Executives say macro conditions, regulation and new infrastructure will define crypto in 2026

After a year marked by volatile markets and shifting expectations, crypto executives say 2026 won’t hinge on a single breakout moment. Instead, they point to a slower but more consequential shift already underway: digital assets becoming embedded in financial infrastructure rather than traded at the margins.

Across interviews and research from Coinbase, Matter Labs, CoinShares, Gate.io, Bitfinex, and Hashdex, executives describe a market that is settling into place. Crypto's next phase, they argue, looks less speculative and more structural, shaped by macro conditions, regulatory clarity, and systems designed to operate at an institutional scale.

Taken together, executives say that 2026 may be the year crypto sheds its speculative edge and assumes a more permanent role in the financial system.

Disruption to infrastructure

Industry leaders say that shift is already visible in where builders and institutions are focusing their efforts.

"The next generation of the internet is being built onchain," said Keith Grose, CEO of Coinbase UK, describing a move toward programmable markets and financial activity that increasingly settles on public blockchains. He pointed to growing emphasis on onchain identity, settlement, and verification layers as evidence of where that focus is heading.

CoinShares frames the same transition as the rise of "hybrid finance," where crypto-native infrastructure and traditional financial systems converge. In its 2026 outlook, the firm argues that digital assets are no longer operating outside the financial system, but are increasingly operating within it, from tokenized funds to blockchain-based settlement rails.

Executives at Matter Labs echo that view, with CEO and co-founder Alex Gluchowski predicting banks will adopt "business in the front, protocol in the back" architectures. Under that model, institutions run private, permissioned systems internally while using public blockchains and zero-knowledge proofs to settle net positions or demonstrate compliance without exposing sensitive data.

Rather than replacing traditional finance, executives say crypto is being absorbed into it.

Regulation catches up

That integration is being shaped as much by regulation as by technology. CoinShares' regulatory analysis highlights divergence across major regions.

Europe's MiCA (Markets in Crypto-Assets Regulation) framework now provides legal certainty across issuance, custody, and trading. In the U.S., momentum has shifted toward enabling legislation even as oversight remains split across agencies. In Asia, jurisdictions such as Hong Kong and Japan are moving toward prudential, Basel-style standards aimed at institutional participation.

Hoolie Tejwani, head of Coinbase Ventures, said clearer rules are already changing how the industry operates. "When founders understand the rules, they build responsibly, and investors can commit with confidence," he said, adding that clearer market structure guidance could be a key catalyst for broader adoption in 2026.

Stablecoins are a key part of those changes.

Hashdex expects stablecoin market capitalization to double in 2026 from its current level of roughly $300 billion, according to The Block data. Hashdex argues that clearer rules, like the GENIUS Act in the U.S., position stablecoins as core financial infrastructure rather than niche payment tools.

The firm describes this as the rise of a "cryptodollar," embedding dollar-denominated settlement rails into global commerce even as some sovereigns diversify away from U.S. reserves.

Matter Labs expects regulation itself to become increasingly programmable. Gluchowski predicts the emergence of jurisdiction-aware rollups that enforce different compliance requirements by geography while anchoring to shared public blockchains.

"Data residency, sanctions, and local licensing rules are already fragmenting the internet of money," he said. "In 2026, that fragmentation will increasingly be reflected in how blockchains are designed."

Tokenization and stablecoin rails

With regulatory guardrails coming into place, executives say the focus in 2026 shifts from pilots to execution.

"Tokenisation is edging closer to becoming a mainstream capital-raising tool," said Bitfinex CTO Paolo Ardoino, arguing that efficiency gains and broader access will push institutions to embed blockchain into core offerings rather than treat it as an experiment.

Hashdex projects that tokenized real-world assets could grow by a factor of ten next year, while CoinShares points to BlackRock’s BUIDL fund, JPMorgan’s tokenized deposits, and PayPal’s PYUSD as early signs that large financial institutions are already building on public chains.

Matter Labs' Omar Azhar expects a clear division of labor to emerge. Stablecoins, he said, will dominate cross-border retail payments, while tokenized commercial bank deposits take over institutional and treasury flows, enabling real-time settlement and automated liquidity management.

For many executives, tokenization in 2026 is less about scale and more about whether it becomes durable infrastructure.

AI moves onchain

Beyond finance, firms also point to a growing, if still early, intersection between AI and crypto.

Some argue that as AI systems become more autonomous, they will increasingly rely on blockchains for identity, verification, and settlement. Hashdex estimates the AI-crypto category could reach $10 billion in 2026, driven by decentralized compute, data provenance, and coordination markets.

Most acknowledge adoption remains nascent, but expect AI-related demand to influence developer activity and infrastructure usage over the coming year.

Bitcoin macro barometer

Against that backdrop, bitcoin enters 2026 less as a speculative bellwether and more as a macro-sensitive anchor asset.

Much of its outlook now hinges on whether incoming U.S. data validates the Federal Reserve’s shift toward easing. With rate decisions for 2025 complete, markets are focused on inflation, labor, and consumption data to gauge how quickly lower rates may translate into improved liquidity conditions next year.

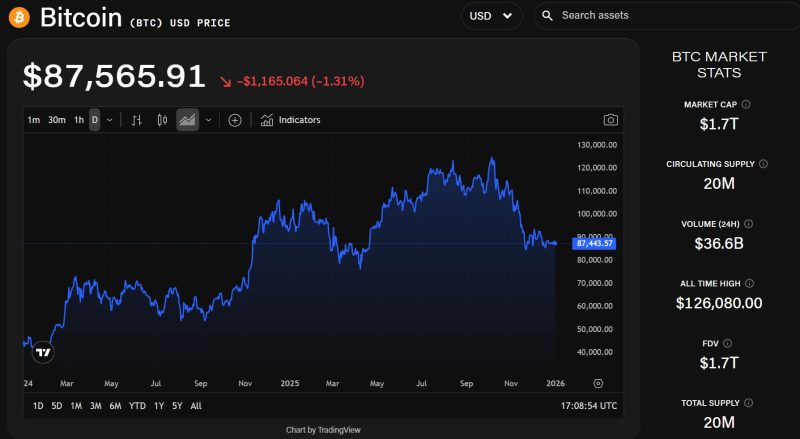

Bitcoin has struggled to regain momentum into year-end and is trading around $87,600, roughly 6% below its 2025 opening level of $93,300, according to The Block price data.

Bitcoin (BTC) price chart. Source: The Block/TradingView

This loss of steam has prompted banks and analysts to temper their near-term forecasts. Standard Chartered cut its end-2025 bitcoin target to $100,000 earlier this month, arguing that corporate "digital asset treasury" buying has largely run its course, leaving ETF inflows as the primary source of incremental demand.

The bank trimmed its projected path through 2029 but maintained a long-term bullish view, forecasting $150,000 in 2026 and $500,000 by 2030.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Altcoins Break Crucial Boundaries in 2025

From AAVE to HYPE: Bitwise bets on altcoins with 11 crypto ETF filings

Alchemy Pay Secures Kansas Money Transmitter License, Expands U.S. Footprint to 11 States

Crypto Market Structure Bill Faces Pivotal US Senate Review on January 15, Offering Crucial Regulatory Clarity