News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 5) | 21Shares Launches 2x Leveraged SUI ETF on Nasdaq; U.S. Treasury Debt Surpasses $30 Trillion; JPMorgan: Strategy’s Resilience May Determine Bitcoin’s Short-Term Trend2Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?3The Chainlink ETF Disappoints Despite $41 Million Inflows — Why?

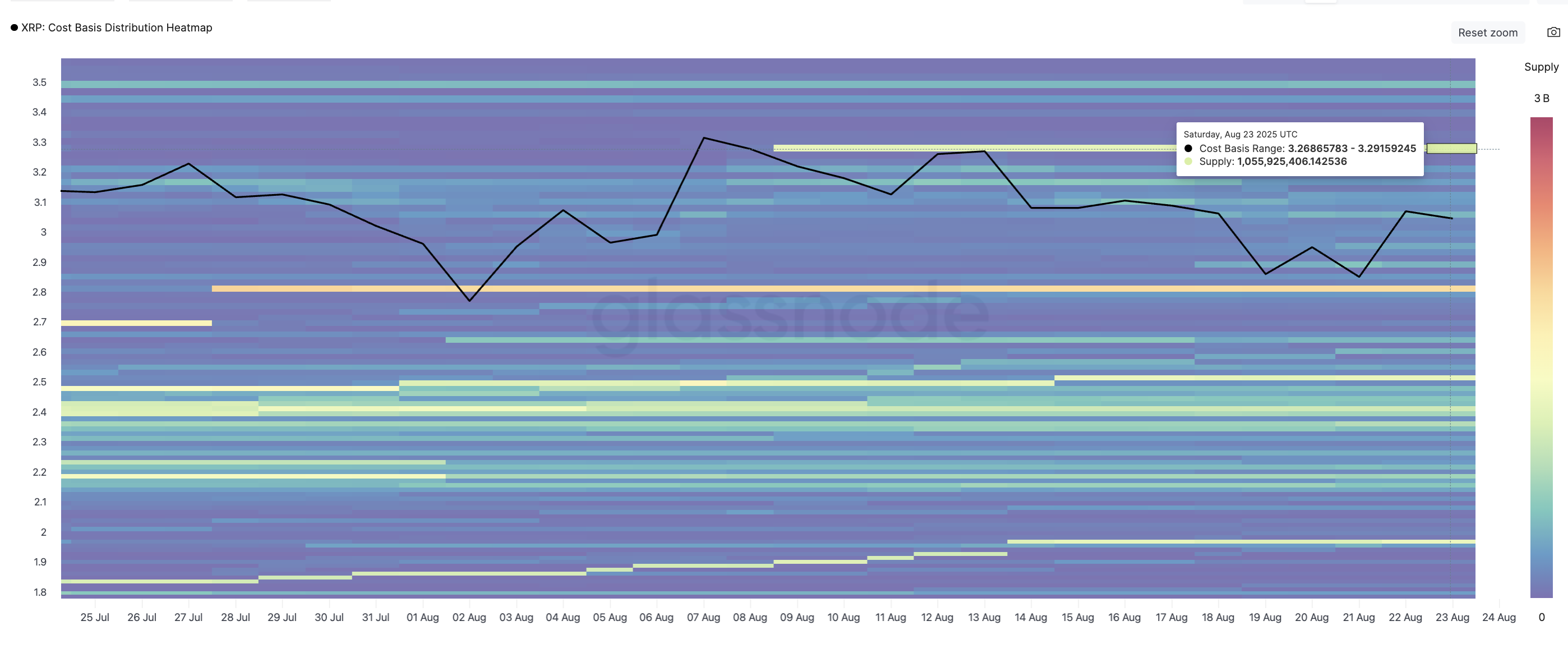

XRP Price Rally Hinges on Breaking This Key Resistance Zone

CryptoNewsNet·2025/08/24 12:20

Australian CEO faces allegations of misleading investors over crypto firm collapse

CryptoNewsNet·2025/08/24 12:20

Cardano’s Lace Wallet to Integrate XRP, Earns Praise & Participation from Lawyer John Deaton

CryptoNewsNet·2025/08/24 12:20

Here’s How Blockchain Will Take Over the IPO Market in 5 Simple Steps

CryptoNewsNet·2025/08/24 12:20

Crypto: Digital Asset Lending Reaches $61.7B and Finally Surpasses Its 2021 Record

Cointribune·2025/08/24 12:05

River Reports Bitcoin’s Surge In Monetary Share

Cointribune·2025/08/24 12:05

Bitcoin: The Bull Run Continues!

Cointribune·2025/08/24 12:05

Saga (SAGA) To Rise Higher? Key Emerging Fractal Signaling Potential Bullish Move

CoinsProbe·2025/08/24 12:05

Bitcoin Price Prediction: BTC Consolidates as Market Awaits THIS Next Big Move

Cryptoticker·2025/08/24 11:55

ChainOpera AI is launching a full-stack collaborative AI economy, with 3 million users and 10,000 developers already joining the Agent Social Network.

Empowering Everyone to Easily Create an AI Agent

BlockBeats·2025/08/24 10:20

Flash

- 03:44Solana co-founder: The total market value of cryptocurrencies will continue to rise, and eventually market value will be redistributed based on revenue-generating capability.Jinse Finance reported that Solana co-founder toly stated on the X platform, "High valuation multiples precisely reflect the risks and opportunities of the entire industry. I believe the total market capitalization of cryptocurrencies will continue to rise, and ultimately, market value will inevitably be redistributed based on revenue-generating capabilities. To achieve this landscape, the industry will face a long and arduous battle for market share, and only those public chains that compete with full force and aim to dominate the entire field will ultimately survive."

- 03:38Data: Sandwich attacks on the Ethereum network in 2025 have already caused users to lose nearly $40 millionAccording to Jinse Finance, data from EigenPhi shows that sandwich attacks on the Ethereum network in 2025 have resulted in user losses of nearly $40 million. Although the monthly trading volume on decentralized exchanges (DEX) has soared from $65 billion to over $100 billion, the scale of profits from these attacks has dropped significantly. Monthly profits from sandwich attacks have decreased from about $10 million at the end of 2024 to only $2.5 million in October 2025, while the frequency of attacks remains high at 60,000 to 90,000 times per month. Most notably, 38% of the attacks target low-volatility liquidity pools such as stablecoins and wrapped assets, and 12% of the attacks are aimed at stablecoin swap pools—where slippage exceeds expectations and losses are particularly severe. The average profit per sandwich attack is only $3, and in 2025, only six attackers accumulated profits of more than $10,000 for the entire year.

- 03:16SlowMist CISO: New React/Next.js vulnerability may affect a large number of DeFi platformsJinse Finance reported that 23pds, Chief Information Security Officer of SlowMist, tweeted that given the emergence of new attack chains for the latest remote code execution vulnerability in React/Next.js, the success rate of related attacks will increase significantly. Since a large number of DeFi platforms currently use React, this vulnerability may have a wide-ranging impact, and all DeFi platforms need to guard against related security risks.

Trending news

More1

Mars Morning News | The first SUI ETF is approved for listing and trading; SEC meeting reveals regulatory differences on tokenization, with traditional finance and the crypto industry holding opposing views

2

Moore Threads makes its debut with a surge of over 500%! The market value of the first domestic GPU stock once exceeded 300 billions yuan.

News