BitMine’s Tom Lee and On-Chain Data Signal a Big December Move for Bitcoin

Bitcoin may be approaching a decisive December as liquidity conditions tighten and on-chain metrics shift. BitMine Chairman Tom Lee says the market has been “limping” since the October 10 liquidation shock, but argues the setup now supports a major move before year-end. Recent on-chain trends and exchange-collateral data point to similar pressure building beneath the

Bitcoin may be approaching a decisive December as liquidity conditions tighten and on-chain metrics shift. BitMine Chairman Tom Lee says the market has been “limping” since the October 10 liquidation shock, but argues the setup now supports a major move before year-end.

Recent on-chain trends and exchange-collateral data point to similar pressure building beneath the surface.

Liquidity Damage Still Defines the Market

Lee told CNBC that the October event severely damaged market-maker balance sheets.

He described these firms as the “central banks” of crypto, responsible for depth, spreads, and inventory. When their balance sheets shrink, liquidity contracts for weeks.

WATCH: Tom Lee says “Bitcoin could hit a new all-time high before year-end”

— BeInCrypto (@beincrypto) November 27, 2025

This matches market performance since early October. Bitcoin has dropped almost 30% from its $126,000 peak.

Meanwhile, November has delivered one of the worst monthly performances for both price and ETF flows in years.

Market makers withdrew risk capital after the liquidation wave erased roughly $19 billion of leveraged positions.

Order-book depth fell sharply across major exchanges, creating air pockets that amplified downside moves. Under such conditions, Bitcoin and Ethereum tend to react earlier to macro stress than equities.

Despite this damage, Lee expects a strong December rally, citing a potential dovish shift from the Federal Reserve.

“Bitcoin makes its best moves in 10 days every year, I think some of those days are still gonna happen before year end,” said Tom Lee.

On-Chain Metrics Show Sellers Losing Control

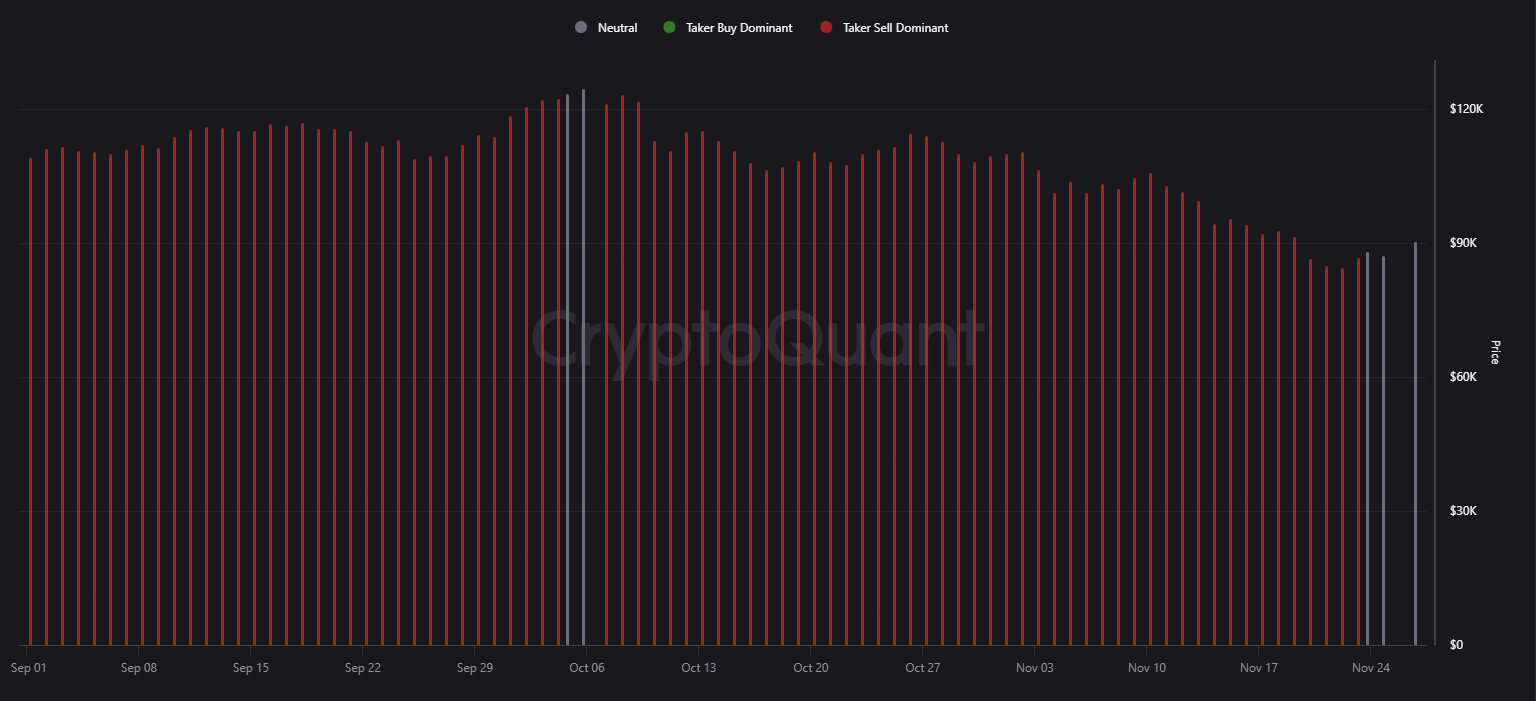

Bitcoin’s 90-day Spot Taker CVD has shifted from persistent sell dominance to a neutral stance. The indicator tracks aggressive market orders on spot exchanges.

Bitcoin Spot Taker CVD(Cumulative Volume Delta, 90-day). Source:

Bitcoin Spot Taker CVD(Cumulative Volume Delta, 90-day). Source:

Red bars dominated from early September through mid-November, showing sustained taker-sell pressure.

The recent move to neutral marks a break in that pattern. It suggests the aggressive selling phase has exhausted.

However, it does not show strong buyer dominance. Instead, the market has entered a balanced phase typical of late-cycle bear markets.

Price remains well below October levels, but the absence of persistent taker-sell pressure signals improved stability.

The shift aligns with the broader leverage reset seen in futures markets, where funding rates have moved near zero.

Borrowing Trends Point to Strong Hands, but Fragile Leverage

CryptoQuant data shows Nexo users prefer borrowing against Bitcoin rather than selling it. BTC accounts for 53% to 57% of all collateral on the platform. That range has held for months despite the drawdown.

' Nexo users aren’t selling their Bitcoin, they’re borrowing against it.BTC now accounts for 54.3% of all collateral on the platform, holding a steady 53–57% range for months.It confirms Bitcoin is the dominant asset users leverage when they need liquidity.

— CryptoQuant.com (@cryptoquant_com) November 27, 2025

This behavior reduces immediate selling pressure. It also confirms that long-term holders continue to treat Bitcoin as their primary liquidity source.

Yet it adds another layer of vulnerability. If Bitcoin drops further, collateralized positions face liquidation risk.

Combined with thin order books, any forced selling could produce outsized volatility. This dynamic reflects late-bear fragility rather than early-bull strength.

A Market Caught Between Exhaustion and Low Liquidity

Current market structure reflects a transition rather than a clean reversal. ETF outflows, damaged liquidity, and macro uncertainty keep pressure on prices.

However, on-chain selling has cooled, and structural holders continue to defend positions.

The result is an environment where small catalysts can produce large moves.

🚨TOM LEE: YEAR-END RALLY IS COMINGDespite a brutal six weeks, Tom Lee says a STRONG December rally is on deck, backed by by a dovish incoming Fed pivot.

— Coin Bureau (@coinbureau) November 27, 2025

A dovish Fed pivot would likely hit thin order books and accelerate a rebound. Another macro shock could trigger renewed deleveraging.

Lee’s view aligns with this setup. The market has stopped bleeding, but it remains fragile. Bitcoin has a history of delivering double-digit moves in compressed periods, especially after aggressive liquidations.

As December approaches, both liquidity conditions and on-chain data suggest the next large move is near.

The direction will depend on macro signals and ETF flows rather than sentiment alone.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Faces a Pivotal Moment: Bulls Defend $93K While Bears Target $75K

- Bitcoin's price recovery loses momentum as key support levels break, risking a drop to $75,000 amid bearish technical indicators. - Bulls must reclaim $92,900+ resistance to avoid deeper correction, but weak RSI/MACD and LTH sell-offs signal structural vulnerability. - DXY consolidation below 100 and extreme fear index (15) reinforce macro risks, while analysts split between $90K consolidation and $75K-$103K dual scenarios. - Ethereum faces similar pressure at $2,939, with Tom Lee predicting a potential

The Role of Infrastructure Grants in Driving Economic Growth in Webster, NY

- Webster , NY leverages $9.8M FAST NY grant to transform Xerox campus and 600 Ridge Road site, boosting industrial real estate and mixed-use development. - Infrastructure upgrades at Xerox's 300-acre brownfield create 1M sq ft of industrial space by 2025, attracting high-tech manufacturers and aligning with state sustainability goals. - 600 Ridge Road's EPA-backed revitalization enables pedestrian-friendly mixed-use projects, synchronized with Xerox campus upgrades to drive 10.1% annual home price growth.

Bitcoin News Today: Bitcoin Faces a Pivotal Week: Optimistic Buying Meets Bearish Whales Amid Economic Uncertainty

- Bitcoin stabilizes near $87,000 after 11-day selloff, with analysts divided on whether the rebound signals a trend reversal or temporary relief. - US ETFs record $1.22B in outflows amid weak institutional demand, compounded by macroeconomic uncertainty and delayed Fed rate-cut expectations. - Technical indicators show mixed signals: RSI suggests waning bearish momentum, while a "Death Cross" pattern historically precedes deep corrections. - Institutional accumulation by mid-sized wallets contrasts with w

Dogecoin News Today: Dogecoin's ETF Ambitions Face Off Against Technical Downturn Amid Market Turbulence

- Dogecoin (DOGE) faces technical collapse after breaking below key support levels and moving averages, driven by 263% above-average volume and algorithmic selling. - Unexpected resilience emerges as DOGE rallies 2.6% post-Musk's D.O.G.E. initiative dissolution and gains 0.7% amid new spot ETF approvals like Grayscale's GDOG . - Broader crypto markets remain bearish with Bitcoin below $85,000 and $120B lost in 24 hours, while DOGE futures open interest surges 3.27% signaling speculative activity. - Analyst