Written by: Jill Gunter, Co-founder of Espresso

Translated by: Luffy, Foresight News

Ten years ago, I began my career in the crypto industry because, in my view, it was the most suitable and effective tool to address the various problems I witnessed during my brief stint on Wall Street.

I found that the current state of the financial system gave rise to three major social ills, and I firmly believed that crypto technology could tackle these challenges.

1) Poor monetary management

Hugo Chávez single-handedly caused Venezuela’s inflation rate to soar above 20,000%

My career began as a bond trader, responsible for Latin American sovereign debt, so I personally experienced the hyperinflation and capital controls in countries like Venezuela and Argentina. The autocratic decisions of national leaders deprived entire generations of their livelihoods and savings, caused domestic bond spreads to widen dramatically, and shut their countries out of capital markets. The injustice this inflicts on individuals, both past and present, is a tragedy.

Of course, Hugo Chávez and Cristina Kirchner (former presidents of Venezuela and Argentina, respectively) are not the only “villains” in this tragedy.

2) Wall Street’s financial barriers

Remember the 2011 protest that occupied Zuccotti Park in Manhattan, New York?

I joined Wall Street a few years after the 2008 financial crisis. Before joining, I had read Michael Lewis’s “Liar’s Poker,” and thought the depiction of the wild speculative culture of 1980s Wall Street was an outdated stereotype. I also knew that the Dodd-Frank Act had been enacted a year before I joined, and this congressional crackdown was supposed to have thoroughly cleaned up the speculative atmosphere on downtown Manhattan trading desks.

From an institutional perspective, rampant speculative behavior had indeed been curbed, and trading desks focused on directional bets were mostly eliminated. But if you knew where to look, you’d see that the speculative spirit never really disappeared. Many of the leaders who emerged after the industry’s 2008 purge were young traders who took over their bosses’ risk positions at the market bottom and then made a fortune thanks to Ben Bernanke’s quantitative easing. What kind of incentives does this experience instill in these newly minted trading “bosses”? Even after witnessing the devastation of a crisis, this new generation was still taught one thing: you can build a career by making big bets with the company’s balance sheet.

In my first year on Wall Street, I walked past the “Occupy Wall Street” protesters every day on my way to and from work. The longer I stayed on Wall Street, the more I agreed with their movement—they wanted to break Wall Street’s privileges and end the situation where reckless gambling by the elite left ordinary people to pick up the tab.

I agreed with the movement, but not with their methods. Passing through the protesters was actually uneventful; their actions weren’t proactive. They held signs and claimed to be the “99%,” but to me, they didn’t have a clear demand for what they wanted from the “1%.”

To me, the answer was obvious: the problem isn’t just Wall Street’s gambling addiction, but that Wall Street has access to “casinos,” investment opportunities, and industry information that ordinary people can never reach; and when Wall Street loses, it’s the public who pays the price.

This can’t be solved by simply adding a few more rules for Wall Street—the core is to create a level playing field for ordinary people.

3) Obscure and outdated financial systems

As early as 2012, I realized that to push the financial system toward greater openness, fairness, transparency, and inclusivity, its underlying infrastructure had to be upgraded.

As a junior trader on the trading floor, I spent hours after each market close on the phone with back-office departments, reconciling accounts, tracking down bonds that should have settled weeks ago, and confirming that all derivative positions had no “wrong-way risk.”

How could these processes not be fully digitized by now!

Of course, on the surface, many steps had been digitized—we used computers and electronic databases. But all these databases required manual intervention to update. Keeping information consistent across parties was a massive, costly, and often opaque undertaking.

I still remember this: even four years after Lehman Brothers’ bankruptcy, Barclays, which acquired its assets, still couldn’t clarify Lehman’s exact assets and liabilities. It sounds absurd, but considering the conflicting or incomplete database records, it all makes sense.

Bitcoin: A Peer-to-Peer Electronic Cash System

Bitcoin is just so cool.

Like gold, it is an asset immune to manipulation and independent of monetary policy; its issuance and circulation model gave ordinary people around the world a full decade to use it as an investment tool before institutions could truly participate at scale; it also introduced a new type of database called blockchain, which requires no clearing, settlement, or reconciliation processes—anyone can run and update it directly.

Bitcoin was (and still is) the antidote to my disillusionment with Wall Street. Some use it to hedge against inflation and capital controls; it allowed the “99%” to get in on investments before Wall Street; and its underlying technology could completely replace the obscure and inefficient systems banks rely on, building a new digital and transparent system.

I had to drop everything and devote myself to this cause. But at the time, skepticism was everywhere, and the most common refrain was, “Isn’t this just something drug dealers use?” In 2014, aside from darknet markets like “Silk Road,” bitcoin had almost no other use cases, and it was hard to refute such doubts—you really had to “use your imagination” to see its potential.

During those tough years, I sometimes thought this technology might never truly take off... But suddenly, the whole world started paying attention and projecting their own fantasies onto it.

The Peak of Fantasy

For years, I had hoped people would see the potential of blockchain technology, but in 2017, I suddenly became a skeptic within the industry, and it was a complicated feeling.

Partly because I was in Silicon Valley’s industry environment, and partly because of the times—everyone wanted to do a blockchain project. People pitched me startup ideas like “blockchain + journalism,” and there were headlines like “Blockchain enters the dental industry.” Every time, I couldn’t help but think, “No, that’s not what it’s for at all!”

However, most of these people weren’t trying to scam anyone—they weren’t launching vaporware, issuing tokens to dump on retail, or launching meme coins. They genuinely believed in the technology’s diverse potential, but this enthusiasm was both misleading and irrational.

From 2017 to 2018, the industry’s fantasies reached their peak.

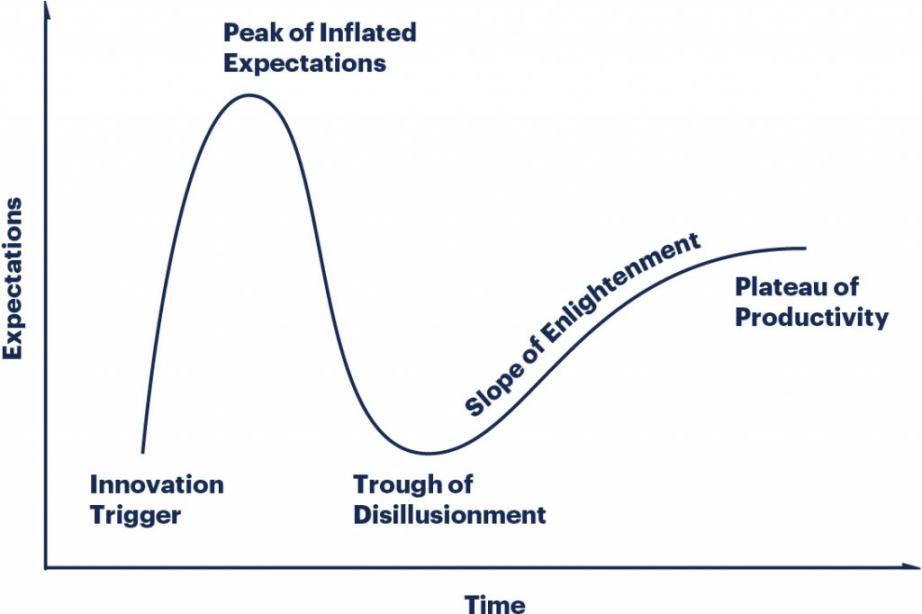

Gartner Hype Cycle

The crypto and blockchain industry didn’t climb the “Slope of Enlightenment” as promised by Gartner’s classic “hype cycle” chart, but instead swung between mania and disillusionment every three to four years.

To understand why, you have to recognize one fact: blockchain is a technology, but it is deeply tied to crypto assets as an asset class, and crypto assets have extremely high beta and risk, making them highly susceptible to macro market fluctuations. Over the past decade, macro markets have been extremely volatile: in a zero-interest-rate era, risk appetite rises and crypto assets boom; when trade wars hit and risk appetite falls, crypto assets are declared “dead.”

To make matters worse, the regulatory environment for this emerging field is also highly volatile, and with catastrophic events like Terra/Luna and FTX destroying vast amounts of capital, it’s no wonder the industry is so volatile.

Remember, We All Want to Change the World

Sticking it out in the industry (whether building projects, investing, commenting, or other work) is extremely difficult.

Everyone knows entrepreneurship is hard, but starting a business in crypto is even harder. Industry sentiment and funding environments are unpredictable, product-market fit is unclear, legitimate entrepreneurs may be subpoenaed or even jailed, and you have to watch as some president launches a token scam, destroying what little mainstream credibility the industry has left... It’s insane.

So I completely understand why, after eight years in the industry, some people feel like they’ve wasted their lives.

The author of this tweet admits that he thought he was joining a revolution, only to find he was helping build a giant casino, and regrets contributing to the “casino-ization” of the economy.

But remember, no anti-establishment movement is perfect—every revolution has a price, and any transformation comes with growing pains.

Elizabeth Warren and the “Occupy Wall Street” movement once tried to shut down Wall Street’s casino, but meme stock frenzies, altcoin bull markets, prediction markets, and decentralized perpetual contract exchanges have brought Wall Street’s casino to the masses.

Is this a good thing? Honestly, I’m not sure. For most of my time in crypto, I’ve felt like we’re just rebuilding consumer protection systems. But many of the so-called consumer protection rules in place are either outdated or misleading, so I think breaking new ground might be a good thing. If my original goal was to create a level playing field, then I have to say, we have indeed made progress.

To truly reform the financial system, this step is necessary. If you want to fundamentally change who benefits from financial returns and how, you will inevitably make the economy more “casino-like.”

Report Card

It’s easy to become disillusioned, but hard to stay optimistic.

But if I look at the industry’s current state against the goals I had when I entered, I’d say things are pretty good overall.

On poor monetary management: we now have bitcoin and other sufficiently decentralized cryptocurrencies that can serve as real alternatives to fiat—they can’t be seized or devalued; with privacy coins, assets can’t even be tracked. This is real progress for human freedom.

On Wall Street’s monopoly: True, the casino has been “democratized”—now it’s not just Wall Street that can blow itself up with high-leverage bets on junk assets! But seriously, I think society as a whole is progressing, with less overregulation of how and how much risk ordinary people can take. After all, we’ve always let people buy lottery tickets, but kept some of the best-performing stock investment opportunities of the past decade out of reach. Early retail investors in bitcoin, ethereum, and other quality assets have shown us what a more balanced world could look like.

As for the problem of obscure and outdated database systems: the financial industry is finally starting to take better technology seriously. Robinhood has adopted blockchain as the underlying technology for stock trading products in the EU; Stripe is building a new global payment system on crypto rails; and stablecoins have become mainstream products.

If you entered the industry for the revolution, take a closer look: everything you longed for may have already arrived, just not in the form you expected.