Polish Crypto Influencer Says the Supercycle Is Dead, Bitcoin Is Back in a Classic Bear Market

Bitcoin is once again at the center of discussions about market cyclicality, and Polish crypto influencer Phil Konieczny argues that the current declines fit perfectly into his previous forecasts. He emphasizes that Bitcoin is behaving according to a historical pattern, and the market realized too late that the bull market was over. According to him,

Bitcoin is once again at the center of discussions about market cyclicality, and Polish crypto influencer Phil Konieczny argues that the current declines fit perfectly into his previous forecasts.

He emphasizes that Bitcoin is behaving according to a historical pattern, and the market realized too late that the bull market was over. According to him, the current bear market is a natural part of the cycle and should not be ignored.

The cryptocurrency market is going through a difficult phase, but in Phil’s opinion everything is going exactly as it should.

Bitcoin in a Bear Market

Phil Konieczny starts his video from the statement that the current market behaves in a textbook way when it comes to 4-year cycles. He claims that Bitcoin, which trades for around $85,000 today, follows a pattern already seen several times.

In the next part, he emphasizes that historical peaks have occurred earlier each time. Phil explains that in 2017 the peak came in December, in 2021 it arrived in November, and the current peak appeared in October. In his view, these data points confirm the market’s cyclicality.

He also notes that Bitcoin is now entering a natural downward phase. He adds that many people ignored the signals, although they were visible.

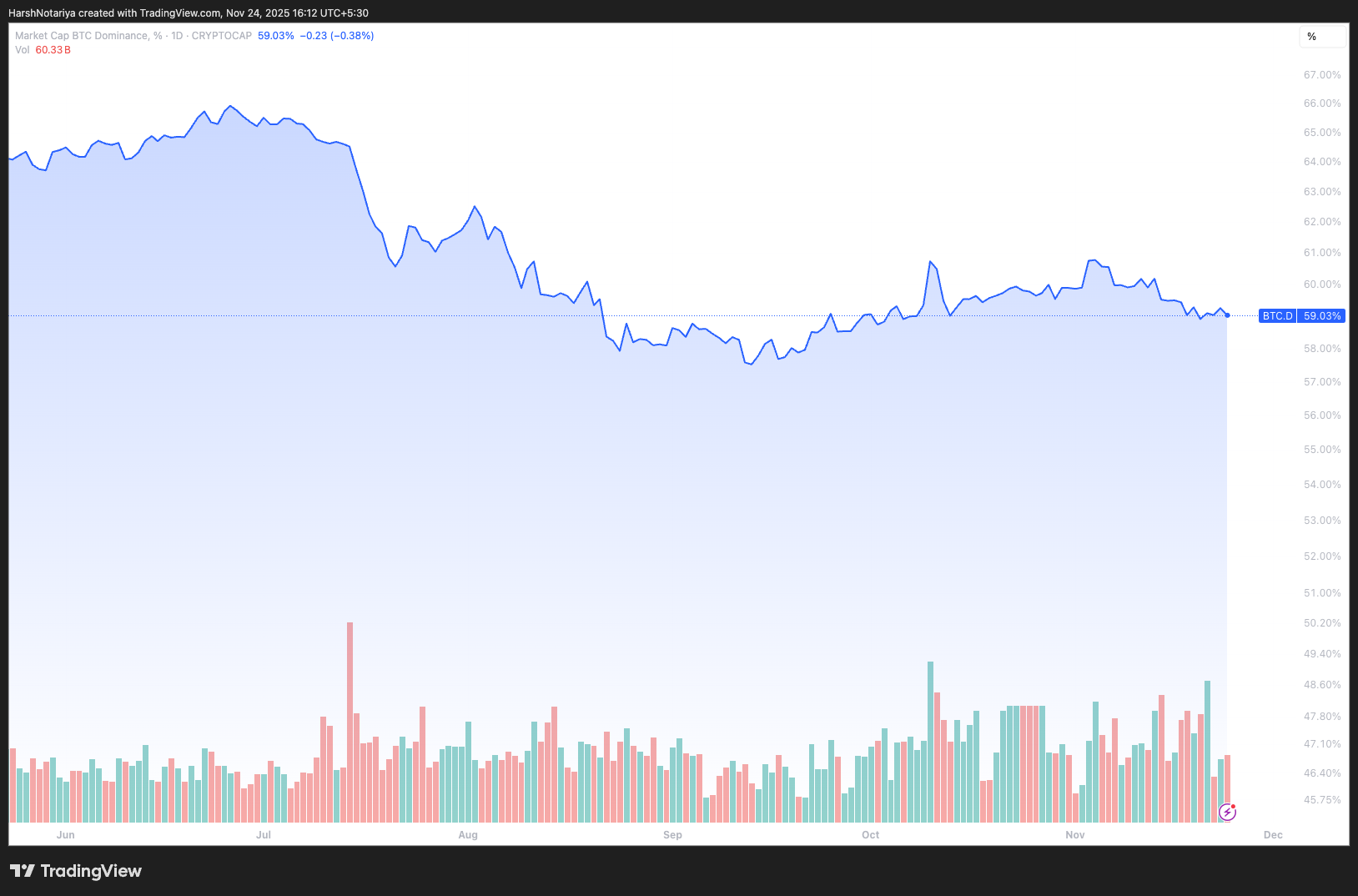

Phil also comments on Bitcoin’s dominance, which in his opinion is not growing as strongly as it should. At the same time, smaller altcoins record huge losses, often at 60–80% per year. This shows the real weakness of the market.

Bitcoin dominance. Source:

TradingView

Bitcoin dominance. Source:

TradingView

Phil’s Key Warnings

Phil Konieczny openly says that the supercycle narrative was wrong. In his opinion, the market gave clear signals that cyclicality continued. He emphasizes that it was unwise to ignore this data.

Meanwhile, Bitcoin is below its 50-week moving average. In Phil’s opinion, this is a classic bear market signal. However, the investors should not ignore the possibilities of a dead-cat bounce.

Bitcoin Trades Below 50-Week EMA For the First Time Since 2023. Source:

TradingView

Bitcoin Trades Below 50-Week EMA For the First Time Since 2023. Source:

TradingView

The Polish influencer warns investors to stay away from altcoins. This is because, the risk of investing on altcoins is too high. Not to mention, many altcoins never recovered from previous bear markets.

Macroeconomics, ETFs and key investor questions about Bitcoin

Phil discusses the macroeconomic situation extensively, which he believes is very worrying. It points to an inverted yield curve that has historically always heralded a recession.

He mentions Americans’ debt and the growing number of company bankruptcies. It also highlights the risks arising from the US–China trade war. In his opinion, these factors significantly limit the growth potential of markets.

Then he discusses the topic of ETFs. He explains that their purchases were one of the main drivers of the beginning of the bull market.

However, he notes that their activity alone is not enough if the macro situation does not improve. Phil ndicates that the correlation between S&P 500 and Bitcoin has become one-sided. This means that stock market declines drag down cryptocurrencies, but increases do not give them the same support.

The Polish influencer sums it up:

- Bitcoin responds to macro and macro looks bad,

- Altcoins have an extremely low chance of making a lasting rebound, the

- The cycle looks the same as the previous ones.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana News Update: Meme Coin Craze and Its Hidden Dangers—Will Apeing Tactics Pay Off?

- Meme coin Apeing ($APEING) offers $0.001 whitelist tokens before public trading, emphasizing structured growth and utility to differentiate from speculative projects. - The 2025 crypto market sees rising meme coin interest amid Bitcoin's rebound, but faces risks like the $116M Balancer hack and Solana's price volatility. - Apeing's community-driven strategy mirrors Dogecoin's success, yet analysts caution against market manipulation and security vulnerabilities in high-risk altcoin investments. - Project

Bitcoin Updates Today: Conflicting Indicators for Bitcoin: Temporary Pullback or Extended Decline?

- Bitcoin trades near $80,000 after 30% correction from $126,000 high, amid $1T+ market value loss from geopolitical tensions and leveraged liquidations. - Binance delists GMT/BTC and ME/BTC pairs to comply with regulations, potentially tightening liquidity for niche crypto pairs. - Analysts split between bullish consolidation (ETF inflows) and bearish warnings (triple divergence, 50-week MA break) for short-term BTC trajectory. - Long-term forecasts range from $150,000–$225,000 (institutional adoption) to

The Growing Prevalence of Shovel-Ready Infrastructure Grants and Their Influence on Real Estate and Industrial Growth

- Shovel-ready grants in NY and PA are accelerating industrial development through infrastructure upgrades and land value appreciation. - Municipal partnerships reduce development risks, transforming underused sites like coal mines into competitive industrial hubs. - Programs like FAST NY and PA SITES have generated billions in private investment, creating 16,700+ jobs and boosting regional competitiveness. - Strategic infrastructure investments in transportation , utilities , and site readiness drive prem

Altcoin advancements surge while security concerns pose risks to the next major breakthrough in cryptocurrency

- Altcoin investors target AI-driven projects like Ozak AI (Phase 7 presale) and Digitap ($TAP) for utility-focused growth amid market uncertainty. - Ozak AI's DePIN architecture and Phala Network partnership highlight AI's role in optimizing crypto yields and financial predictions. - Security risks escalate as South Korea's Upbit suffers $36M Solana breach, echoing Trezor CEO's warnings about exchange vulnerabilities. - Institutional adoption grows with projects like BlockchainFX ($BFX) redistributing tra