Date: Thu, Sept 04, 2025 | 05:30 AM GMT

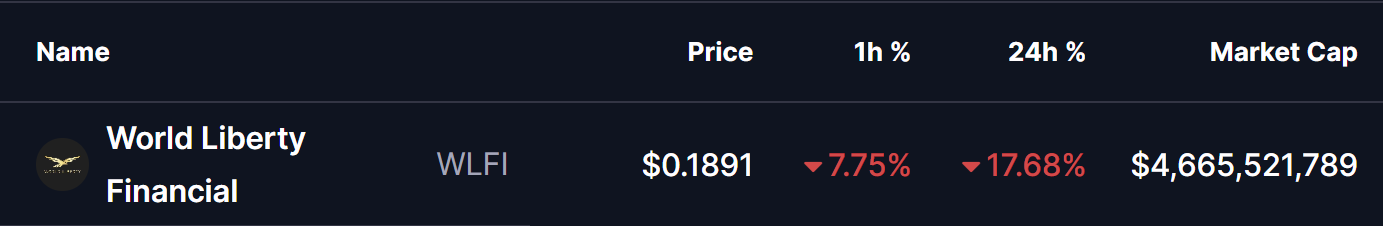

The cryptocurrency market is once again facing turbulence as Ethereum (ETH) retraced to $4,375 from its 24-hour high of $4,489. This weakness has spilled over to altcoins, with the newly launched World Liberty Financial (WLFI) taking one of the heaviest hits.

Over the last hour alone, WLFI dropped 7%, extending its daily decline to over 17%. This sharp sell-off has triggered notable liquidations, and technical signals are hinting that the token may face additional downside before a meaningful recovery attempt.

Source: Coinmarketcap

Source: Coinmarketcap

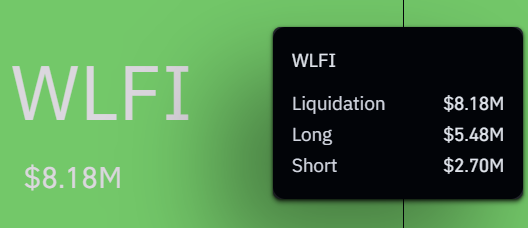

WLFI Liquidation Soars

The current drop has sparked massive volatility in WLFI trading. According to Coinglass data, the past hour saw liquidations of more than $8.18 million, with long traders suffering $5.48 million in losses, while shorts lost about $2.70 million. These numbers underscore how unpredictable and risky WLFI’s trading environment remains at this stage.

Source: Coinglass

Source: Coinglass

Is More Downside Ahead?

Looking at the 4H chart, WLFI has broken down from an ascending broadening wedge pattern, a structure often viewed as bearish. The breakdown from the wedge’s lower boundary near $0.2816 accelerated the decline, dragging WLFI below the critical $0.20 support zone.

WLFI 4H Chart/Coinsprobe (Source: Tradingview)

WLFI 4H Chart/Coinsprobe (Source: Tradingview)

At the time of writing, WLFI is trading around $0.1893.