3 Bitcoin Mining Stocks To Watch In The Third Week Of November 2025

BMNR, BTDR, and HIVE face heavy declines but oversold conditions and strong fundamentals hint at possible rebounds in the third week of November.

When we look at Bitcoin’s price, the concern extends to the altcoins as well; however, it should also extend to the companies associated with BTC-related activities.

In line with the same, BeInCrypto has analysed three Bitcoin mining companies’ stock performance and what lies ahead for them.

BitMine Immersion Technologies (BMNR)

BMNR has dropped 24% this week and trades at $30.95. Despite the decline, Bitmine has continued accumulating ETH, adding 54,156 ETH worth more than $170 million over the past seven days. This signals a strong long-term conviction from the company.

The RSI is nearing the oversold zone, which often precedes a reversal. If conditions stabilize, BMNR could rebound from the $30.88 support and climb toward $34.94 or even $37.27, offering relief after a week of heavy losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR Price Analysis. Source:

TradingView

BMNR Price Analysis. Source:

TradingView

If Bitcoin weakens further, BMNR may follow the broader downturn. A deeper decline could send the stock below $27.80, with potential downside extending to $24.64. This would invalidate the bullish outlook and signal intensified bearish momentum.

Bitdeer Technologies Group (BTDR)

Bitdeer has recorded some of the steepest losses among Bitcoin mining stocks, falling 53% over seven sessions. The share price now sits at $10.63, reflecting intense selling pressure as broader market weakness continues to weigh on mining companies.

BTDR’s RSI is deep in the oversold zone, signaling conditions that often precede a reversal. If buyers step in, the stock could rebound from $9.56 and move toward $11.92, with potential upside extending to $15.24 if momentum strengthens.

BTDR Price Analysis. Source:

TradingView

BTDR Price Analysis. Source:

TradingView

If market conditions fail to improve, BTDR could continue its decline. A breakdown below $9.56 may drive the price toward $7.96. This would invalidate the bullish outlook and signal an extended downside for the mining firm.

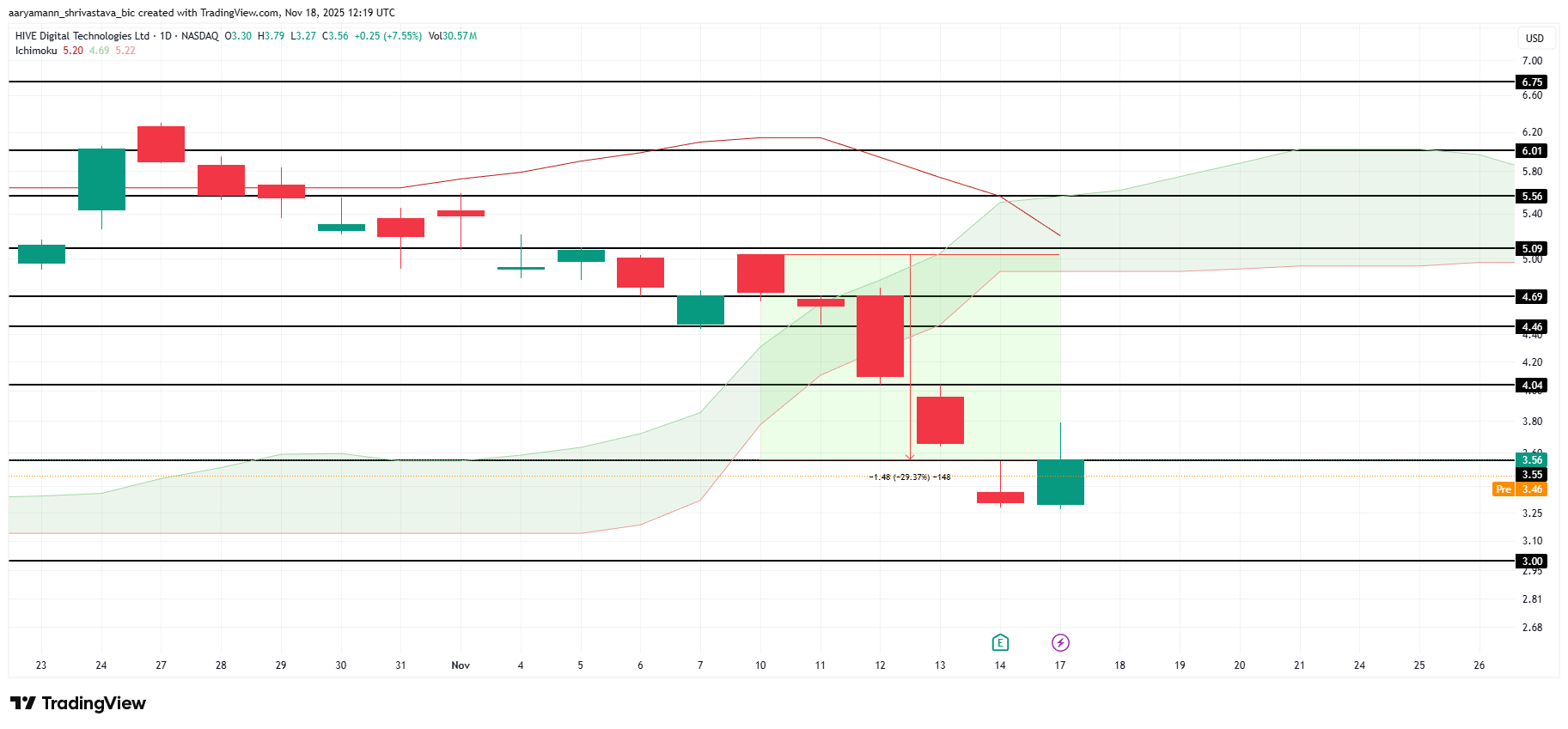

HIVE Digital Technologies Ltd. (HIVE)

Bitcoin mining company HIVE has dropped 29% over the past week but now trades at $3.56 after gaining 7.5% today. The surge follows the company’s announcement of 285% revenue growth in Q2, which has boosted investor confidence despite recent volatility.

This strong performance could fuel a broader recovery and lift HIVE toward $4.04. Restoring recent losses would require a move to $5.09. Reaching this target may take time, but it remains possible if momentum and sentiment continue improving.

HIVE Price Analysis. Source:

TradingView

HIVE Price Analysis. Source:

TradingView

If the stock fails to capitalize on the company’s earnings strength, HIVE may resume its decline. A drop toward the $3.00 support level or lower would invalidate the bullish thesis and signal renewed weakness.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea's Cryptocurrency Reform: Will New Regulations Enhance Confidence While Preserving Innovation?

- South Korea's National Assembly plans to enforce strict VASP regulations requiring criminal record checks for all major shareholders, including foreign investors. - The law mandates re-evaluation of existing VASPs, creating compliance challenges for smaller firms with complex ownership structures. - By extending oversight to global criminal records, the reform sets a potential international precedent and could reshape cross-border crypto investments. - While critics warn of stifled innovation, proponents

Bitcoin News Update: Tether’s Risky Asset Holdings Challenge Stablecoin Reliability

- S&P Global downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% Bitcoin exposure exceeds S&P's 3.9% overcollateralization threshold, risking undercollateralization if prices fall. - Tether defends practices with quarterly audits and $10B 2025 profit, dismissing the downgrade as outdated. - Recent crypto market turmoil and past stablecoin collapses highlight risks in opaque reserve management. - Tether's resilience amid crises contrasts with S&P's warning

Elon Musk's SpaceX moves 1,163 Bitcoin worth $105M

Trending news

MoreBitget Daily Digest (Nov 27) | Initial jobless claims for the week ending November 22 came in at 216,000; Nasdaq ISE proposes raising the IBIT option position limit to 1 million contracts; S&P Global downgrades USDT stability rating to the lowest tier, warning of Bitcoin exposure risks

South Korea's Cryptocurrency Reform: Will New Regulations Enhance Confidence While Preserving Innovation?