3 Token Unlocks to Watch in the Final Week of November 2025

The crypto market will welcome tokens worth more than $566 million in the final week of November 2025. Several major projects, including Hyperliquid (HYPE), Plasma (XPL), and Jupiter (JUP), will release significant new token supplies. These unlocks might lead to market volatility and influence price movements in the short term. Here’s a breakdown of what

The crypto market will welcome tokens worth more than $566 million in the final week of November 2025. Several major projects, including Hyperliquid (HYPE), Plasma (XPL), and Jupiter (JUP), will release significant new token supplies.

These unlocks might lead to market volatility and influence price movements in the short term. Here’s a breakdown of what to watch for each project.

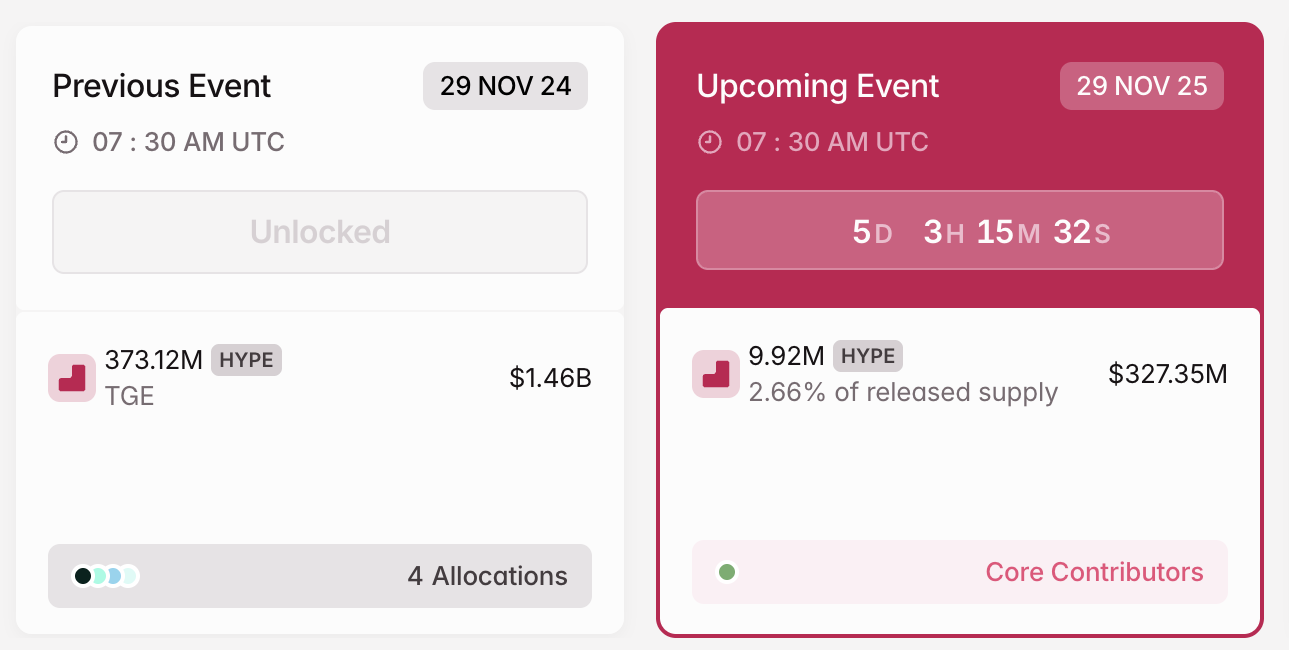

1. Hyperliquid (HYPE)

- Unlock Date: November 29

- Number of Tokens to be Unlocked: 9.92 million HYPE (0.992% of Total Supply)

- Current Circulating Supply: 270.77 million HYPE

- Total supply: 1 billion HYPE

Hyperliquid is a leading decentralized perpetual futures exchange built on its own Layer-1 blockchain. It offers high-performance trading with low latency, on-chain order books, and also sub-second transaction finality.

On November 29, the project will release 9.92 million tokens valued at approximately $327.35 million. This accounts for 2.66% of the current released supply.

HYPE Crypto Token Unlock in November. Source:

Tokenomist

HYPE Crypto Token Unlock in November. Source:

Tokenomist

Hyperliquid will distribute all the unlocked tokens among core contributors.

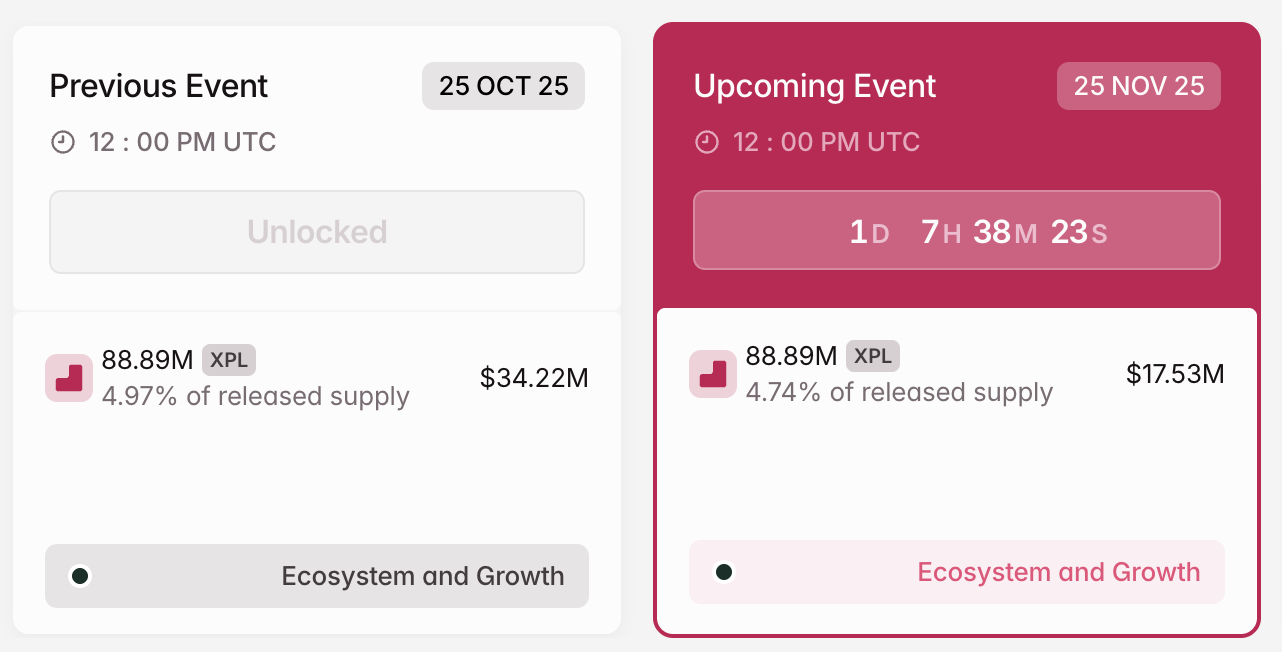

2. Plasma (XPL)

- Unlock Date: November 25

- Number of Tokens to be Unlocked: 88.89 million XPL (0.89% of Total Supply)

- Current Circulating Supply: 1.88 billion XPL

- Total supply: 10 billion XPL

Plasma is a Layer 1 blockchain platform built to enhance the efficiency and scalability of stablecoin transactions. It enables zero-fee USDT transfers, allows the use of custom gas tokens, supports confidential payments, and delivers the throughput required for global-scale adoption.

Plasma will unlock 88.89 million XPL on November 25. The tokens are worth $17.53 million. Moreover, they account for 4.74% of the current circulating supply.

XPL Crypto Token Unlock in November. Source:

Tokenomist

XPL Crypto Token Unlock in November. Source:

Tokenomist

The team will direct all of the 88.89 million XPL to the ecosystem and growth.

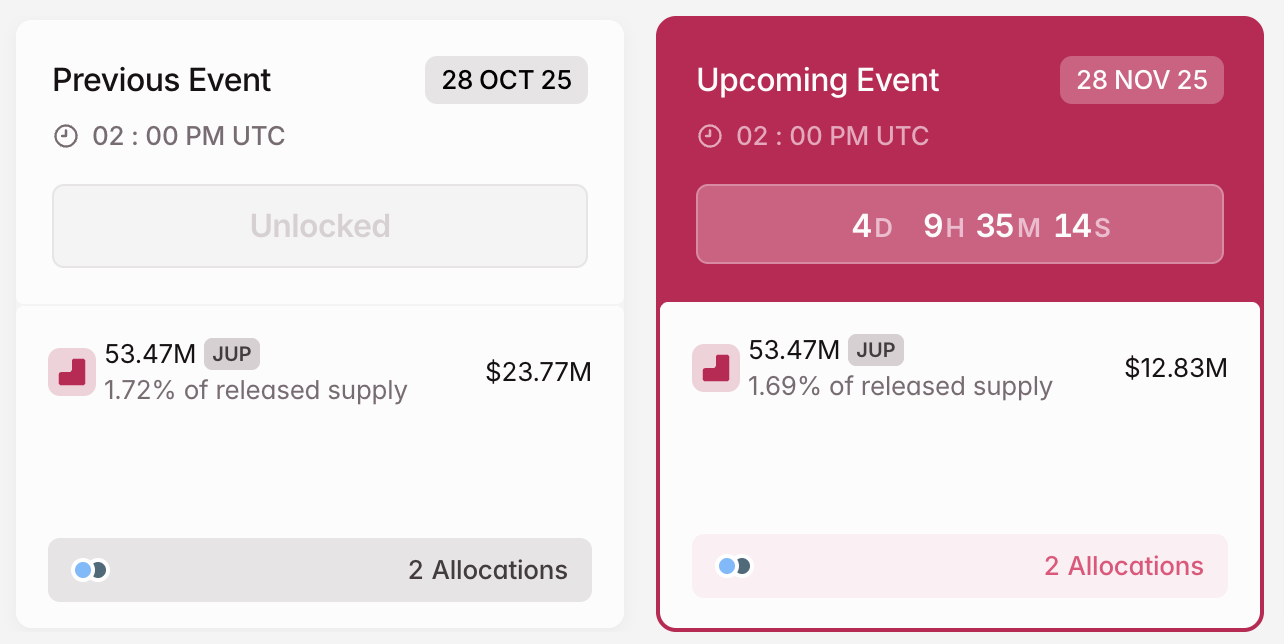

3. Jupiter (JUP)

- Unlock Date: November 28

- Number of Tokens to be Unlocked: 53.47 million JUP (0.53% of Total Supply)

- Current Circulating Supply: 3.2 billion JUP

- Total supply: 10 billion JUP

Jupiter is a decentralized liquidity aggregator on the Solana (SOL) blockchain. It optimizes trade routes across multiple decentralized exchanges (DEXs) to provide users with the best prices for token swaps with minimal slippage.

On November 28, Jupiter will unlock 53.47 million JUP tokens. The supply is worth approximately $12.83 million, representing 1.69% of its circulating supply. Furthermore, this unlock follows a monthly cliff vesting schedule.

JUP Crypto Token Unlock in November. Source:

Tokenomist

JUP Crypto Token Unlock in November. Source:

Tokenomist

Jupiter has allocated the tokens primarily to the team, who will get 38.89 million JUP. Furthermore, Mercurial stakeholders will receive 14.58 million JUP altcoins.

In addition to these, other prominent unlocks that investors can look out for in the final week of November include Artificial Superintelligence Alliance (FET), Aerodrome Finance (AERO), IOTA (IOTA), and various altcoins, contributing to the overall market-wide releases.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea's Cryptocurrency Reform: Will New Regulations Enhance Confidence While Preserving Innovation?

- South Korea's National Assembly plans to enforce strict VASP regulations requiring criminal record checks for all major shareholders, including foreign investors. - The law mandates re-evaluation of existing VASPs, creating compliance challenges for smaller firms with complex ownership structures. - By extending oversight to global criminal records, the reform sets a potential international precedent and could reshape cross-border crypto investments. - While critics warn of stifled innovation, proponents

Bitcoin News Update: Tether’s Risky Asset Holdings Challenge Stablecoin Reliability

- S&P Global downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% Bitcoin exposure exceeds S&P's 3.9% overcollateralization threshold, risking undercollateralization if prices fall. - Tether defends practices with quarterly audits and $10B 2025 profit, dismissing the downgrade as outdated. - Recent crypto market turmoil and past stablecoin collapses highlight risks in opaque reserve management. - Tether's resilience amid crises contrasts with S&P's warning

Elon Musk's SpaceX moves 1,163 Bitcoin worth $105M

Bitcoin News Today: Bitcoin’s Puell Multiple Approaches 0.50 Mark, Fueling Optimism Amid Ongoing Doubts About Market Structure

- Bitcoin's Puell Multiple nears 0.50, historically signaling price cycle bottoms since 2015, sparking market speculation. - Bitcoin Munari's $0.22 token launch on Solana highlights hybrid blockchain strategies, aligning with evolving regulatory frameworks. - Institutional demand for Bitcoin yield strategies grows as Anchorage Digital reports rising interest in collateralized products. - Fed policy shifts and exchange promotions like Bitget's Black Friday campaign reflect crypto's macroeconomic and competi