How is your 2025 going? As the founder of Infini, Gen Z Christian bluntly says he hopes it passes quickly.

For a Fintech startup that has only been established for a year, whether it’s experiencing a trust crisis due to a theft or having to personally tear down old answers to pivot, these are not setbacks that can be easily glossed over.

Rewind three years, and in 2022 Christian was still a typical crypto Degen, obsessed with NFTs, then diving into DeFi and memes, with emotions fluctuating with the market, relying on intuition and feel for judgment. That was an era where you just dared to jump in, narratives ran ahead of risk control, and growth covered up too many details.

But now, from products and asset management to payment rails, the industry’s feedback has changed. The harsh reality that a single incident can wipe out all trust made Christian realize that the most valuable thing in finance is not efficiency, but trust.

For Christian’s generation, financial enlightenment was almost fed by products—from QR code payments to password-free deductions, from one-click installment to tap-to-pay, the golden age of Fintech lowered financial barriers and made smoothness the default.

But when they started their own businesses, the industry climate had changed. Many entrepreneurs of the previous generation grew big on dividends first and then caught up, while this generation often learns as they go.

So this conversation is not just about the path of a product or a company, but a more current portrait of entrepreneurs. In an era of ever-thinner fees, pickier channels, and compliance increasingly resembling time costs, what truly drives business forward is a long-term deliverable experience.

Finance is not just a game for the “old folks”; new markets need to retain the ambition of young people while learning to become tougher at the most fragile links. 2025 is destined to be a year Christian will remember for a long time, because from this year on, Infini and he have truly entered the core of the financial business—not just running fast, but also enduring slowness and pain.

Beating Highlights:

· The bigger opportunity may not only be in B2B cross-border settlement, but in scenarios closer to where transactions occur: how to make it easier for the new generation of entrepreneurs to collect payments and manage funds, and how to target the global market from the start of business—this is the value stablecoins are about to deliver.

· What’s truly hard to copy is a company’s core: how you treat and serve customers, especially whether you truly value their assets and are willing to respond 24/7 when they have issues. Now, many products don’t differ much in features; faster iteration, more refined user experience, and more timely and patient response are actually decisive.

· Good entrepreneurs need the courage to let go—even if the business is doing well, if it can’t get us to our goals in the expected time, the team should look for a more worthwhile direction.

· Rather than just offering a seemingly better asset management product, it’s better to help users truly understand risk; don’t place all trust in any single asset or institution, and at least maintain independent judgment.

· What makes products and teams stand out is often in the details: every detail of the product, every line of copy, every design element, every implementation behind a feature—all these ultimately shape what the product becomes.

· The more layers and politics a startup has, the more it drags down efficiency and delivery. Everyone makes mistakes, myself included, and I’m willing to admit it. But more importantly, you have to dare to speak up when you see problems; don’t stay silent out of concern, or the whole team’s goals will be affected.

The following is the full interview:

“Young people need a sense of awe”

Beating: You once said things had always gone smoothly for you, but when your setback hit in the form of $50 million, what was your first reaction?

Christian: My first reaction was definitely shock, my mind went blank, wondering how something like this could happen to me. Not long ago I’d just seen a similar incident and we’d paid special attention to it, but I never thought we’d be next.

But I quickly realized there were only two outcomes: either solve the problem, get through it, and keep moving forward with the team; or fail to handle it, which for most people basically means game over.

The result is clear to everyone now—fortunately, we made it through, and growth was even smoother after March and April. That was my truest reaction at the time: I didn’t overthink it, just felt it was what I had to do.

Beating: After going through this, what’s the biggest change in your mindset that you didn’t have before?

Christian: The biggest gain is “awe.” Many young people don’t understand awe, especially when things go smoothly—it’s easy to get carried away. Cases like SBF are essentially about a lack of awe and respect for the industry, the market, and users.

After this, I became more certain of two things. First, I’m not omnipotent, and I will make mistakes. The goal of risk control isn’t to never make mistakes, but to minimize losses when they happen and not let a single error become fatal.

Second, many problems ultimately come down to people. Whether intentional or not, someone didn’t do their job well. So after the incident, we spent a lot of effort rebuilding and strengthening our recruitment, screening standards, and team mechanisms.

I’m actually grateful for this experience—if it hadn’t happened, Infini’s team state and capability might not be as good as they are now. It forced me to keep iterating and aligning standards, and made it clearer that people whose values and pace don’t match are unlikely to go far together.

Of course, I was depressed at first, but now it’s more a continuous sense of gratitude. Things will eventually be resolved; the key is how you resolve them, and whether your reputation and trust can be maintained long-term.

Beating: “The general public doesn’t necessarily need financial products, but needs financial literacy”—why do you feel this way?

Christian: This year we experienced black swan events in the industry; whether in crypto or traditional finance, there’s no such thing as a product that will never have problems. So-called better people just understand risk control better, are more responsible, and can do things more long-term.

But if someone bets their entire fortune on trust, even if the odds of an incident are one in ten thousand, it’s still unbearable if it happens.

So I increasingly feel that helping people build the right financial mindset is more important. Rather than just offering a seemingly better asset management product, it’s better to help users truly understand risk; don’t place all trust in any single asset or institution, and at least maintain independent judgment.

Precisely because of these reflections, we’ve adjusted our direction—from initially focusing only on asset management to now wanting to do payments and collections well first. I increasingly believe the two must eventually be combined: you have to solve “how to make money, how to collect money” first, before you can accumulate principal and then manage and protect it. That’s my biggest takeaway this year.

Fearless of First-Mover Advantage: Infini’s Underlying Ambition

Beating: Infini made a significant pivot, withdrawing from the to-C business and shifting focus. How did you make that judgment, and where did the determination to change come from?

Christian: When we were doing ToC, our team was young and lacked relevant experience, so we hit a lot of pitfalls. Some pitfalls you just don’t know until you step in yourself, and no one will proactively tell you. For some people, this lack of transparency is actually key to their profits and arbitrage.

But I really dislike that kind of system—I’ve always felt the payments industry should be more transparent. Plus, we weren’t really ready as a whole, so it was especially tough.

Also, the business model wasn’t clear enough. For example, we made almost no money from the U Card business because we wanted to keep costs as low as possible so more people could use it, not just big clients.

But as users increased, problems arose: these users didn’t necessarily bring in revenue, but we had to spend a lot of time and energy handling various issues. The team was basically pushed along by problems, and everyone was tired and unhappy.

R&D was constantly firefighting, customer service had to stay up late replying, complaints were huge, and many issues weren’t even solvable by us because the chain was too long and there were too many links—any one of which could break down.

That’s why we wanted to build things based on blockchain: the underlying rails are more certain, there are fewer supply chain issues, and as long as we do our part well, we can deliver a more stable product and experience.

Furthermore, we realized that no matter how well we did on this path, we weren’t really creating new value.

It was more like regulatory arbitrage—it did bring convenience to people who found traditional bank cards inconvenient, but the underlying network didn’t change, costs and efficiency weren’t fundamentally improved, and because the rails were more complex, optimization costs were higher and ultimately passed on to consumers.

Rather than continuing to grow in a track with limited differentiation and a race to the bottom on price, I believe good entrepreneurs need the courage to let go.

Even if the business was doing well, if it couldn’t get us to our goals in the expected time, the team should look for a more worthwhile direction. In contrast, the path we’re on now is truly worth building for the long term, and there’s still a lot of infrastructure and standards to be filled in.

Beating: Now Infini has expanded into acquiring business, which is a direction that values channels and operations. How did you find your first batch of clients? What needs did you address?

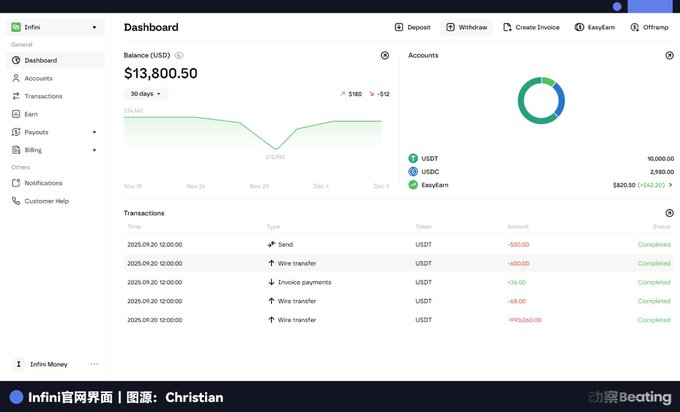

Christian: Acquiring is definitely our core segment, but we won’t stop there. Our positioning is more like a Financial OS, aiming to provide near bank-level experience and functionality.

Specifically, acquiring needs to solve two main problems. The first is to provide lighter payment and collection accounts for overseas entrepreneurs and small teams. My judgment is that in the future, many people making products and starting to collect payments won’t necessarily need a bank account first.

Especially in the AI era, where tools have greatly compressed the time from development to launch, you can’t follow the traditional pace and wait for bank processes. What used to take a month to set up an account and connect can now be done in ten minutes with Infini, and integration can be completed in a day, so you can start collecting payments.

This is very practical for independent developers, super individuals, and small startup teams. Among our fewer than 20 seed merchants, AI application developers make up a high proportion, and there are indeed “one-person companies” using it—their most urgent need is to get payments running.

The second is to let merchants connect to stablecoin payments earlier. Today, the vast majority of companies’ revenue is still settled in fiat, but I think the proportion of stablecoins in wallets will increase, especially in regions like Latin America.

When we did U Card, we noticed many users just wanted to pay for Netflix, Starlink, or shop on Amazon. Why should they have to convert stablecoins to cards before spending? There’s inevitable friction in the process—if they could pay directly with stablecoins, the chain would be shorter and the experience better.

For merchants, adding a stablecoin payment method is essentially adding a revenue stream. Just like in traditional payments, adding another wallet channel often increases your customer base.

We’ve also seen cases where stablecoin acquiring brings in new users, not just making things smoother for old ones. The scale is still small, but the earlier you connect, as merchants grow and user habits improve, this channel’s share will rise.

Beating: Mature Fintech companies like Revolut have accumulated scale, data, and strong compliance over ten years. Even if they’re not first to launch a new feature, they can quickly copy and distribute it to tens of millions of users. In contrast, Crypto Native companies are still constrained by fundraising, licensing, and compliance. How do you compete with such first-mover advantages? What is Infini’s core moat in your Financial OS strategy?

Christian: I think there are two perspectives. First, Fintech doesn’t have strong network effects like social products where the winner takes all.

Many small Fintech companies can thrive because the core of customer choice is often trust.

Every era has giants and challengers. Today, this trend is even stronger. Some big domestic companies can quickly launch features that catch attention and use massive resources to compete—this does happen, and the probability is rising.

But I don’t focus on preventing copying—ideas are cheap, features and interfaces can be replicated.

What’s truly hard to copy is a company’s core: how you treat and serve customers, especially whether you truly value their assets and are willing to respond 24/7 when they have issues.

Now, many products don’t differ much in features; faster iteration, more refined user experience, and more timely and patient response are actually decisive.

The True Mission of Financial Products Is Equality

Beating: Many believe that most innovation in the past twenty years has been at the distribution layer, optimizing experience, but the underlying logic of capital flow remains traditional, leading to homogeneity, thin profits, and intense competition. As a new generation Fintech entrepreneur, what do you most want to improve?

Christian: I agree with this view. Over a longer timeline, many familiar Fintech products were born in the last fifteen years or so.

The first generation of successful unicorns did innovate a lot, but most of their innovation was still under the traditional banking and payment paradigm—essentially making better products and experiences on old systems.

But in this traditional paradigm, a long-standing problem is the entry barrier. Many Fintech products require users to have a traditional bank account to use them.

No matter how much innovation you do on top, you still have to sync a lot of information and details to the underlying bank; as long as you rely on banking licenses and systems, you can’t avoid these restrictions. Second is the cost of transfer networks, especially cross-border: high fees, small transfers are hard to justify, timing is unstable, and mutual recognition and anti-money laundering processes between countries are complex.

Beating: Where do you capture value?

Christian: For ToB companies, one of the biggest future values is enabling businesses to access and use financial services without relying on a traditional bank account as a foundation. For independent developers, small teams, or startups, this will make onboarding exponentially more efficient.

Our advantage as new entrepreneurs is that, from an infrastructure and technology perspective, we can build a more global business today, especially covering emerging markets faster, allowing users to register and use services more freely and smoothly.

Of course, in the long run, everyone will move toward more complete compliance and licensing, but the starting path is different.

In terms of products, we try to build new payment networks based on stablecoins. Traditional players are also moving in this direction, but most still settle around card organizations like Visa and Mastercard.

My judgment is that the bigger opportunity may not only be in B2B cross-border settlement, but in scenarios closer to where transactions occur: how to make it easier for the new generation of entrepreneurs to collect payments and manage funds, and how to target the global market from the start of business—this is the value stablecoins are about to deliver.

Beating: The previous generation of Fintech entrepreneurs also tried “specialization” early on, targeting students, part-timers, or teenagers, but were eventually forced to become all-in-one super apps.

Christian: I think this isn’t just Fintech logic, but a path all applications eventually take—real growth often starts with a precise entry into the pain points of a small group.

First, solve that pain point thoroughly, then expand along the needs, discover similar problems among adjacent groups, and keep designing and iterating to gradually push the boundaries.

Of course, companies will differentiate at a certain stage—some founders are content to do one niche area to the extreme, and if that problem is solved well enough, they’re willing to defend their territory and go deeper and more specialized.

Others want to go further, serve more people, see more needs, and from a business perspective, pursue greater scale, profit, and capitalization.

Beating: If you had to describe your ideal Fintech product in one sentence, what would it be?

Christian: My ideal product, and what we hope to build in the future, is about equality: providing the capabilities of banks and financial services in a more indiscriminate, fair way to everyone who needs it—especially every aspiring entrepreneur. In my view, this is the true mission of financial products.

The New Generation Entrepreneur’s View on Management

Beating: Some say being older is an advantage in finance—what do you think?

Christian: I think the phenomenon of Fintech favoring older, more experienced founders is more common in Asia, but there are also many very young and excellent entrepreneurs in Europe and the US.

The difference is mainly due to environment and ecosystem. I’ve asked many investors—they do prefer older, more experienced people, especially in highly regulated, risk-controlled industries like Fintech, which makes sense. Many pitfalls are only known through experience over time, so from that perspective, they have an advantage.

But I don’t think age itself is decisive. We don’t judge candidates by age—being older doesn’t mean lacking innovation, and being young doesn’t mean you can’t do well.

The key is two things: whether you’ve experienced pitfalls, and your understanding and bottom-line control of risk.

Since everyone will hit pitfalls, the other variable is growth and iteration speed. Young people may have to pay some tuition—I’ve paid plenty myself—but if you can improve quickly and truly clarify compliance and risk control, you can do well too.

Beating: You said you once pretended to be an entrepreneur—what was fake about it?

Christian: It’s a state, especially for some older founders who were managers at big companies—they tend to carry over old habits after starting a business, thinking they just need to do a few management things well: raise money, build a team, set direction. These are indeed CEO responsibilities, because no one else can do them.

But if you think doing those three things means everything will go as planned, I think that’s a false proposition and why many people stumble.

What truly makes products and teams stand out is often in the details: every detail of the product, every line of copy, every design element, every implementation behind a feature—all these ultimately shape what the product becomes.

Team management is the same. It’s not that the team can’t do well, but if the founder sets the example and standards at the start, execution will go much more smoothly and it’s easier to achieve consistent high quality.

Beating: You must have gained a lot of insight into organizational management during the entrepreneurial process.

Christian: Besides not pretending to be an entrepreneur, you also have to lead by example and be on the front lines with the team, at least willing to understand things. If you don’t understand, aren’t interested, or aren’t curious, it’s hard for colleagues to treat it as something they’re truly responsible for.

Of course, you can’t be an expert at everything, but your attitude matters—let everyone see you’re thinking and improving. Often, morale is built this way.

Then, you must find the right people. The most fatal thing about hiring the wrong person isn’t lack of ability, but slowing down the organization’s iteration speed. Some people are great, just more suited to big companies; in startups, they don’t fit the pace and can’t deliver as expected.

One of the most important traits of a startup is the courage to make trade-offs—let unsuitable people go early and keep looking for better fits.

The strength of a startup team depends on whether the overall average quality is high enough—ideally, everyone can take charge and deliver at a high standard. With AI tools, teams will likely be leaner in the future, not expanding to hundreds or thousands.

But the smaller the team, the more everyone needs to be on the same level, because any drop in attitude or ability can drag down the whole team’s speed.

So besides building products, continuously evaluating, adjusting, and making the team stronger is extremely important.

Beating: How do you select suitable entrepreneurial partners?

Christian: I value three things more than experience, background, or education. First is iteration speed and curiosity—learning ability. It’s not necessarily related to age, especially since we’re in a new field with no mature paradigms or products to copy; learning and thinking ability is paramount.

Also, if someone hardly uses AI or other productivity tools in their workflow, I feel they lack an awareness of maximizing efficiency.

Second is long-termism—whether they can stick with the team. Many in crypto are used to short-term gains, which is reasonable, but we don’t see ourselves as a pure Web3/Crypto company, but more as a long-term internet product and platform.

We don’t plan to issue tokens or focus on short-term monetization; often we sacrifice short-term cash flow for long-term value. There are many decisions and little room for error—if someone just wants to make quick money, they’re not a good fit for us.

Third is absolute candor. The more layers and politics a startup has, the more it drags down efficiency and delivery. Everyone makes mistakes, myself included, and I’m willing to admit it. But more importantly, you have to dare to speak up when you see problems; don’t stay silent out of concern, or the whole team’s goals will be affected.

Beating: Who do you admire most in your entrepreneurial journey?

Christian: The founder of Revolut—I really admire Revolut as a company. They have absolute execution and extremely high standards for the team.

From a product perspective, what Revolut did early on wasn’t revolutionary—card issuance, forex exchange are the basics of traditional banking—but what I really admire is their drive and speed.

The common impression is that European companies are slow and inefficient, but Revolut proved that Europe can have the speed and intensity of Chinese internet companies. Their strength is in quickly replicating basic features, then constantly optimizing and eventually beating you. That’s a powerful ability, and I hope we can develop it too.

The second is the founder’s attitude toward team management. He has a famous saying: get shit done—I even use it as our internal collaboration tool signature.

It’s not about advocating 996 or using rules to pressure people, but about mutual selection when building the team—those who join must have a sense of responsibility. How does responsibility show? First, curiosity; second, wanting to do things well and to the extreme.

Behind this is a very strict management philosophy—he has extremely high standards for the team, and if someone isn’t up to par, they’re let go. This almost ruthless standard, in turn, makes the team very strong, high-quality, and fast-moving.

That’s what I aspire to, and I hope to get as close as possible. Of course, everyone will eventually find their own management style.

Beating: What’s the most inspiring or favorite book you’ve read this year?

Christian: After reading “The Lychee of Chang’an,” I realized I didn’t know much about the Tang Dynasty, so I read three related books in a row. The more I read, the more I was struck—history’s most exciting parts often revolve around Li Shimin, and his experience inspired me greatly. Conquering the world in ancient times is a lot like entrepreneurship today—it’s about leadership, bringing people together to accomplish something.

I especially admire Li Shimin’s breadth and vision, which is almost universally recognized among emperors. He could win and then gather, trust, and even reuse former enemies and rivals.

Entrepreneurs should have this kind of breadth, because the best people are often rebellious and hard to persuade. If you can get them to sincerely follow you, that’s rare and crucial.

He also seized power through a coup, even against his own father. Maybe because I studied philosophy, I wonder what kind of situation would make someone make a choice considered treacherous in traditional morality?

For me, it’s not simply about good or bad, merit or fault. It’s more like offering a perspective—maybe some people are in a different moral state. Ultimately, how each person chooses in different situations is thought-provoking and worth pondering long-term.

Beating: 2025 may be a bit bumpy for you—what would you write in your year-end summary?

Christian: I honestly hope 2025 passes quickly (laughs). It’s not that the whole year is bumpy, but it’s definitely not easy. Looking back, I actually feel lucky to have experienced so much at this age—it’s also been my fastest year of growth.

My year-end summary is really just one thing: what could I do better if I had another chance? What lessons should I learn? Of course, I spend more time thinking about what to do next. I’m also lucky to have found that many people have been with me through this tough time—colleagues, friends, family.

At the same time, this year made it clearer who will stick with you and solve problems together in tough times—I’m more willing to trust them and feel it’s worth working together long-term.