News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

AUD/USD rises to near 0.6700 as RBA rate hike bets emerge

101 finance·2026/01/02 02:42

Tokyo shares expected to reach record levels in 2026 amid potential yen depreciation risks

101 finance·2026/01/02 02:27

GBP/USD gathers strength above 1.3450 on Fed rate cut bets, BoE's gradual policy path

101 finance·2026/01/02 01:39

Altcoins Soar While Bitcoin Eyes $89,000 Mark

Cointurk·2026/01/01 23:42

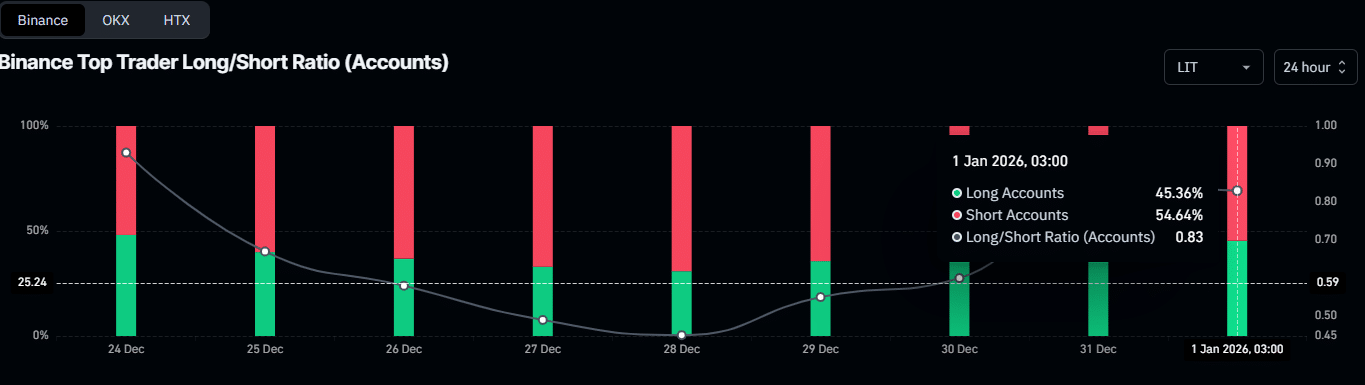

Lighter faces $250mln capital flight after token debut — What’s next for LIT?

AMBCrypto·2026/01/01 23:03

AVAX and DOGE Surge: Crypto Markets Take a Turn

Cointurk·2026/01/01 21:51

Crypto Hacks 2025: The Shocking $2.2 Billion Toll on Digital Asset Security

Bitcoinworld·2026/01/01 21:21

Justin Sun LIT Purchase: Strategic $33M Acquisition Reveals Bullish Confidence in DeFi Future

Bitcoinworld·2026/01/01 21:21

Flash

02:41

Thermal coal: Supply improves after New Year's Day, market sentiment remains cautiousGolden Ten Futures reported on January 4 that, following the completion of annual tasks at the end of last year, more coal mines that had previously halted production resumed operations, leading to a contraction in market supply. Overall, coal prices remained stable with localized increases. As of December 31, 2025, the mainstream pithead price of Yulin Q6000 thermal coal was 595-610 yuan/ton, a cumulative decrease of 80 yuan/ton compared to the end of last month, representing a decline of 11.72%. After the New Year’s Day holiday, some coal mines that had suspended production and sales due to the completion of annual tasks at the end of last year gradually resumed normal production, improving market supply. Downstream users mostly continued to purchase as needed, with end-users maintaining just-in-time demand. Traders’ sentiment was somewhat divided, with some remaining cautious and observant, while others showed a slight increase in purchasing enthusiasm. Overall, coal shipments from operating mines were average, with a few experiencing relatively smooth sales. Most coal mines made narrow adjustments to pithead prices based on their own inventory and railcar arrivals. During the holiday, pithead prices in some regions showed slight fluctuations. Going forward, attention should still be paid to inventory reduction in the mid- and downstream sectors and changes in weather conditions. (SCI99)

02:41

Tires: The all-steel tire market continues to weaken, with dealer inventories remaining highAccording to Golden Ten Data Futures on January 4, in December, most distributors saw an increasing trend in inventory, with only a few maintaining stable inventory levels compared to the previous month, and a small number experiencing a slight decline. This month, downstream outdoor operations and industrial and mining production further declined, leading to weak terminal market demand for all-steel tires. Dragged down by terminal market demand, distributors' shipments continued to weaken this month, performing worse than last month overall. In addition, distributors have gradually entered the contract signing and payment collection phase this month, resulting in a slower overall shipping pace. However, under the pressure of meeting targets, distributors still engaged in some restocking activities, causing inventory levels to trend upward. Some distributors, due to already high inventory levels from previous periods and significant pressure, intentionally controlled inventory and reduced purchases this month, keeping inventory stable or even slightly lower compared to last month. Zhuochuang Information believes that January is the last month before the Spring Festival, with terminal market demand dropping to its lowest point, and by the end of the month, some downstream industries have already entered the Spring Festival holiday period, resulting in minimal overall demand. At the same time, distributors are still mainly focused on collecting payments, with a relatively slow shipping pace, making it difficult to reduce inventory. Meanwhile, there is still some restocking activity among distributors, so overall inventory levels are expected to remain high.

02:41

Geopolitical conflicts continue to intensify, boosting cost-side support for ethylene glycolGolden Ten Data Futures News on January 4: At present, the downstream textile and apparel industry has entered the off-season for consumption, with seasonal declines expected in polyester and weaving operating rates. Additionally, there are still plans for trial runs of new ethylene glycol units on the supply side, so the expectation of continued inventory accumulation for ethylene glycol remains, and the supply-demand pressure for ethylene glycol is still significant. However, during the New Year’s holiday, escalating geopolitical tensions in Venezuela have increased market concerns over the stability of crude oil supply, thereby strengthening cost-side support for ethylene glycol. Today, both international crude oil and ethylene glycol futures markets are closed, so there is still limited directional guidance for the ethylene glycol spot market. Spot trading is mainly focused on turnover, with fewer heard fixed-price negotiations. (Sublime Information)

News