Date: Mon, Nov 17, 2025 | 05:20 AM GMT

The broader altcoin market continues to struggle under downside pressure as Ethereum (ETH) extends its 30-day decline beyond 17%, dragging sentiment across major assets — including XRP.

XRP has seen a modest dip recently, but beneath the surface, something more interesting is taking shape. A clear harmonic pattern is emerging, hinting that a potential rebound could be approaching.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Signals More Upside

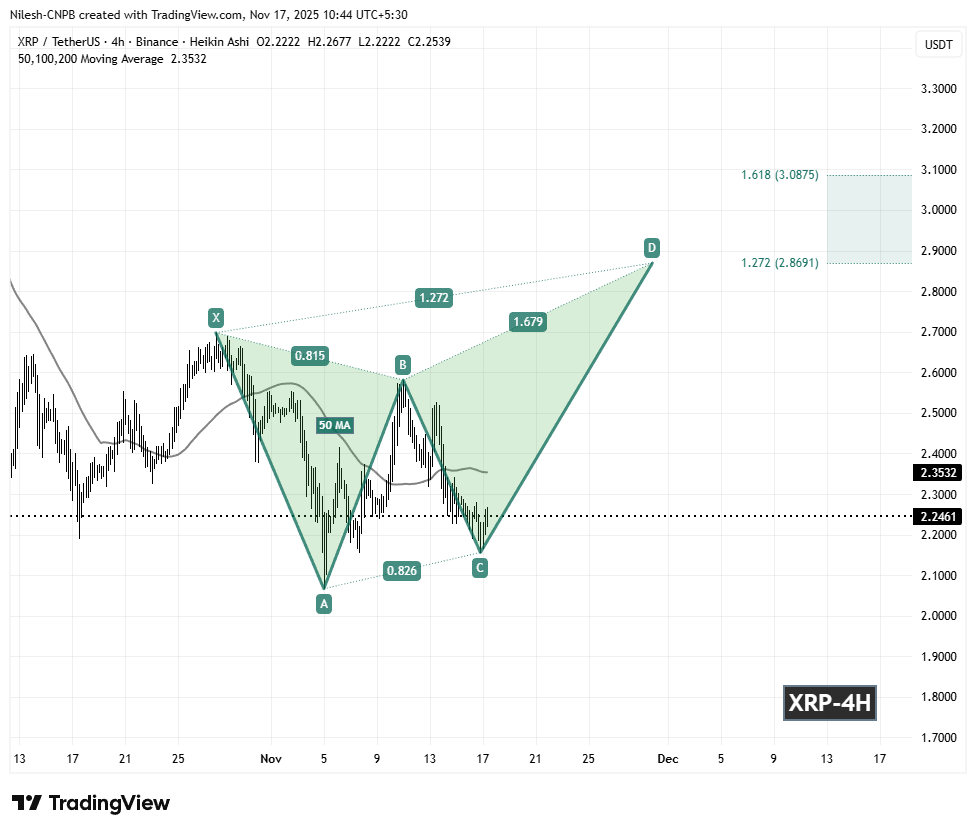

On the 4-hour timeframe, XRP is developing a Bearish Butterfly harmonic pattern — a structure that typically pushes price higher until the final D-point completes. While the full reversal usually happens at the PRZ, the move toward that zone often invites steady upside momentum.

The pattern originated at Point X near $2.6975, followed by a decline into Point A, a rebound into Point B near the 0.815 retracement, and a sharper correction down to Point C at $2.1558.

XRP 4H Chart/Coinsprobe (Source: Tradingview)

XRP 4H Chart/Coinsprobe (Source: Tradingview)

From that level, XRP has begun to stabilize. The token is currently trading around $2.2461, showing early signs of recovery — though stronger confirmation is still needed.

What’s Next for XRP?

The immediate focus rests on the C-support zone around $2.1558. Holding this level is essential to keep the harmonic pattern valid.

If bulls defend this region and momentum builds, the next resistance to watch is the 50 moving average, currently positioned near $2.3532. A decisive reclaim of this dynamic resistance would strengthen the bullish outlook and could kickstart the CD-leg toward higher targets.

Should XRP gather upward traction, the path leads toward the Potential Reversal Zone (PRZ) between $2.8691 (1.272 Fibonacci extension) & $3.0875 (1.618 Fibonacci extension). This zone marks the expected completion of the Butterfly pattern, typically acting as a major resistance cluster or reversal point.

However, a breakdown below the $2.1558 support would weaken the harmonic structure and delay the bullish setup, leaving XRP vulnerable to deeper downside tests before any meaningful rebound attempt can occur.