Elon Musk's SpaceX moves 1,163 Bitcoin worth $105M

Key Takeaways

- SpaceX moved 1,163 Bitcoin worth $105M to a new wallet, following a larger transfer last month.

- The moved funds are believed to be for custody reasons, with SpaceX's wallet now holding 6,095 BTC.

A crypto wallet associated with SpaceX moved 1,163 Bitcoin valued at around $105 million to a new wallet today, according to Arkham Intelligence data . The transfer comes after the Elon Musk-owned space exploration company sent $268 million in Bitcoin to a new address last month.

Analysts suggest SpaceX may have moved the funds for custody purposes rather than selling them. The labeled wallet currently holds 6,095 Bitcoin worth almost $553 million.

Following a three-year dormancy period, the wallet resumed activity in late July, sending out $153 million worth of Bitcoin.

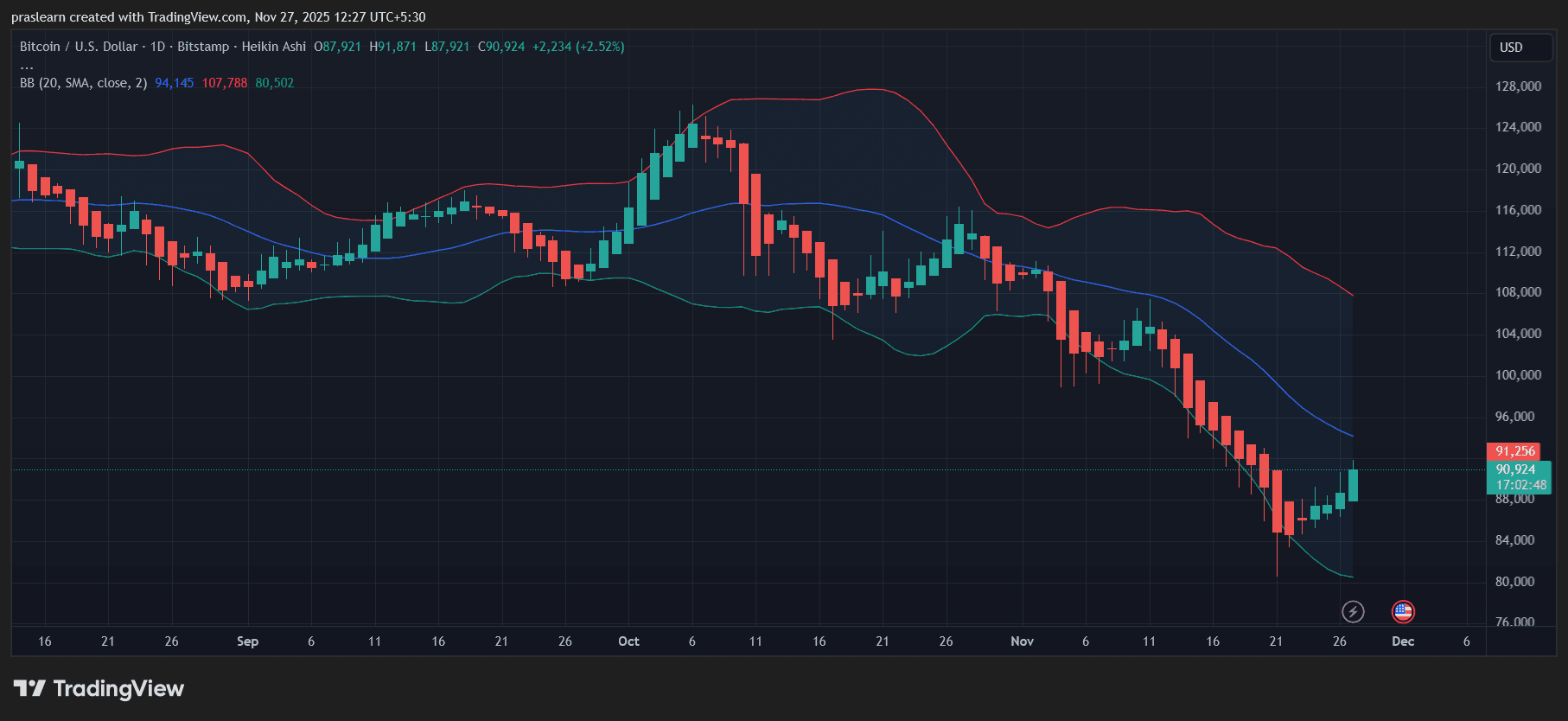

Bitcoin is currently trading near $91,000, up 3.5% over the past 24 hours, according to CoinGecko.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet Introduces Zero-Fee Feature for Its Crypto Card in Over 50 Markets

Are Big Changes in Store for the Bitcoin Price?

Secure Blockchain, Misleading Agreements: Spoofing Incidents Increase on Monad

- Monad's mainnet faces spoofing attacks as scammers use smart contracts to mimic ERC-20 token transfers, misleading users with fake logs. - Co-founder James Hunsaker clarifies the network remains secure, but external contracts exploit EVM openness to create deceptive transactions. - Over 76,000 wallets claimed MON tokens in airdrop, creating high-traffic conditions that attackers leverage through fabricated swaps and signatures. - Security experts warn users to verify contract sources and avoid urgent pro

Bitcoin Latest Updates: Worldwide Regulatory Changes and Major Investors Propel Bitcoin and Brazil's Markets Upward

- Bitcoin surged to $91,500 amid institutional adoption, Fed rate cut expectations, and post-halving rebound, despite $3.79B ETF outflows and inherent volatility. - Brazil's stock market hit records after tax reforms exempted low-income households, aligning with global redistributive policies and boosting 15 million earners. - Binance delisted BTC pairs like GMT/BTC for regulatory compliance, while on-chain metrics signaled crypto market consolidation and mixed altcoin prospects. - Global macro risks persi