Low-Cap Privacy Play: Why Capital is Rotating From ZEC and DASH Into COTI

COTI’s innovative programmable privacy model has sparked a massive rally, positioning it as a standout among low-cap privacy coins. With growing on-chain activity and investor optimism, its November surge highlights shifting market dynamics in crypto privacy.

Interest in privacy coins is shifting toward low-cap privacy altcoins. Last month, capital inflows moved from large-cap names like Zcash (ZEC) to mid-cap altcoins such as Dash (DASH). This month, attention has turned to low-cap projects like Coti (COTI).

What advantages make investors confident in Coti right now? And how long can the rally last? The following analysis provides a closer look.

COTI’s Record-Breaking Month

Coti (COTI) is a privacy-focused blockchain platform that utilizes Garbled Circuits technology to deliver programmable privacy, allowing users to control their data with flexibility.

Launched in 2019, COTI initially focused on fast and low-cost payments. Recently, however, it has pivoted strongly toward privacy solutions, now integrated across more than 70 blockchain networks, including Ethereum.

“Privacy isn’t a feature for the next cycle. It’s the infrastructure that unlocks the next trillion in on-chain value. RWAs, DeFi, AI agents all require Programmable Privacy. The capital is waking up to this reality.”— Shahaf Bar-Geffen, CEO of Coti, stated.

This approach has convinced many investors that COTI holds an advantage over other privacy coins such as Zcash. ZEC’s recent rally has also inspired current COTI holders.

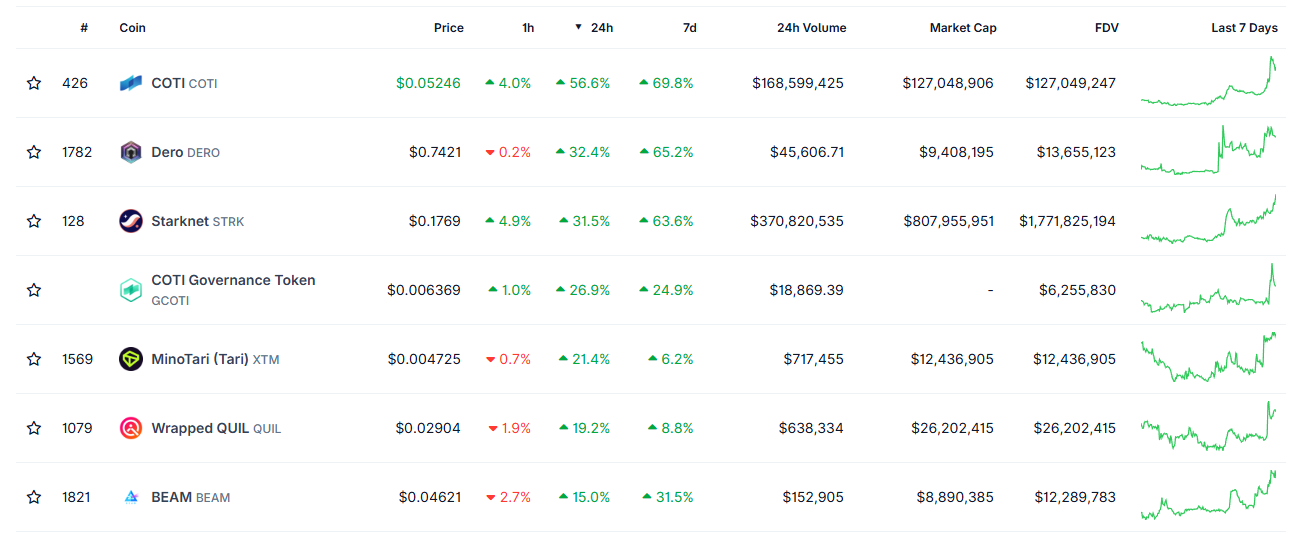

At press time, COTI surged more than 54% in the past 24 hours, becoming the best-performing altcoin in CoinGecko’s Privacy Blockchain Coins category.

Privacy Blockchain Coins. Source:

CoinGecko

Privacy Blockchain Coins. Source:

CoinGecko

COTI’s market capitalization rose from $65 million to $127 million in November. Despite this growth, it still lags far behind billion-dollar players like DASH and ZEC.

In a bullish market environment, the rise of low-cap altcoins often fuels optimism. Historical data shows COTI once reached a $1.6 billion market cap in 2017. The November rally has revived investor hopes for a return to previous highs.

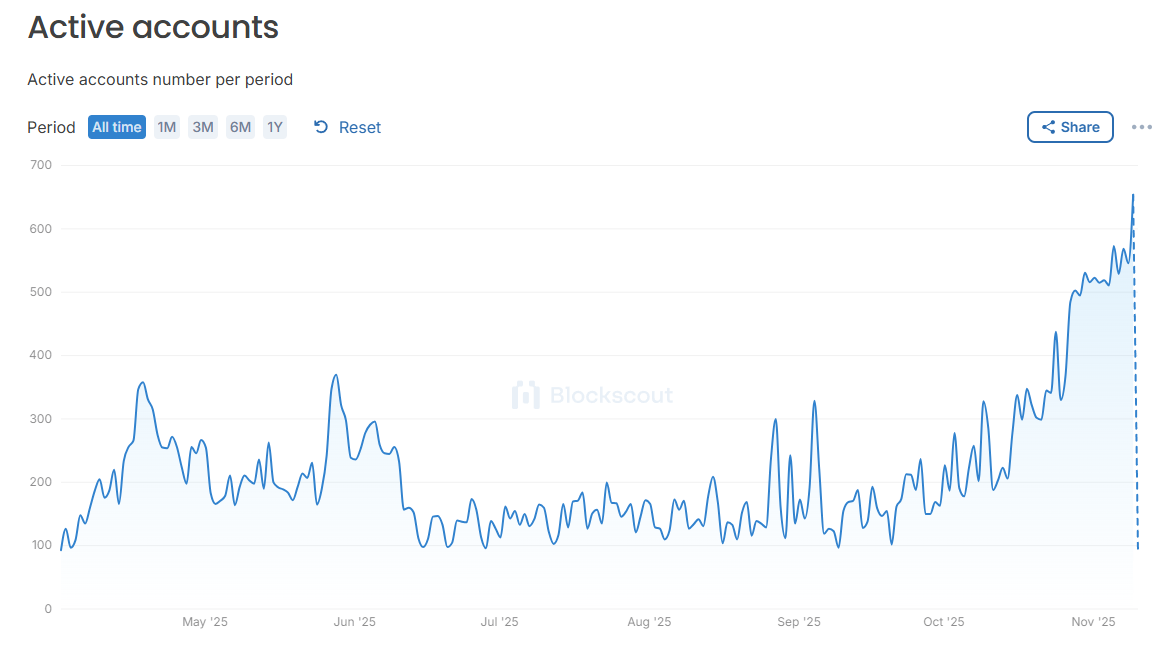

Daily Active Addresses Reach Six-Month High

On-chain data supports this optimism. According to Cotiscan, the number of daily active addresses on the COTI network hit its highest level in six months, signaling growing real-world usage.

Daily Active Addresses on The COTI Network. Source:

Cotiscan

Daily Active Addresses on The COTI Network. Source:

Cotiscan

In April, the network had around 100 active addresses per day. That number has now climbed to over 650 and continues to accelerate into October.

While this growth indicates rising user interest, it remains modest compared to COTI’s long-term potential.

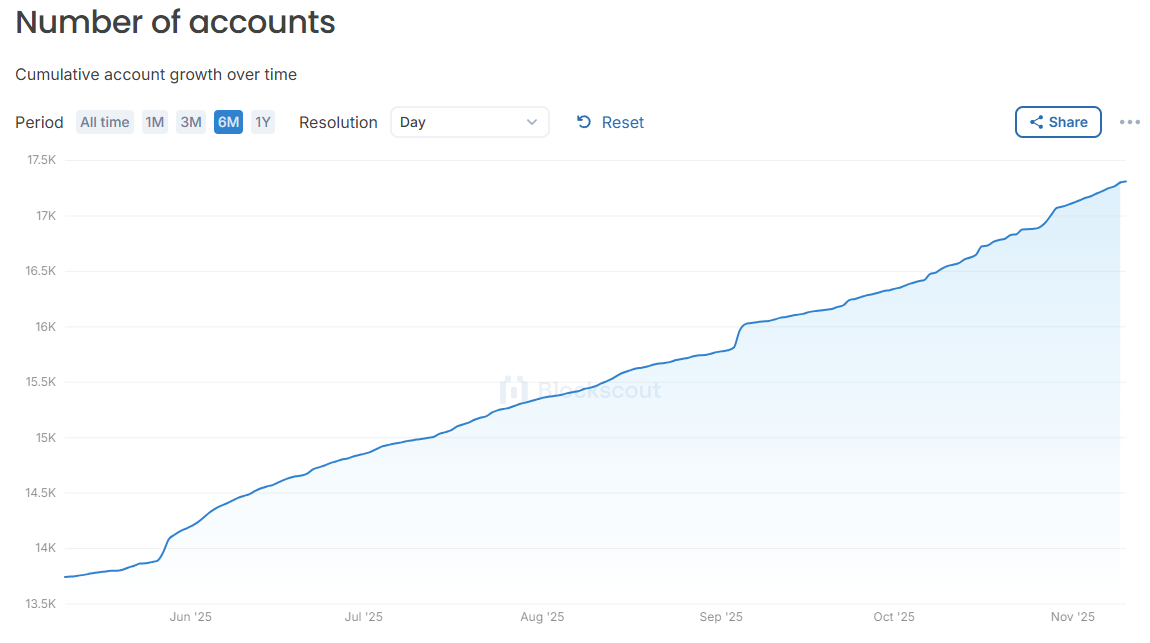

Account Numbers and Transaction Volume Climb

Cotiscan data also shows a steady increase in total accounts, now exceeding 17,000 — marking consistent growth over the past six months.

Number of Coti Accounts. Source:

Cotiscan

Number of Coti Accounts. Source:

Cotiscan

COTI currently processes more than 22,000 transactions daily, with nearly 59 million total transactions completed on the network.

Opportunities and Risks for COTI Investors

Analysts believe COTI’s rally may not be over yet. Technically, the chart shows a bullish falling wedge pattern. After a short-term correction, the price could continue rising toward $0.08.

$Coti #Coti Retested Crucial Zone Successfully, Expecting Move Towards 0.044$ Area, Descending Trendline) Once Tl Got Cleared, It Can Give Move Towards 0.09$ pic.twitter.com/e0dKhkPQIc

— World Of Charts (@WorldOfCharts1) November 9, 2025

However, the shift of capital into low-cap privacy coins could also serve as a cautionary signal. It suggests investors may view large and mid-cap privacy coins as fully valued, turning to smaller caps as a last opportunity.

This behavior often reflects a classic phase in the crypto capital rotation cycle, where attention shifts from large-cap leaders to smaller, speculative assets before broader market consolidation.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Elon Musk's SpaceX moves 1,163 Bitcoin worth $105M

Bitcoin News Today: Bitcoin’s Puell Multiple Approaches 0.50 Mark, Fueling Optimism Amid Ongoing Doubts About Market Structure

- Bitcoin's Puell Multiple nears 0.50, historically signaling price cycle bottoms since 2015, sparking market speculation. - Bitcoin Munari's $0.22 token launch on Solana highlights hybrid blockchain strategies, aligning with evolving regulatory frameworks. - Institutional demand for Bitcoin yield strategies grows as Anchorage Digital reports rising interest in collateralized products. - Fed policy shifts and exchange promotions like Bitget's Black Friday campaign reflect crypto's macroeconomic and competi

Premeditated Concealment? Bubblemaps Alleges Edel Engaged in Token Sniping

- Blockchain firm Bubblemaps accuses Edel Finance of sniping 30% of EDEL tokens via 160 linked wallets during its Nov 12 launch, using bot-driven tactics and layered wallet structures to obscure the acquisition. - Edel co-founder James Sherborne denies the claims, stating 60% of tokens were lawfully locked in vesting contracts as disclosed, while criticizing Bubblemaps' analysis as a "Hayden Davis defense" referencing memecoin controversies. - EDEL's market cap has plummeted 62% to $14.9 million amid erodi

Naver’s $13.8B Fintech Powerhouse Debuts on Nasdaq Amid Regulatory Challenges

- Naver Financial's $10.3B acquisition of Dunamu (Upbit) creates a $13.8B fintech entity to unify crypto and digital finance services. - CEO Choi Soo-yeon clarifies no Nasdaq listing decisions have been finalized due to regulatory uncertainties and market volatility. - The merger aims to strengthen South Korea's fintech landscape but faces scrutiny from domestic and U.S. regulators over crypto compliance. - Naver prioritizes domestic stability and stablecoin projects over aggressive international expansion