Key Market Information Discrepancy on September 29th, a Must-See! | Alpha Morning Report

1.Top新闻:Hypurr NFT地板价升至1310 HYPE,约合6.15万美元 2.代币解锁:$OP

Featured News

1.US Stock Crypto Concept Stocks Soar in After-Hours Trading, Bitmine Surges Over 5%

2.NYDIG: Cryptocurrency Treasury Asset (DAT) Company Evaluation Metric mNAV Is Misleading

3.Hypurr NFT Floor Price Rises to 1310 HYPE, Equivalent to $61,500

4.ApeX Announces Launch of APEX Token Buyback Plan, Covering $12 Million Initial Funding and 50% of Future Protocol Revenue

5.Kalshi Lowers Probability of "US Government Shutdown This Year" Prediction to 63%

Articles & Threads

1. "In-Depth Analysis: PerpDEX Shuffling Moment, What's Next for Hyperliquid?"

The decentralized perpetual trading market is undergoing an unprecedented surge in growth and reshaping of the competitive landscape. As of September 2025, the global perp DEX daily trading volume has exceeded $520 billion, a 530% increase from the beginning of the year, with a cumulative monthly trading volume reaching $130 trillion. Behind this growth are breakthroughs in technological innovation, the growing demand for decentralized financial products from users, and regulatory pressure on centralized exchange platforms. The entire sector now holds approximately 26% market share of the crypto derivatives market, a significant leap from single digits in 2024.

Rapid market differentiation is reshaping the competitive landscape. Traditional order book models (such as dYdX, Hyperliquid) dominate the professional trading sector with precise price discovery and deep liquidity, while AMM models (such as GMX, Gains Network) attract retail users with instant liquidity and simplified operations. Emerging hybrid models (such as Jupiter Perps) attempt to combine the strengths of both by seamlessly switching between order book and AMM in a high-speed environment through a keeper system. In terms of data performance, the order book model is gaining more market share, with Hyperliquid handling $2.76 trillion in cumulative trading volume with its CLOB architecture.

2.《Unexpectedly, PunkStrategy Starts to Surge》

On the Ethereum mainnet, a coin named $PNKSTR has surged by about 160% in the past 2 days, with a market cap surpassing $50 million at one point, becoming a dazzling sight in the extremely dry on-chain market. Currently, the token has retraced slightly, with a market cap of around $43 million. The full name of $PNKSTR is "PunkStrategy," which completes the NFT and token loop flywheel through trading CryptoPunks NFT.

Each $PNKSTR transaction incurs a 10% fee, with 8% being deposited into the protocol. Once the protocol's fund pool accumulates enough to cover the cost of purchasing CryptoPunks, the contract will automatically buy a floor-priced CryptoPunks and automatically list it for sale at 1.2 times the purchase price. After a successful sale, the obtained ETH will be used to purchase and burn $PNKSTR tokens.

Market Data

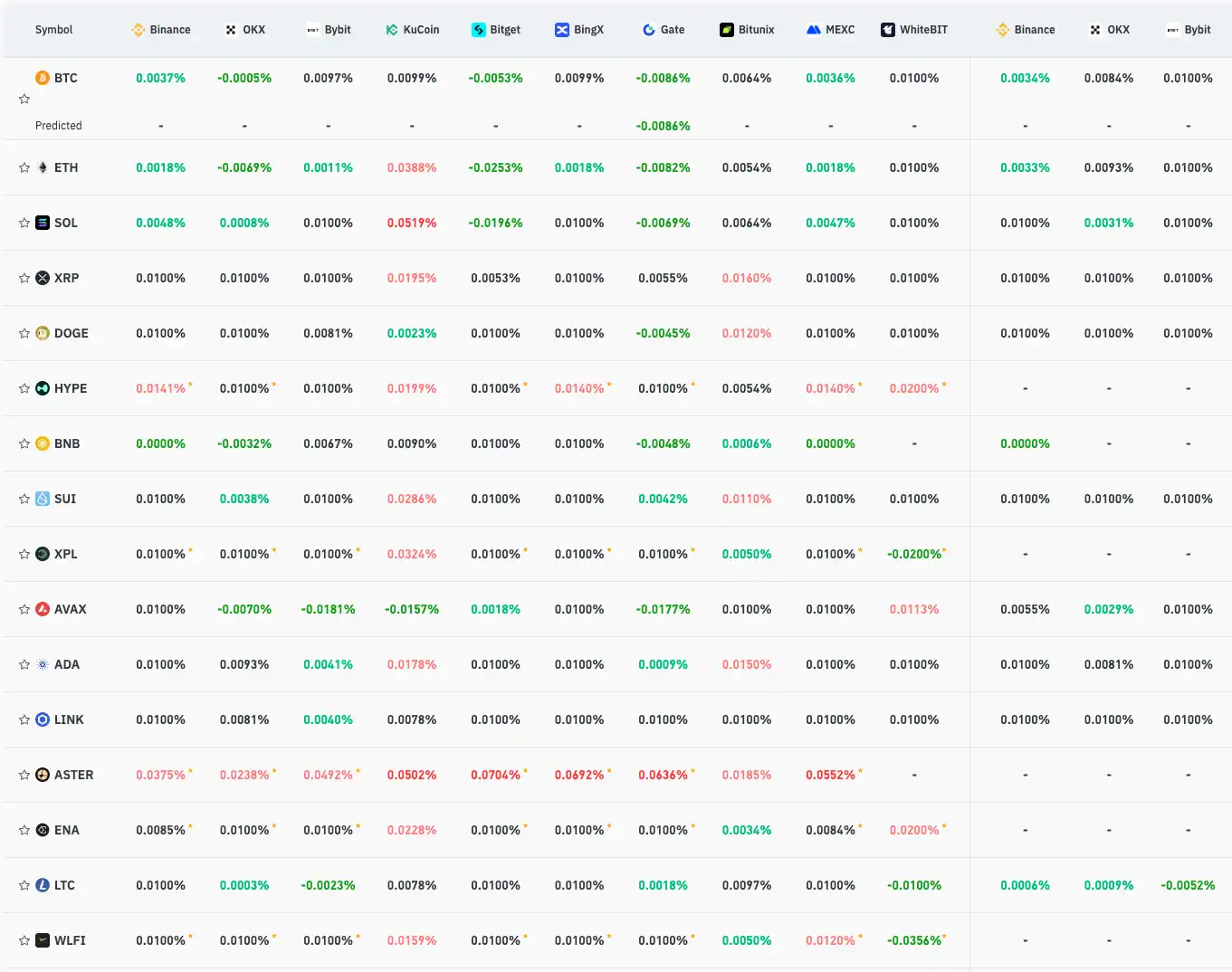

Daily Market Overall Capital Heat (Reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Token Unlocks

Funding Rate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP News Today: Institutional ETFs and Derivatives Indicate a Positive Shift for XRP Above Crucial Support Levels

- XRP rebounds above $2.20 as buyers defend key support, supported by $107.92M in ETF inflows and rising institutional confidence. - Technical analysis highlights a bullish "Staircase to Valhalla" pattern, with $2.26-$2.52 resistance levels and Fibonacci targets signaling potential for $2.69. - Derivatives data shows aggressive long-positioning (OI: $4.11B), with Binance's 2.56 long-short ratio and 57% options OI surge reinforcing bullish momentum. - Institutional ETF conversions (e.g., Grayscale Zcash) an

Why Switzerland's Temporary Halt on Crypto Highlights Worldwide Regulatory Disunity

- Switzerland delays crypto tax data-sharing until 2027, highlighting global regulatory fragmentation amid CARF adoption challenges. - Two-phase approach prioritizes domestic law alignment before reciprocal agreements with key economies like U.S., China, and Saudi Arabia. - 75 CARF signatories progress unevenly, with U.S. and Brazil proposing alternative frameworks, complicating cross-border compliance. - Swiss crypto firms face operational risks during transition, as critics warn of regulatory arbitrage b

Thailand’s Bold No-Crypto-Tax Move: Shaping a Future Southeast Asian Crypto Center

- Thailand imposes 0% capital gains tax on local crypto trading (2025-2029) to boost its digital economy and attract investors. - The policy aligns crypto profits with tax-exempt stock trading, supported by a 2024 Bitcoin ETF and Tourist DigiPay pilot for foreign visitors. - Regulatory caution is evident through biometric data shutdowns and PDPA compliance, balancing innovation with security amid regional competition. - Projected $1B annual economic gains aim to position Thailand as a top Southeast Asian c

The Transformation of Webster, NY: Targeted Property and Infrastructure Initiatives After the Xerox Era

- Webster , NY, secured a $9.8M FAST NY grant to transform the former Xerox campus into a shovel-ready industrial hub, part of Governor Hochul’s upstate revitalization strategy. - Infrastructure upgrades, including road and sewer improvements, aim to attract advanced manufacturing and logistics firms by reducing development risks and costs. - The Xerox campus redevelopment includes mixed-use projects, projected to create 250 jobs and boost property values through residential and commercial integration. - W