Bitcoin Updates Today: Conflicting Indicators for Bitcoin: Temporary Pullback or Extended Decline?

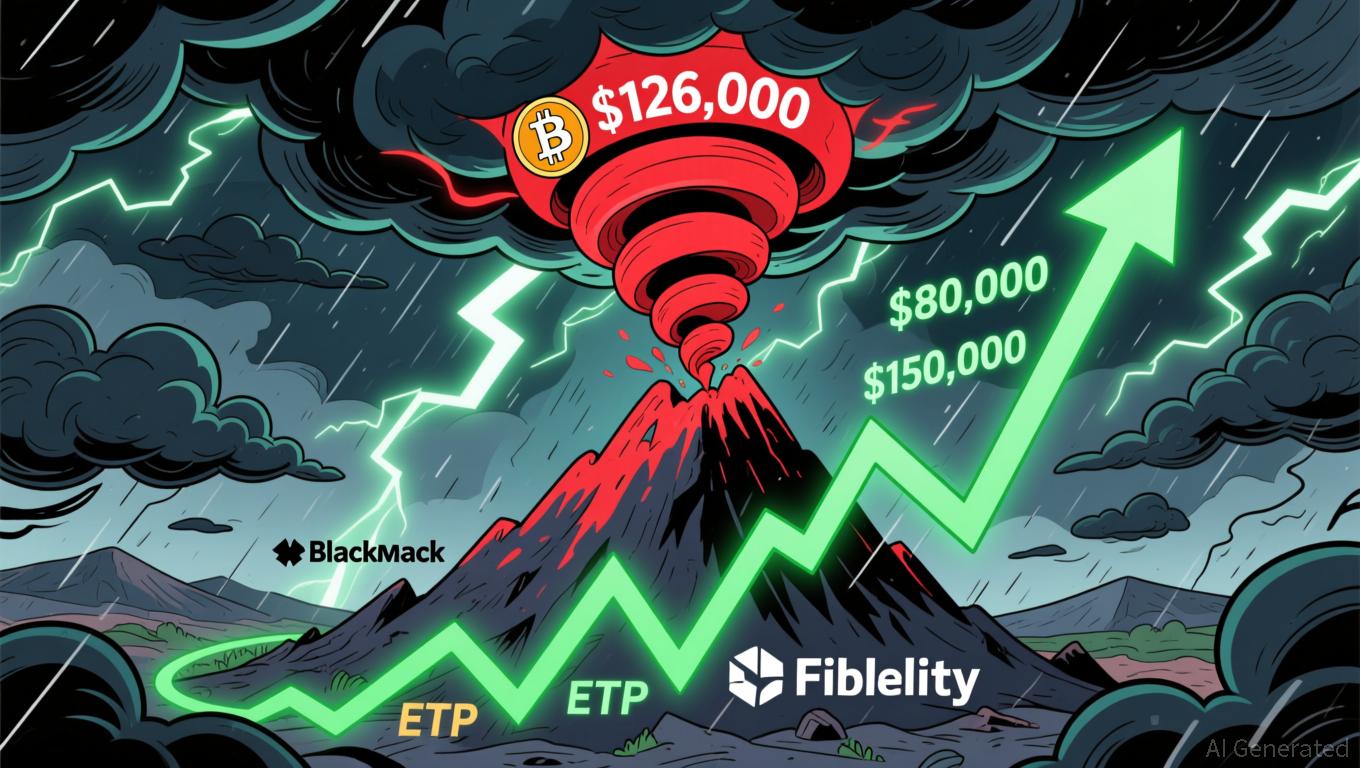

- Bitcoin trades near $80,000 after 30% correction from $126,000 high, amid $1T+ market value loss from geopolitical tensions and leveraged liquidations. - Binance delists GMT/BTC and ME/BTC pairs to comply with regulations, potentially tightening liquidity for niche crypto pairs. - Analysts split between bullish consolidation (ETF inflows) and bearish warnings (triple divergence, 50-week MA break) for short-term BTC trajectory. - Long-term forecasts range from $150,000–$225,000 (institutional adoption) to

Bitcoin at a Crossroads: Bulls and Bears Clash Near $80,000

Bitcoin is currently navigating a critical phase, with market sentiment split between optimism and caution as the cryptocurrency hovers close to the $80,000 mark. This comes after a significant 30% drop from its record high of $126,000 reached in October 2025. Recent volatility, fueled by geopolitical unrest and widespread leveraged liquidations, has wiped out over $1 trillion from the overall crypto market. As a result, both individual traders and large institutions are reevaluating their Bitcoin positions.

In the midst of these developments, Binance has removed the GMT/BTC and ME/BTC trading pairs, reflecting the platform’s ongoing efforts to comply with regulatory requirements. This decision may further restrict liquidity for less popular trading pairs.

Analysts Divided on Short-Term Outlook

Experts remain split on where Bitcoin is headed in the near future. Some believe the current downturn is simply a pause within a larger upward trend. Notably, Bitcoin proponent Max Keiser suggests that the market has entered a phase of accumulation, pointing to continued net inflows into U.S. spot Bitcoin ETFs despite the price slump. On the other hand, some analysts warn of the potential for a more severe decline. Technical analyst Tony Severino has highlighted a rare “triple bearish divergence” on longer timeframes—a pattern that has historically signaled the end of bull markets and the start of extended declines. This, combined with Bitcoin’s recent drop below its 50-week moving average, has heightened fears of a possible bear market emerging in 2026.

Long-Term Predictions Remain Divided

Forecasts for Bitcoin’s price over the next year vary widely. Optimistic projections see the cryptocurrency climbing to between $150,000 and $225,000 by the end of 2025, driven by increased institutional participation, potential interest rate cuts by the Federal Reserve, and renewed ETF inflows. Recent moves, such as Harvard University’s $443 million investment in spot Bitcoin ETFs and Metaplanet in Japan amassing $100 million in Bitcoin, underscore the growing interest from major players. However, more cautious analysts expect prices to remain in the $80,000 to $100,000 range, citing fragile market sentiment and record outflows from ETFs.

Technical Signals Add to the Uncertainty

Technical analysis paints a mixed picture. Although Bitcoin saw a brief 3.6% rebound on November 27, the overall trend remains downward. The cryptocurrency has yet to convincingly break through key resistance levels at $93,000 and $111,000. Additionally, the TOTALES market cap index continues to struggle against historical resistance, and the S&P 500’s inconsistent performance adds further complexity to Bitcoin’s outlook.

What Lies Ahead?

The future direction of Bitcoin will likely be shaped by a combination of macroeconomic trends and blockchain-specific factors. A shift in Federal Reserve policy or a resurgence in ETF inflows could spark renewed bullish momentum. However, if the triple bearish divergence plays out, a deeper slide toward the $35,000–$40,000 range remains a possibility. For now, the key question is whether the current pullback is merely a temporary correction or the start of a prolonged bear market—a decision point that will have significant consequences for investors navigating the evolving crypto landscape.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: MUTM Soars by $19M While MegaETH Plummets: Real Performance Outshines Hype in the Evolving Crypto Landscape

- Mutuum Finance (MUTM) raised $19M in Phase 6 presale, with 250% price growth since 2025 launch and 90% allocation completed. - KuCoin secured AUSTRAC and MiCA licenses, expanding compliance reach across 29 EEA countries while acquiring payment firms to strengthen institutional credibility. - Bitcoin surged past $90K amid Fed rate cut speculation, contrasting MegaETH's $1B token sale collapse due to technical failures, highlighting execution risks in volatile markets. - Crypto exchanges pledged $3.19M for

Bitcoin News Update: Triple Bearish Divergence in Bitcoin Suggests ETF Rally May Be Unstable

- Bitcoin trades near $86.6K, down 31.3% from October peak amid $3.5B November ETF outflows and $2B liquidations. - Technical analysis flags "triple bearish divergence" as price hits higher highs while momentum indicators weaken. - Spot Bitcoin ETFs see $238M inflows but face $90K resistance; Ethereum ETFs gain $175M yet ETH remains below $3,000. - Key support at $85K risks accelerating sell-off to $80K, with 50–60% retracement targeting $34,409–$44,100 if bearish pattern completes.

CME Outage Highlights Cooling Systems as the Global Market’s Major Vulnerability

- CME's 2025 outage exposed cooling systems as critical vulnerability, halting 90% of global derivatives trading via CyrusOne data center failure. - Frozen prices in WTI, S&P 500 futures, and gold triggered erratic movements, with silver dropping $1 amid widened bid-ask spreads. - Despite robust financials ($1.54B revenue Q3 2025), CME faces infrastructure scrutiny as crypto futures growth plans clash with outage risks. - 24/7 crypto trading expansion scheduled for 2026 highlights need for resilient system

Gold Climbs as Fed Faces Uncertainty Over December Rate Cut Amid Limited Data

- Gold prices hit $4,120/oz as Fed rate cut expectations dropped to 33% due to delayed November jobs data, triggering market uncertainty. - JPMorgan and Goldman Sachs project gold to reach $5,055/oz by 2026, citing central bank demand and potential Fed policy neutrality. - Asian markets showed mixed performance while U.S. equity futures wavered, reflecting fragility amid geopolitical tensions and Fed leadership speculation. - Geopolitical risks, including U.S.-Ukraine peace talks and China's semiconductor