News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

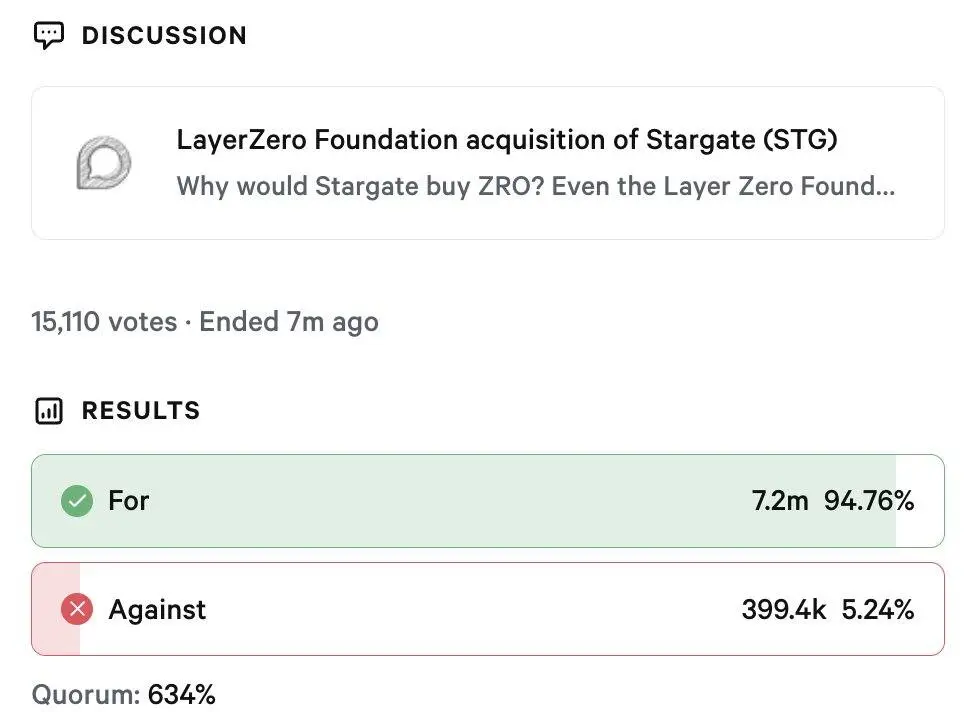

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

- 09:10The probability of "Bitcoin reaching $100,000 again this year" on Polymarket drops to 25%On December 14, it was reported that the probability of "bitcoin reaching $100,000 again this year" on Polymarket is currently at 25%. In addition, the probability of it reaching $110,000 again is currently at 4%, while the probability of falling below $80,000 is at 22%.

- 08:50The Crypto Fear Index drops to 21, and the market remains in a state of extreme fear.Jinse Finance reported, according to Alternative data, today the Crypto Fear & Greed Index dropped to 21 (compared to 23 yesterday), indicating that the market remains in a state of extreme fear. Note: The Fear & Greed Index ranges from 0-100 and includes the following indicators: volatility (25%) + market trading volume (25%) + social media popularity (15%) + market surveys (15%) + bitcoin's proportion in the entire market (10%) + Google trending keywords analysis (10%).

- 08:47Analysis: Bitcoin options with a notional value of approximately $23.8 billions will expire on December 26, potentially leading to concentrated liquidation and repricing of risk exposure at year-end.According to ChainCatcher, on-chain data analyst Murphy stated that bitcoin options with a notional value of approximately $23.8 billion will expire on December 26, covering quarterly options, annual options, and a large number of structured products. This means that the BTC derivatives market will experience a "concentrated clearing and repricing of risk exposure" at the end of the year. Prices may be structurally constrained before expiry, but uncertainty will increase after expiration. From the data, there is a large accumulation of OI at the two positions closest to the current BTC spot price: $85,000 Put: 14,674 BTC; $100,000 Call: 18,116 BTC. In terms of scale, this is not retail behavior, but rather large-scale long-term capital, most likely ETF hedging, BTC treasury companies, large family offices, and other institutions that hold large amounts of BTC spot for the long term. The Put at the $85,000 strike price is initiated by the buyer, reflecting a strong demand for downside risk hedging at this level. Similarly, the large accumulation of Call OI at the $100,000 strike price does not essentially mean "the market is bullish to this level," but rather that long-term capital is willing to give up upside potential above this price in exchange for current certainty of cash flow and overall risk control. By buying Puts below and selling Calls above, the BTC return distribution is compressed within a manageable range. With OI already highly established, this $85,000–$100,000 options corridor will have a structural impact on BTC prices before December 26, creating "implicit resistance above, passive buffering below, and fluctuations within the middle range."