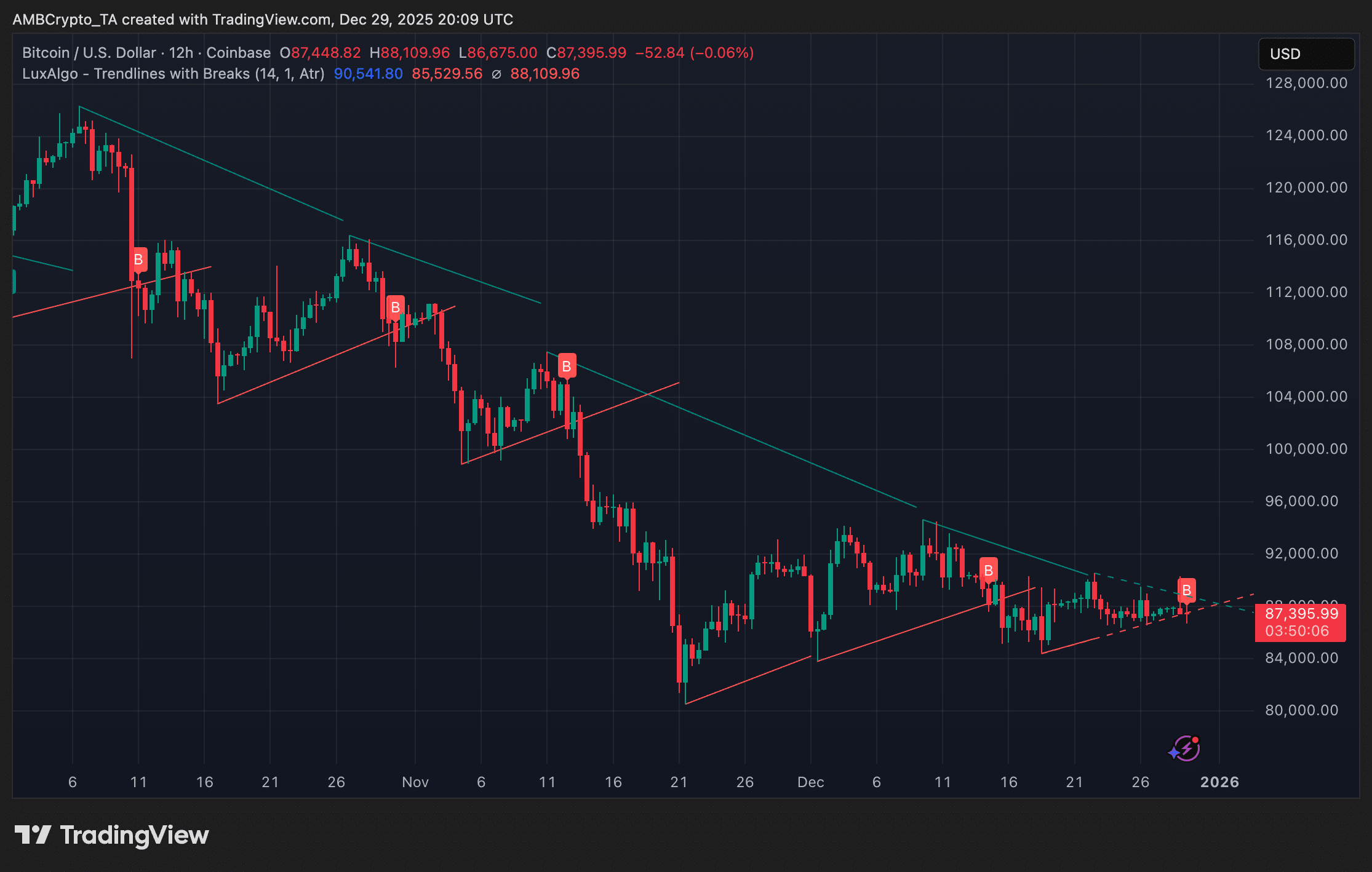

Price structure points to compression, not recovery

The 12-hour Bitcoin chart reinforces the message from sentiment data. Price remains locked in a broader downward structure defined by lower highs, with recent action compressing into a narrowing range around the mid-$80,000 region.

Despite several attempts, Bitcoin has been unable to sustain a break above the descending trend resistance. Each bounce has met selling pressure, suggesting supply remains active even as downside momentum slows.

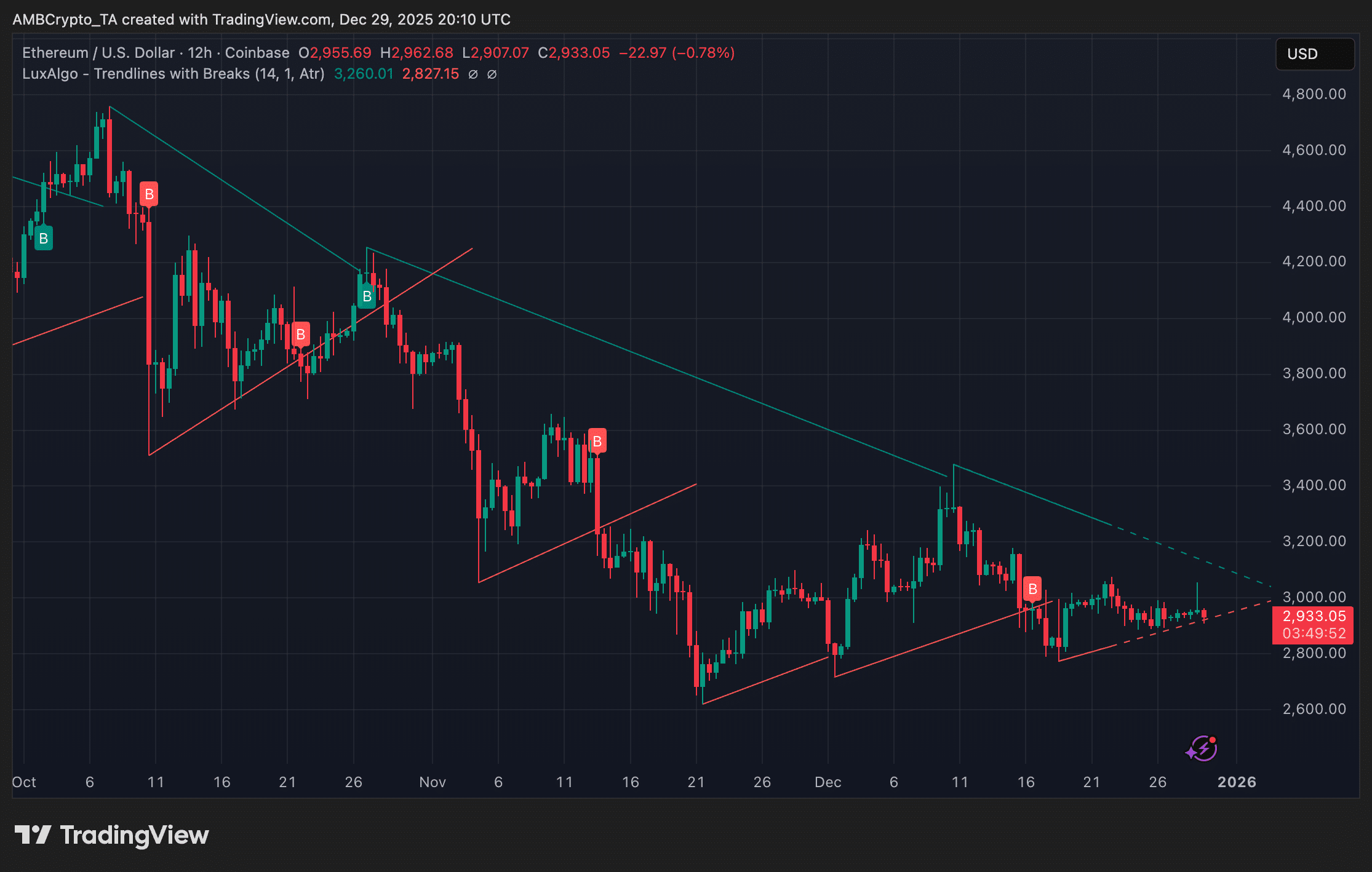

Ethereum’s chart tells a similar story. While ETH has stabilised above recent lows at around $2,930, its recovery remains capped beneath declining resistance. The move mirrors Bitcoin’s lack of trend confirmation.

Taken together, the charts indicate consolidation rather than a reversal.

From reflex bounce to uncertainty

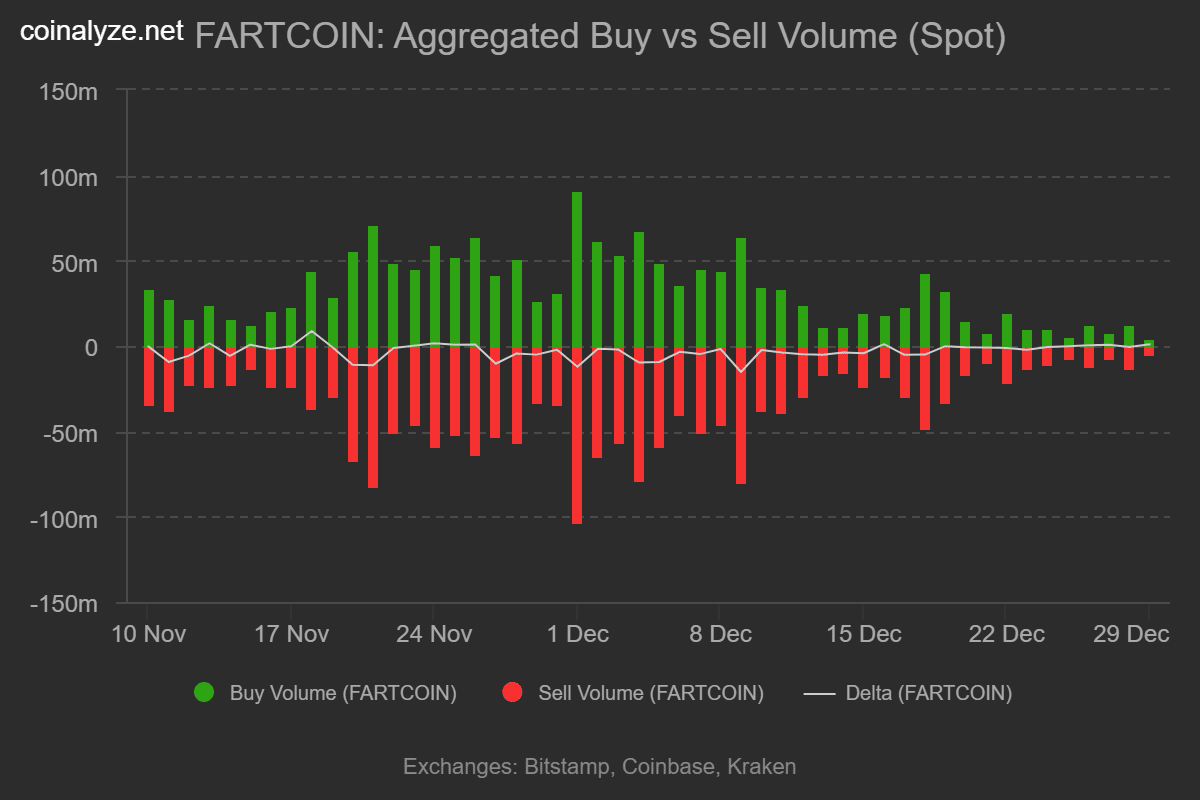

The key distinction in the current setup is the absence of escalation. Fear spiked, price bounced, but neither volume nor sentiment expanded enough to support continuation.

Instead, the market appears to be transitioning from reactive positioning into a waiting phase.

Historically, sustained recoveries tend to emerge when improving sentiment is reinforced by structural breakouts.

That alignment is currently missing. Equally, the lack of renewed panic selling suggests that the market is not entering a capitulation phase either.

This places Bitcoin and Ethereum in a familiar middle ground: supported enough to avoid sharp sell-offs, but constrained by lingering overhead supply and hesitant participation.

What the setup implies going forward

With sentiment neutral and price compressed, the market is likely entering a period where external catalysts or fresh positioning will be required to resolve the range.

Until then, short-term volatility may continue without a clear directional bias.

For now, the post-Christmas move stands as a reminder that fear can spark bounces — but without conviction, those bounces often fade into consolidation rather than trend.

Final Thoughts

- Bitcoin and Ethereum’s late-December bounce was driven more by sentiment extremes than sustained buying conviction.

- Until price breaks decisively above resistance or sentiment re-enters fear, consolidation is likely to persist.