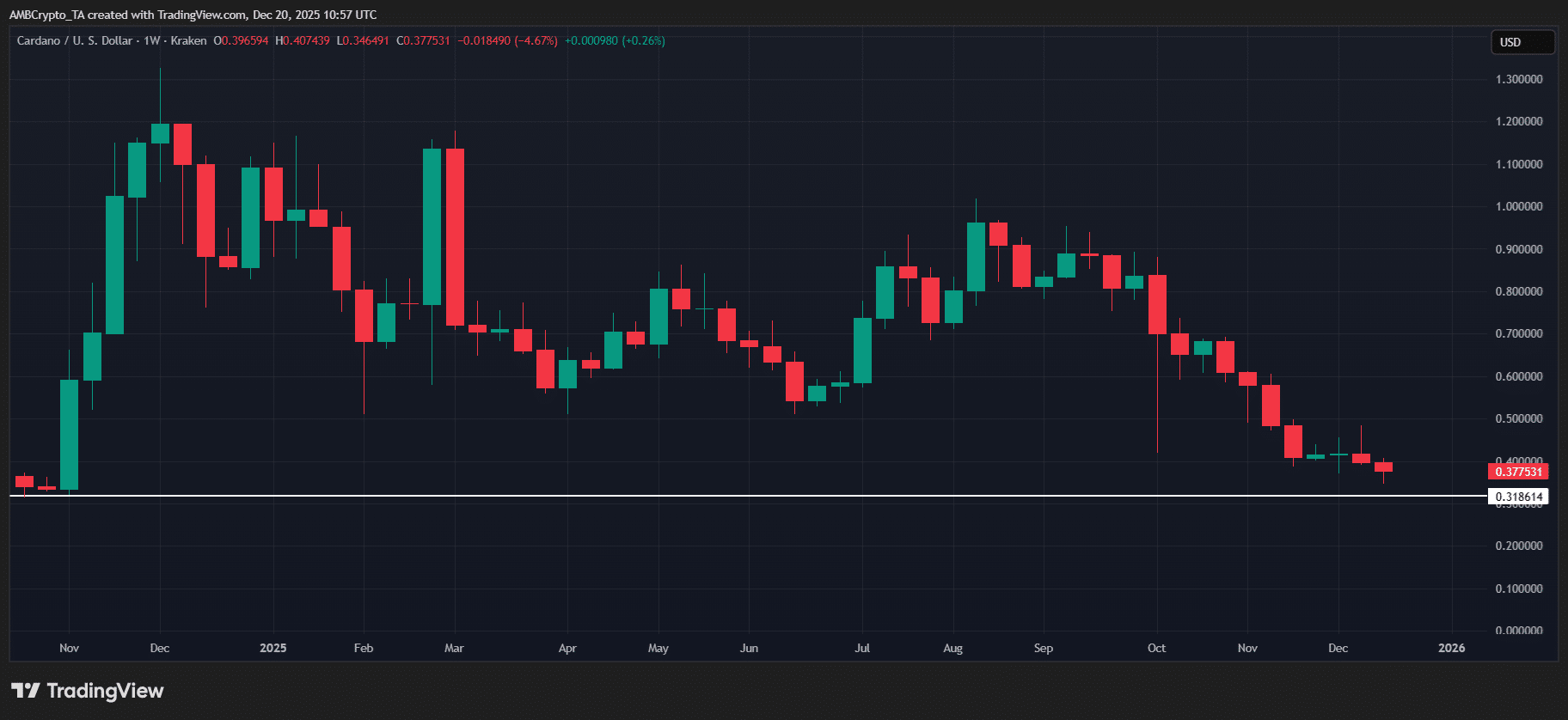

has been struggling to find a direction amidst cryptocurrencies facing narrow trading ranges. The decrease in volatility indicates the market’s indecisiveness, as technical indicators and on-chain data suggest that Ethereum remains in a consolidation phase without a clear short-term trend. This scenario prompts caution among traders, emphasizing the importance of critical levels for potential breakouts. var litespeed_vary=document.cookie.replace(/(?:(?:^|.*;\s*)_lscache_vary\s*\=\s*([^;]*).*$)|^.*$/,"");litespeed_vary||fetch("/wp-content/plugins/litespeed-cache/guest.vary.php",{method:"POST",cache:"no-cache",redirect:"follow"}).then(e=>e.json()).then(e=>{console.log(e),e.hasOwnProperty("reload")&&"yes"==e.reload&&(sessionStorage.setItem("litespeed_docref",document.referrer),window.location.reload(!0))});

Insights from Daily and 4-Hour Charts

On the daily chart, Ethereum trades between a long-standing downtrend line and a strong horizontal support around the $2,500 level. This downtrend line acts as a dynamic resistance, rejecting price rallies, and despite sporadic buyer intervention, it fails to produce a sustained breakout. The persistence of strong sellers in the market is clearly evident in this setup.

The $2,500 level serves as a critical defense line on the downside. Recent selling pressure hitting this area has been met by buyers, preventing a deeper retracement. Consequently, Ethereum stays within a directionless, narrow range. The continuation of daily closes within this band signifies an ongoing consolidation phase.

In contrast, the four-hour chart provides a clearer view of the short-term market. Although Ethereum attempted an upward breakout within a flag pattern formed from local lows, the effort was unsuccessful. After briefly dropping below support, the price rebounded quickly, forming a false breakout. This move trapped short-term sellers while offering limited room for buyers. Nevertheless, the lack of a restored robust uptrend indicates that this reaction remains a mere correction for now.

Impact of ETF Withdrawals and On-chain Data

Alongside the technical stalemate, on-chain data presents a cautious outlook for Ethereum. Mid-December saw significant institutional withdrawals from spot Ethereum ETFs, with substantial exits, particularly from BlackRock’s ETF, signaling weak institutional risk appetite. Total weekly outflows exceeding $600 million underscore the notable contraction in buying liquidity.

The timing of these events is critical, as heavy withdrawals early in the week weaken Ethereum’s ability to defend key support levels. Institutional investors reducing positions at current prices emerge as a short-term risk factor with downward pressure.

Meanwhile, another development in the Ethereum ecosystem gains attention. Recent surges in transaction volumes and lower fees in significant Layer-2 projects indicate a shift in network usage from the main chain to side solutions. While this supports Ethereum’s scalability in the long run, it constrains demand on the main network in the short term.

$3,093.86

$3,093.86