Bitcoin ends 2025 in a tight range, reflecting a market caught between caution and long-term conviction. On the four-hour chart, BTC traded near the $88,500 zone, where repeated rebounds met persistent selling pressure.

Hence, price action suggested consolidation rather than a clear directional breakout. Traders continued to watch technical levels closely, while broader market signals pointed to restrained optimism heading into 2026.

Bitcoin maintained a short-term bearish structure on the four-hour timeframe. Price stayed below the declining 100-EMA and 200-EMA, clustered near the $89,800 to $90,000 region.

Consequently, this zone acted as a ceiling that limited upside momentum. Repeated attempts to reclaim higher ground failed, reinforcing seller control.

Moreover, momentum indicators reflected hesitation. The Supertrend remained in sell mode, while price formed lower highs. This structure suggested that buyers defended support but lacked strength to drive a sustained rally. As long as BTC stayed below $89,900, the market favored range trading or another test of lower demand zones.

Key resistance levels included $89,500 to $89,900, followed by $91,600, which marked a prior swing high. Additionally, a broader supply area sat between $94,500 and $95,000, representing a major hurdle for bulls.

Related: Shiba Inu Price Prediction: SHIB Market Resets as Open Interest Falls…

Despite bearish signals, Bitcoin continued to find demand near established support levels. The $87,700 to $87,300 zone absorbed repeated selloffs, indicating active buying interest. Besides, the $86,600 to $85,950 area aligned with a Fibonacci support and prior consolidation.

A deeper breakdown below $83,900 could expose BTC to the $80,600 macro support. However, price stability above near-term supports kept the broader structure intact. Consequently, the market leaned toward consolidation rather than aggressive downside continuation.

Source:

Source:

Derivatives data showed persistent engagement through 2025. Bitcoin futures open interest expanded steadily, remaining above $55 billion in late December. Significantly, elevated open interest during consolidation suggested ongoing leveraged positioning and sensitivity to volatility spikes.

Source:

Source:

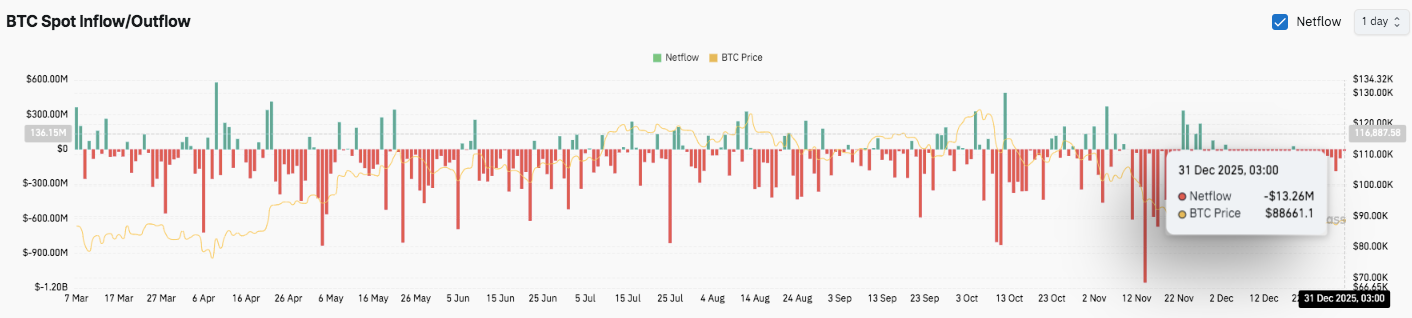

However, spot flow data painted a defensive picture. Outflows consistently exceeded inflows, signaling distribution rather than accumulation. Additionally, traders appeared to sell into strength, limiting recovery momentum.

Corporate behavior echoed this caution. Prenetics, backed by David Beckham, paused its Bitcoin treasury purchases after months of market weakness.

Related: Cardano Price Prediction 2026: Midnight Launch & Solana Bridge Could Push ADA To $2.50+

The company redirected capital toward its consumer business, reflecting selective risk management. Hence, while long-term interest in Bitcoin remained, near-term positioning reflected restraint as 2026 approached.

Key levels remain well-defined for Bitcoin as it trades within a tight 4-hour range.

Upside levels to watch include $89,500 and $89,900, where the 100-EMA, 200-EMA, and Supertrend converge. A confirmed breakout above $90,000 could open the door toward $91,600, followed by the higher resistance zone near $94,500–$95,000. These levels mark previous swing highs and broader supply areas.

On the downside, immediate support sits at $87,700–$87,300, a zone that has repeatedly attracted buyers. Below that, $86,600 and $85,950 act as a critical Fibonacci support band. A breakdown through this area would expose $83,900, with $80,600 standing as the broader range low and macro support.

The technical structure suggests Bitcoin remains compressed beneath declining moving averages, reflecting short-term bearish pressure. Price continues to print lower highs, signaling limited upside momentum for now. However, repeated defenses of support indicate sellers lack strong follow-through.

Bitcoin’s near-term direction hinges on whether buyers can reclaim and hold above $90,000. Sustained acceptance above this level could shift momentum toward $91,600 and $94,500.

Failure to hold $87,300, however, would increase the risk of a deeper pullback toward $85,950 and $83,900. For now, Bitcoin sits at a pivotal inflection zone, with volatility expansion likely once this range resolves.

Related: Solana Price Prediction 2026: Firedancer, Western Union USDPT, and $476M ETF Inflows Target $350+