Kalshi Doubles Valuation to $11 Billion With $1 Billion Funding Round

Prediction market platform Kalshi has secured $1 billion in fresh funding, pushing its valuation to $11 billion. The move comes amid the rapid integration of prediction platforms into the mainstream. Users flock to these sites to wager on everything from elections and crypto prices to even daily temperature readings. Kalshi Hits $11 Billion Valuation After

Prediction market platform Kalshi has secured $1 billion in fresh funding, pushing its valuation to $11 billion.

The move comes amid the rapid integration of prediction platforms into the mainstream. Users flock to these sites to wager on everything from elections and crypto prices to even daily temperature readings.

Kalshi Hits $11 Billion Valuation After Record Latest Round

Kalshi’s latest capital raise comes less than two months after the company secured $300 million at a $5 billion valuation. Citing people familiar with the matter, TechCrunch reported that the newest round was led by both previous backers and new investors.

The returning investors included Sequoia and CapitalG. Andreessen Horowitz, Paradigm, Anthos Capital, and Neo joined them. Meanwhile, rival platform Polymarket is pursuing its own ambitious funding, targeting a $12 billion valuation.

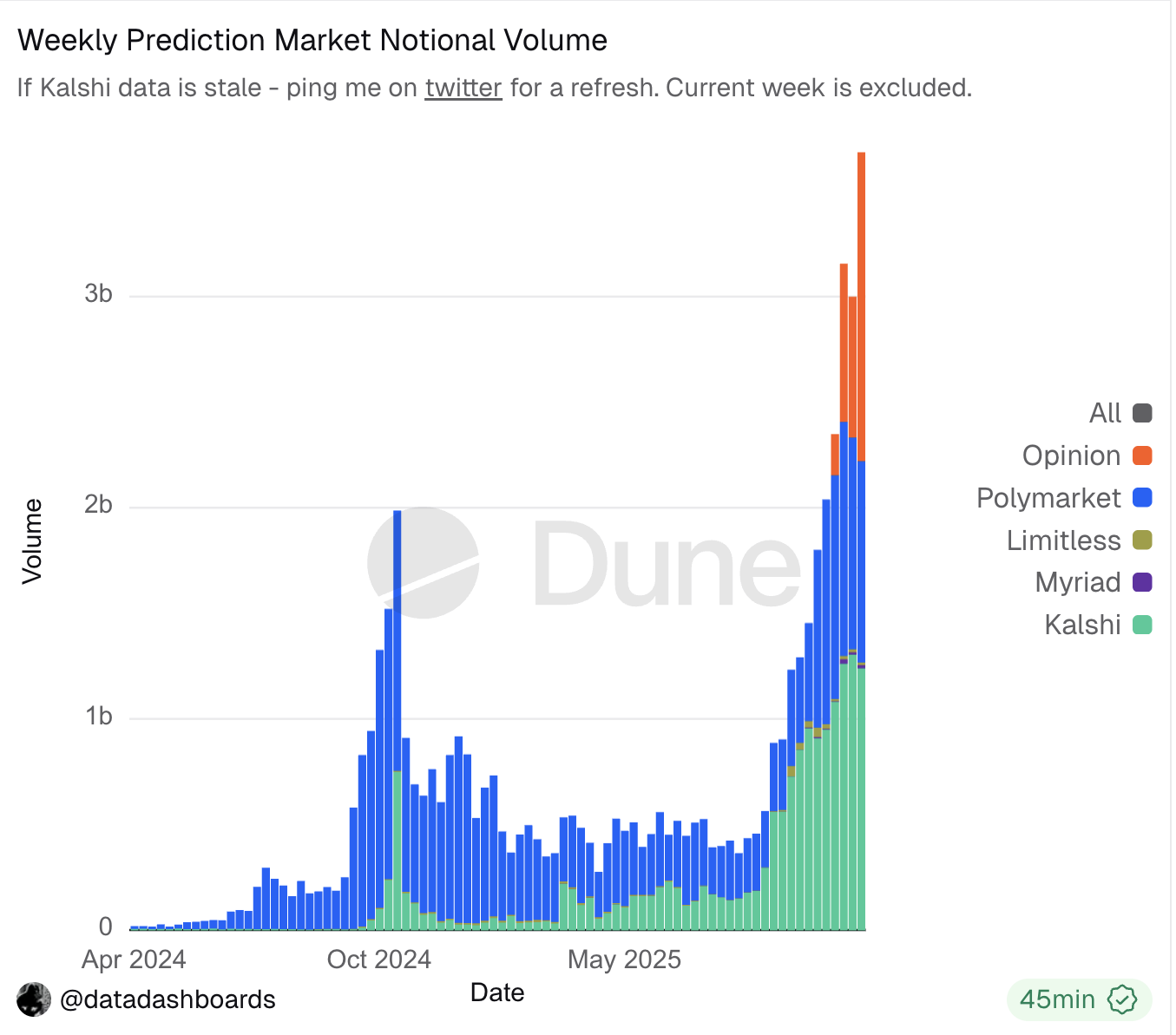

Kalshi has emerged as the leading prediction platform, overtaking Polymarket in September. However, the dominance has been recently challenged by Opinion.

Dune Analytics data showed that the platform recorded a weekly notional volume of $1.46 billion. This was slightly higher than Kalshi’s $1.2 billion, while Polymarket trailed behind with less than $1 billion.

Market Volume of Prediction Platforms. Source:

Dune

Market Volume of Prediction Platforms. Source:

Dune

Still, Kalshi has continued to expand its presence. The platform now serves users in over 140 countries. According to the official data tracker, Kalshi’s cumulative transactions stand at over 68.4 million, with a cumulative trading volume exceeding $17 billion.

Additionally, prediction markets continue to gain mainstream visibility, further bolstered by Google’s latest move. Google Finance has integrated real-time data from both Kalshi and Polymarket, marking a notable step in bringing event-based trading to a wider audience.

Despite this growth, Kalshi faces escalating legal challenges. The platform operates as a federally regulated Designated Contract Market under the Commodity Futures Trading Commission.

“Kalshi is regulated by the Commodity Futures Trading Commission (CFTC) – an independent agency of the US government that has regulated US derivatives markets since 1974 and is overseen by Congress,” the firm noted.

Nonetheless, issues are emerging at the state level. In Massachusetts, the attorney general filed a lawsuit in September aiming to stop the company from offering its sports-related prediction products within the state.

In Nevada, US District Court Judge Andrew Gordon has indicated that he may reconsider his April ruling of granting Kalshi a preliminary injunction against the state’s enforcement of gambling laws. Maryland regulators have denied the platform’s request for a preliminary injunction.

Lastly, in New York, the company has taken the offensive, filing a lawsuit to prevent the state’s gaming commission from classifying its sports prediction markets as illegal gambling.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Elon Musk's SpaceX moves 1,163 Bitcoin worth $105M

Bitcoin News Today: Bitcoin’s Puell Multiple Approaches 0.50 Mark, Fueling Optimism Amid Ongoing Doubts About Market Structure

- Bitcoin's Puell Multiple nears 0.50, historically signaling price cycle bottoms since 2015, sparking market speculation. - Bitcoin Munari's $0.22 token launch on Solana highlights hybrid blockchain strategies, aligning with evolving regulatory frameworks. - Institutional demand for Bitcoin yield strategies grows as Anchorage Digital reports rising interest in collateralized products. - Fed policy shifts and exchange promotions like Bitget's Black Friday campaign reflect crypto's macroeconomic and competi

Premeditated Concealment? Bubblemaps Alleges Edel Engaged in Token Sniping

- Blockchain firm Bubblemaps accuses Edel Finance of sniping 30% of EDEL tokens via 160 linked wallets during its Nov 12 launch, using bot-driven tactics and layered wallet structures to obscure the acquisition. - Edel co-founder James Sherborne denies the claims, stating 60% of tokens were lawfully locked in vesting contracts as disclosed, while criticizing Bubblemaps' analysis as a "Hayden Davis defense" referencing memecoin controversies. - EDEL's market cap has plummeted 62% to $14.9 million amid erodi

Naver’s $13.8B Fintech Powerhouse Debuts on Nasdaq Amid Regulatory Challenges

- Naver Financial's $10.3B acquisition of Dunamu (Upbit) creates a $13.8B fintech entity to unify crypto and digital finance services. - CEO Choi Soo-yeon clarifies no Nasdaq listing decisions have been finalized due to regulatory uncertainties and market volatility. - The merger aims to strengthen South Korea's fintech landscape but faces scrutiny from domestic and U.S. regulators over crypto compliance. - Naver prioritizes domestic stability and stablecoin projects over aggressive international expansion