News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

Telegram Founder Pavel Durov Slams France Over “Absurd” Criminal Probe as TON Token Struggles

Telegram founder Pavel Durov has lashed out at French authorities, accusing them of pursuing a baseless criminal investigation that has dragged on for more than a year and left him tethered to legal obligations in Paris.

DeFi Planet·2025/08/25 13:30

Galaxy Digital, Jump Trading, Multicoin Capital in Talks for $1B Solana Token Purchase

Galaxy Digital, Jump Trading, and Multicoin Capital are reportedly in discussions to raise $1 billion for the purchase of Solana’s SOL tokens, according to Bloomberg.

DeFi Planet·2025/08/25 13:30

Pavel Durov Slams French Handling of Telegram Case, Citing Damage to France’s Image

Cointribune·2025/08/25 13:30

Apple Rushes Emergency Patches for Crypto-Stealing Vulnerability

Cointribune·2025/08/25 13:30

Saylor Makes Third Straight Bitcoin Buy in August

Cointribune·2025/08/25 13:30

Metaplanet Adds 103 BTC, Holdings Soar to 18,991 Bitcoins

Cointribune·2025/08/25 13:30

Hyperliquid (HYPE) On-Chain Metrics Surge — Hits Multiple New All-Time Highs

CoinsProbe·2025/08/25 13:25

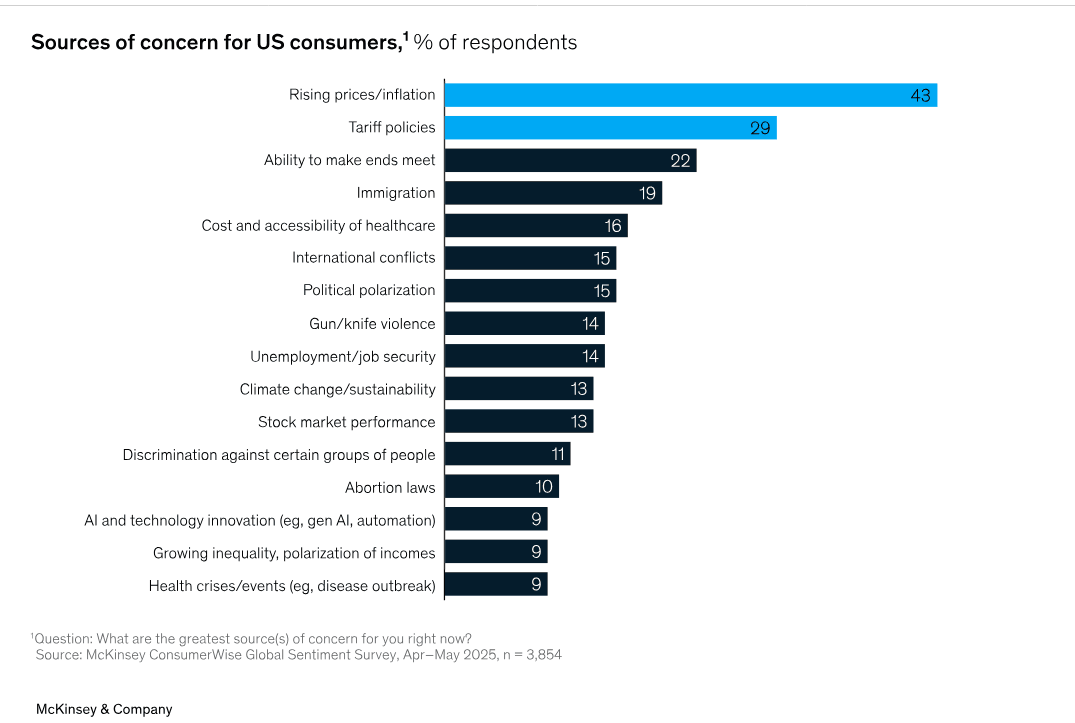

Shiba Inu Crash Ahead? Why Tight Budgets Could Hit SHIB Hard?

Cryptoticker·2025/08/25 13:15

Trump family went pro-crypto after Biden ‘weaponized banks’ — WSJ

Cointime·2025/08/25 13:05

One year since Durov’s arrest: What’s happened and what’s ahead?

Cointime·2025/08/25 13:05

Flash

- 05:29Moore Threads co-founder Li Feng reportedly involved in ICO projects and a dispute over 1,500 bitcoins owedAccording to ChainCatcher, as reported by Foresight News, Moore Threads surged nearly 470% on its first day of listing on the STAR Market on December 5, with its market value surpassing 300 billions yuan. However, at the same time, co-founder Li Feng's past controversies in the crypto industry have once again attracted attention. The report pointed out that in 2017, Li Feng, along with Li Xiaolai and others, participated in the issuance of a token project called "Maledgecoin (MGD)." During the ICO boom, the project raised about 5,000 ETH, but several aspects of the team's background in the whitepaper were alleged to be exaggerated, and some uses of funds were not transparent. Under regulatory pressure, the project was later renamed "Alpaca Coin." In addition, in 2018, the founder of an exchange, Star, publicly accused Li Feng of failing to repay 1,500 bitcoins borrowed, and claimed that legal proceedings had been initiated in both China and the United States. The loan agreement presented by Star showed that the two parties first signed an agreement in 2014, and due to the need for an extension, it was renewed in 2017, but ultimately a breach of contract still occurred. Due to issues with cross-border enforcement and the legal recognition of virtual assets, this dispute has yet to reach a clear resolution.

- 05:29The TOP1 holder of DOYR token bought over $24 million within 5 minutes of launch, currently with an unrealized profit of $193,000.According to ChainCatcher, on-chain analyst Ai Yi has monitored that the market capitalization of DOYR has surpassed $15 million, with the TOP1 holder having an unrealized profit of $193,000 and a return rate as high as 7,858.9%. Address 0x234...655fd purchased 2.773 BNB ($2,456) at an average price of $0.0001444 within 5 minutes after the token was launched. Subsequently, during the price increase, 23.6% of DOYR was sold, and the address still holds 13 million tokens.

- 05:29Hasu comments on Vitalik's idea of an on-chain Gas futures market: weak willingness to go long may lead to insufficient liquidity and difficulty in achieving scale.Jinse Finance reported that Hasu, Lido's strategic advisor and Flashbots' strategy director, commented on X regarding Vitalik's proposal to establish an on-chain Gas futures market. He stated that this market lacks natural short positions: a large number of users are inherently exposed to Gas costs (short) and wish to hedge, but there are hardly any participants willing to take long positions on Gas in the market. Therefore, liquidity may be insufficient, making it difficult to form a meaningful market size. In response, Vitalik suggested that the protocol itself could act as the market's short side, that is, by auctioning off the rights to use future base fees on-chain (up to 2 years in advance). Although Hasu questioned the effectiveness of the incentives in this model, Vitalik explained that after users or application developers pre-purchase Gas, they move from being "natural Gas shorts" to "neutral"; at the same time, the protocol is naturally "long" due to the burning of base fees, and through pre-sales, this part of the risk can be neutralized.

News