Crypto supporters are now framing stablecoin rewards as a “national security” issue. This follows revelations that China plans to allow yield on the digital Yuan to drive adoption.

One of the fierce supporters of USD-based stablecoin yield, Coinbase CEO Brian Armstrong, defended the rewards and warned,

“U.S. stablecoins must remain competitive on a global stage.”

Stablecoin wars: Banks vs crypto

Since August, traditional banks, through their umbrella body, the Bank Policy Institute (BPI), have been advocating for a ban on the rewards.

They cited potential capital flight to stablecoins, which could reduce bank deposits and impact their ability to offer credit to small businesses.

Their demands?

Amend the stablecoin law, the GENIUS Act, or include the restriction in the ongoing discussions on the crypto market structure bill.

For crypto supporters, however, the banks are just afraid of competition. They argued that stablecoins would offer over 3% in rewards, compared to the less than 1% interest currently offered by banks.

In fact, Coinbase argued that stablecoins are widely used abroad than onshore and wouldn’t be a threat to banks. But BPI refuted this claim and cautioned lawmakers,

“Any level of stablecoin adoption will likely cause displacements in bank deposits and reduction of credit, and those effects will only further increase if stablecoin adoption is as pronounced and transformative.”

Now, the Chinese move has offered the crypto industry a renewed push to defend the rewards.

For his part, Jake Chervinsky, CLO at crypto VC Variant Fund, noted that the stablecoin yield was now a matter of “national security” rather than “incumbents seeking regulatory moat.”

He added,

“It’s a matter of national security. The GENIUS Act was a great victory for US dollar dominance worldwide. Revisiting stablecoin rewards would hand that win to China.”

Chervinsky echoed Faryar Shirzad, Coinbase Chief Policy Officer, who also cautioned that opposing stablecoin rewards would empower foreign players.

“If this issue is mishandled in Senate negotiations on the market structure bill, it could hand our global rivals a big assist in giving non-US stablecoins and CBDCs a critical competitive advantage at the worst possible time.”

Source: X

Yield-bearing stablecoin growth

According to a Bloomberg report, Chinese commercial banks that operate digital yuan (E-CNY) wallets will pay interest to clients based on the amount held, starting from the 1st of January.

As of writing, Coinbase pays interest on USDC, and PayPal also offers a yield on PYUSD. Overall, the stablecoin market has grown from $254 billion to $307 billion following the passage of the GENIUS Act in July.

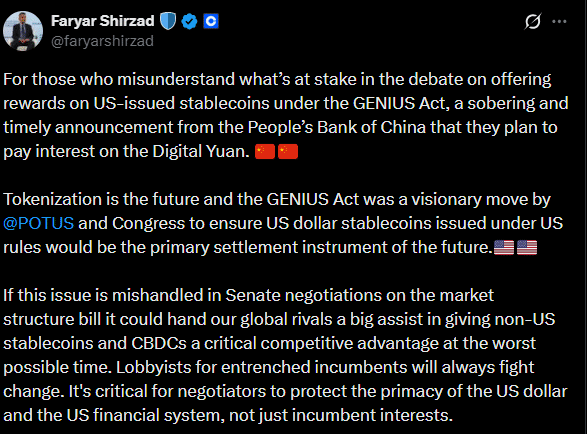

Other DeFi-focused interest-bearing stablecoins like Maple’s sUSDS and BlackRock’s BUIDL have also doubled from $6B to +$12B in 2025, underscoring rising demand.

Source: StableWatch

Final Thoughts

- U.S. crypto industry now wants stablecoin rewards defended as a “national security” issue.

- The banking lobby still views the growth of stablecoin adoption as a threat to the sector.