Bitcoin Price Tanks Below $97K as Analyst Warns the Worst Is Yet to Come

Despite the positive developments on a macro front, such as the US government reopening, BTC’s quite unfavorable price actions continued in the past 12 hours or so as the asset plunged to a new multi-month low.

The cryptocurrency stood above $107,000 just three days ago after Trump promised to send tariff checks of at least $2,000 to some Americans and hinted that the government shutdown might end soon. However, bitcoin failed to capitalize on this momentum and quickly dipped back to $103,000.

Nevertheless, it rebounded to $105,000 on Wednesday before the bears took complete control of the market, especially on Thursday. The POTUS signed legislation to reopen the government, which was first followed by an immediate bounce, but the landscape changed for the worse shortly after.

In less than a day, bitcoin dumped by more than eight grand and currently struggles below $97,000, which is the lowest it has been since early May.

Doctor Profit, who has been bearish on the asset for weeks, believes the worst is yet to come by predicting another nosedive to somewhere around $90,000 and $94,000.

#Bitcoin: First promised target of 90-94k region is about to be hit. Important to note that I wont take any profits from the short at 90-94k region! https://t.co/p6qQqxsaor pic.twitter.com/Rhamwixvct

— Doctor Profit 🇨🇭 (@DrProfitCrypto) November 14, 2025

The altcoins have followed suit with multiple double-digit price declines. AAVE, ENA, RENDER, SUI, PEPE, and LINK are also down by more than 12%. Even the largest of the bunch has plunged by over 11% and now struggles well below $3,200.

You may also like:

- Bitcoin’s Price Jumps as Trump Signs Bill to End Record US Govt Shutdown

- Bitcoin Tumbles Below $100K Again, Liquidations Approach $700 Million

- BTC Steadies Over $100K: Sign of Maturity While ‘Moonvember’ Buzz Builds

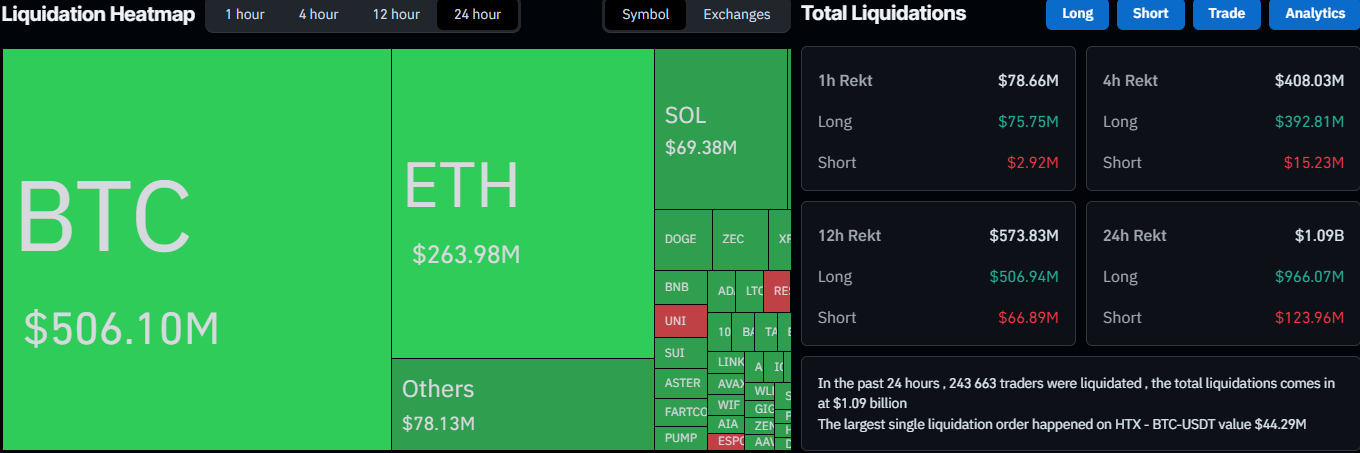

The total value of wrecked positions has skyrocketed to almost $1.1 billion on a daily basis. The single-largest liquidated position, according to CoinGlass, took place on HTX and was worth a whopping $44.29 million. The number of wrecked traders is above 240,000.

Naturally, longs represent the lion’s share, with $966 million. Short liquidations are worth $124 million as of press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

South Korea's Cryptocurrency Reform: Will New Regulations Enhance Confidence While Preserving Innovation?

- South Korea's National Assembly plans to enforce strict VASP regulations requiring criminal record checks for all major shareholders, including foreign investors. - The law mandates re-evaluation of existing VASPs, creating compliance challenges for smaller firms with complex ownership structures. - By extending oversight to global criminal records, the reform sets a potential international precedent and could reshape cross-border crypto investments. - While critics warn of stifled innovation, proponents

Bitcoin News Update: Tether’s Risky Asset Holdings Challenge Stablecoin Reliability

- S&P Global downgrades Tether's USDT to "5 (weak)" due to high-risk reserves and transparency gaps. - Tether's 5.6% Bitcoin exposure exceeds S&P's 3.9% overcollateralization threshold, risking undercollateralization if prices fall. - Tether defends practices with quarterly audits and $10B 2025 profit, dismissing the downgrade as outdated. - Recent crypto market turmoil and past stablecoin collapses highlight risks in opaque reserve management. - Tether's resilience amid crises contrasts with S&P's warning

Elon Musk's SpaceX moves 1,163 Bitcoin worth $105M

Trending news

MoreBitget Daily Digest (Nov 27) | Initial jobless claims for the week ending November 22 came in at 216,000; Nasdaq ISE proposes raising the IBIT option position limit to 1 million contracts; S&P Global downgrades USDT stability rating to the lowest tier, warning of Bitcoin exposure risks

South Korea's Cryptocurrency Reform: Will New Regulations Enhance Confidence While Preserving Innovation?